Answered step by step

Verified Expert Solution

Question

1 Approved Answer

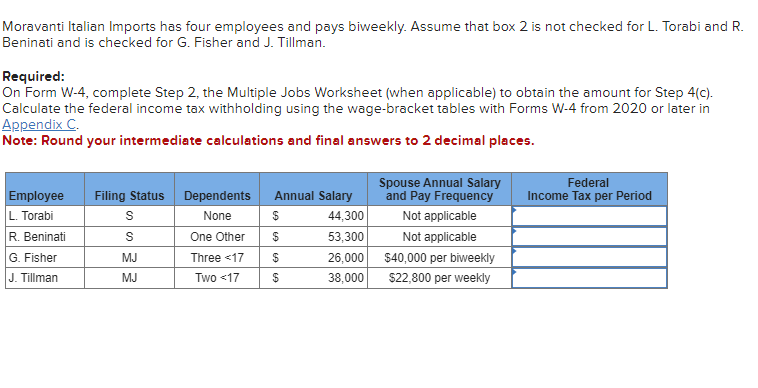

Moravanti Italian Imports has four employees and pays biweekly. Assume that box 2 is not checked for L. Torabi and R. Beninati and is

Moravanti Italian Imports has four employees and pays biweekly. Assume that box 2 is not checked for L. Torabi and R. Beninati and is checked for G. Fisher and J. Tillman. Required: On Form W-4, complete Step 2, the Multiple Jobs Worksheet (when applicable) to obtain the amount for Step 4(c). Calculate the federal income tax withholding using the wage-bracket tables with Forms W-4 from 2020 or later in Appendix C. Note: Round your intermediate calculations and final answers to 2 decimal places. Employee L. Torabi Filing Status S Dependents None Annual Salary Spouse Annual Salary and Pay Frequency Federal Income Tax per Period $ 44,300 Not applicable R. Beninati S One Other $ 53,300 Not applicable G. Fisher MJ Three

Step by Step Solution

There are 3 Steps involved in it

Step: 1

The image displays a table with information on four employees of Moravanti Italian Imports Their fil...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started