Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On January 1, two years ago, Parkway Corporation purchased all of the outstanding common stock of Shaw Company for $220,000 cash. On that date,

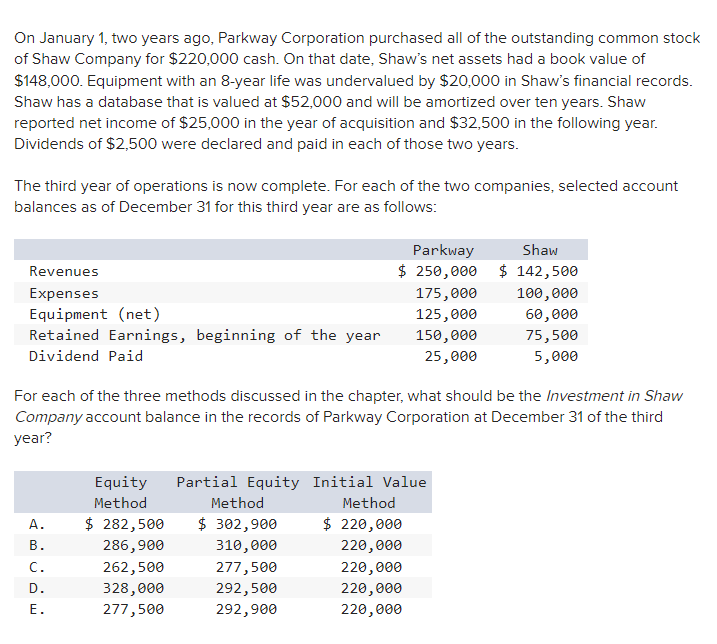

On January 1, two years ago, Parkway Corporation purchased all of the outstanding common stock of Shaw Company for $220,000 cash. On that date, Shaw's net assets had a book value of $148,000. Equipment with an 8-year life was undervalued by $20,000 in Shaw's financial records. Shaw has a database that is valued at $52,000 and will be amortized over ten years. Shaw reported net income of $25,000 in the year of acquisition and $32,500 in the following year. Dividends of $2,500 were declared and paid in each of those two years. The third year of operations is now complete. For each of the two companies, selected account balances as of December 31 for this third year are as follows: Revenues Parkway $ 250,000 Shaw $ 142,500 Expenses 175,000 100,000 Equipment (net) 125,000 60,000 Retained Earnings, beginning of the year Dividend Paid 150,000 75,500 25,000 5,000 For each of the three methods discussed in the chapter, what should be the Investment in Shaw Company account balance in the records of Parkway Corporation at December 31 of the third year? Equity Method Partial Equity Initial Value Method Method A. $ 282,500 $ 302,900 $ 220,000 B. 286,900 310,000 220,000 C. 262,500 277,500 220,000 D. 328,000 292,500 220,000 E. 277,500 292,900 220,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started