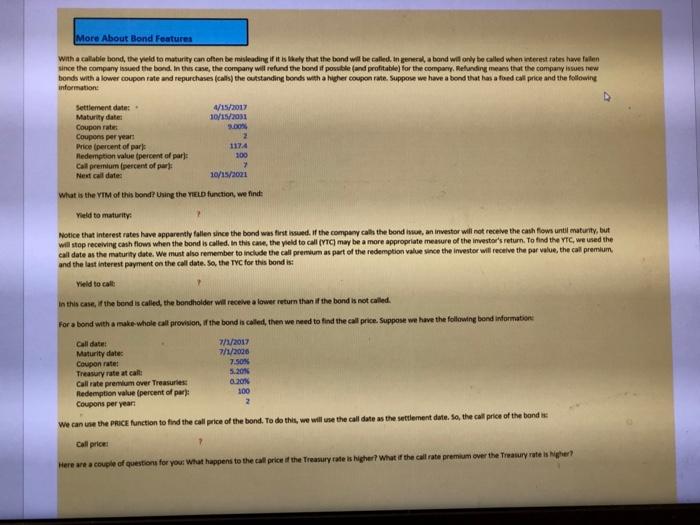

More About Bond Features with a callabie bond, the yield to maturity can often be misleading if it is kely that the band will be called in general, a bond will only be called when interest rates have falen since the company issued the bord. In this case, the company will refund the bond if posible and profitable for the company. Refunding matut the company wes new bonds with a lower coupon rate and repurchases (cs) the outstanding bonds with a higher coupon rate. Suppose we have a bond that has a foed call price and the following information Settlement datet Maturity date Coupon rate Coupons per years Price percent of paris Redemption value percent of paris Cal premium (percent of part: Next call date: 4/15/2017 10/15/2031 9.00 2 1174 100 7 10/15/2021 What is the YIM of this bond? Using the YIELD function, we find Yield to maturity Notice that interest rates have apparently fallen since the bond was first issued if the company calls the bond in an investor will not receive the cash flows until maturity, but will stop receiving cash flows when the bond is called. In this case, the yield to call (YTC) may be a more appropriate measure of the investor's return. To find the YTC, we used the call date as the maturity date. We must also remember to include the call premium as part of the redemption value since the investor will receive the per value the call premium and the last interest payment on the call date. So, the TYC for this bond is: Yield to call in this case, the bond is called the bondholder will receive a lower return than if the bond is not called for bond with a make whale call provision, if the bond is called, then we need to find the call price. Suppose we have the following bond information Call datet 7/1/2017 Maturity date 2/1/2026 Coupon rate: 7.50 Treasury rate at call: 5.2016 Call rate premium over Treasures 20 Redemption value (percent of part: 100 Coupons per year: 2 We can use the PRICE function to find the call price of the bond. To do this, we will use the call date as the settlement date. So, the call price of the bonds Call price Here are a couple of questions for you. What happens to the call price of the Treasury rate is higher? What if the call rate premium over the Treasury rate is her! More About Bond Features with a callabie bond, the yield to maturity can often be misleading if it is kely that the band will be called in general, a bond will only be called when interest rates have falen since the company issued the bord. In this case, the company will refund the bond if posible and profitable for the company. Refunding matut the company wes new bonds with a lower coupon rate and repurchases (cs) the outstanding bonds with a higher coupon rate. Suppose we have a bond that has a foed call price and the following information Settlement datet Maturity date Coupon rate Coupons per years Price percent of paris Redemption value percent of paris Cal premium (percent of part: Next call date: 4/15/2017 10/15/2031 9.00 2 1174 100 7 10/15/2021 What is the YIM of this bond? Using the YIELD function, we find Yield to maturity Notice that interest rates have apparently fallen since the bond was first issued if the company calls the bond in an investor will not receive the cash flows until maturity, but will stop receiving cash flows when the bond is called. In this case, the yield to call (YTC) may be a more appropriate measure of the investor's return. To find the YTC, we used the call date as the maturity date. We must also remember to include the call premium as part of the redemption value since the investor will receive the per value the call premium and the last interest payment on the call date. So, the TYC for this bond is: Yield to call in this case, the bond is called the bondholder will receive a lower return than if the bond is not called for bond with a make whale call provision, if the bond is called, then we need to find the call price. Suppose we have the following bond information Call datet 7/1/2017 Maturity date 2/1/2026 Coupon rate: 7.50 Treasury rate at call: 5.2016 Call rate premium over Treasures 20 Redemption value (percent of part: 100 Coupons per year: 2 We can use the PRICE function to find the call price of the bond. To do this, we will use the call date as the settlement date. So, the call price of the bonds Call price Here are a couple of questions for you. What happens to the call price of the Treasury rate is higher? What if the call rate premium over the Treasury rate is her