more clear

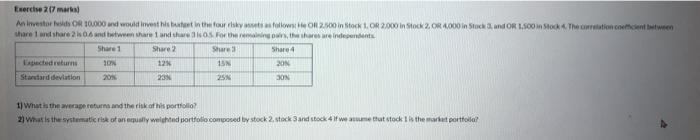

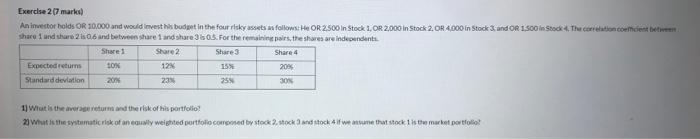

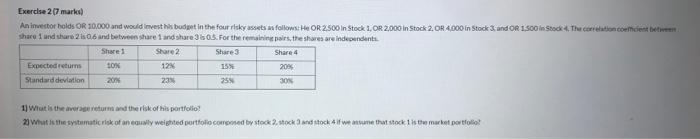

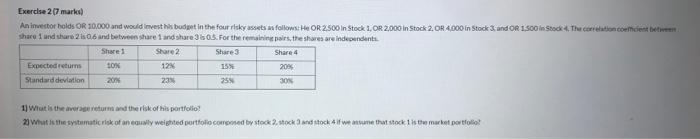

Exercise 27 mars An investors OR 10.000 do invest is best in the four systemie 2.0 intockt. R2,000 in Stock 2.0R 4.000 in Stock and OR 1.00 in Stock The creation of tween share and share 20 and went and S. For them, there are indende Share 1 Share2 Share Share 4 SON 12 15 20N Star tard deviation 23 25 30 1 What is the average return and the risk of his portfolio? 2 What is the systematic risk at an equally weighted portfolio.composed by stock 2.stock and stock 4 If we mettet stock is the market portfolo Exercise 27 marks Animvector holds OR 10.000 and would meet his budget in the four risky assets as follows: 1 OR 2.500 in Stock 1. OR2,000 InStock2. OR 4.000 in Stock 3, and OR 1.500 in stock 4 The correlation coeficient between share and share 2106 and between share and share. For the remaining pairs, the shares are independents Share1 Share 2 Share 4 Expected returns SON 12 155 20% Standard deviation 23 25 30% 1) Wit is the average return and the risk of his portfolio! 2) What is the systematic risk of an equal weighted portfolio Corsed by stock 2.stock and stock 4if we asume that stock is the market porto! Exercise 27 mars An investors OR 10.000 do invest is best in the four systemie 2.0 intockt. R2,000 in Stock 2.0R 4.000 in Stock and OR 1.00 in Stock The creation of tween share and share 20 and went and S. For them, there are indende Share 1 Share2 Share Share 4 SON 12 15 20N Star tard deviation 23 25 30 1 What is the average return and the risk of his portfolio? 2 What is the systematic risk at an equally weighted portfolio.composed by stock 2.stock and stock 4 If we mettet stock is the market portfolo Exercise 27 marks Animvector holds OR 10.000 and would meet his budget in the four risky assets as follows: 1 OR 2.500 in Stock 1. OR2,000 InStock2. OR 4.000 in Stock 3, and OR 1.500 in stock 4 The correlation coeficient between share and share 2106 and between share and share. For the remaining pairs, the shares are independents Share1 Share 2 Share 4 Expected returns SON 12 155 20% Standard deviation 23 25 30% 1) Wit is the average return and the risk of his portfolio! 2) What is the systematic risk of an equal weighted portfolio Corsed by stock 2.stock and stock 4if we asume that stock is the market porto