Answered step by step

Verified Expert Solution

Question

1 Approved Answer

More info a . Acquired equipment and furniture for $ 8 4 , 0 0 0 . Its expected useful life is 5 years. Dr

More info a Acquired equipment and furniture for $ Its expected useful life is years. Dr Glowinsky will

use straightline depreciation, assuming zero terminal disposal value.

b Fees collected, $ These fees included $ paid in advance by some patients on

December X

c Rent is paid at the rate of $ monthly, payable quarterly on the twentyfifth of March,

June, September, and December for the following quarter. Total disbursements during X for

rent were $ including an initial payment on January

d Fees billed but uncollected, December $

e Utilities expense paid in cash, $ Additional utility bills unpaid at December $

f Salary expense for dental assistant and secretary $ paid in cash. In addition, $ was

earned but unpaid on December X

a Acquired equipment and furniture for $ Its expected useful life is years. Dr Glowinsky will

use straightline depreciation, assuming zero terminal disposal value.

b Fees collected, $ These fees included $ paid in advance by some patients on

December X

c Rent is paid at the rate of $ monthly, payable quarterly on the twentyfifth of March,

June, September, and December for the following quarter. Total disbursements during X for

rent were $ including an initial payment on January

d Fees billed but uncollected, December $

e Utilities expense paid in cash, $ Additional utility bills unpaid at December X $

f Salary expense for dental assistant and secretary $ paid in cash. In addition, $ was

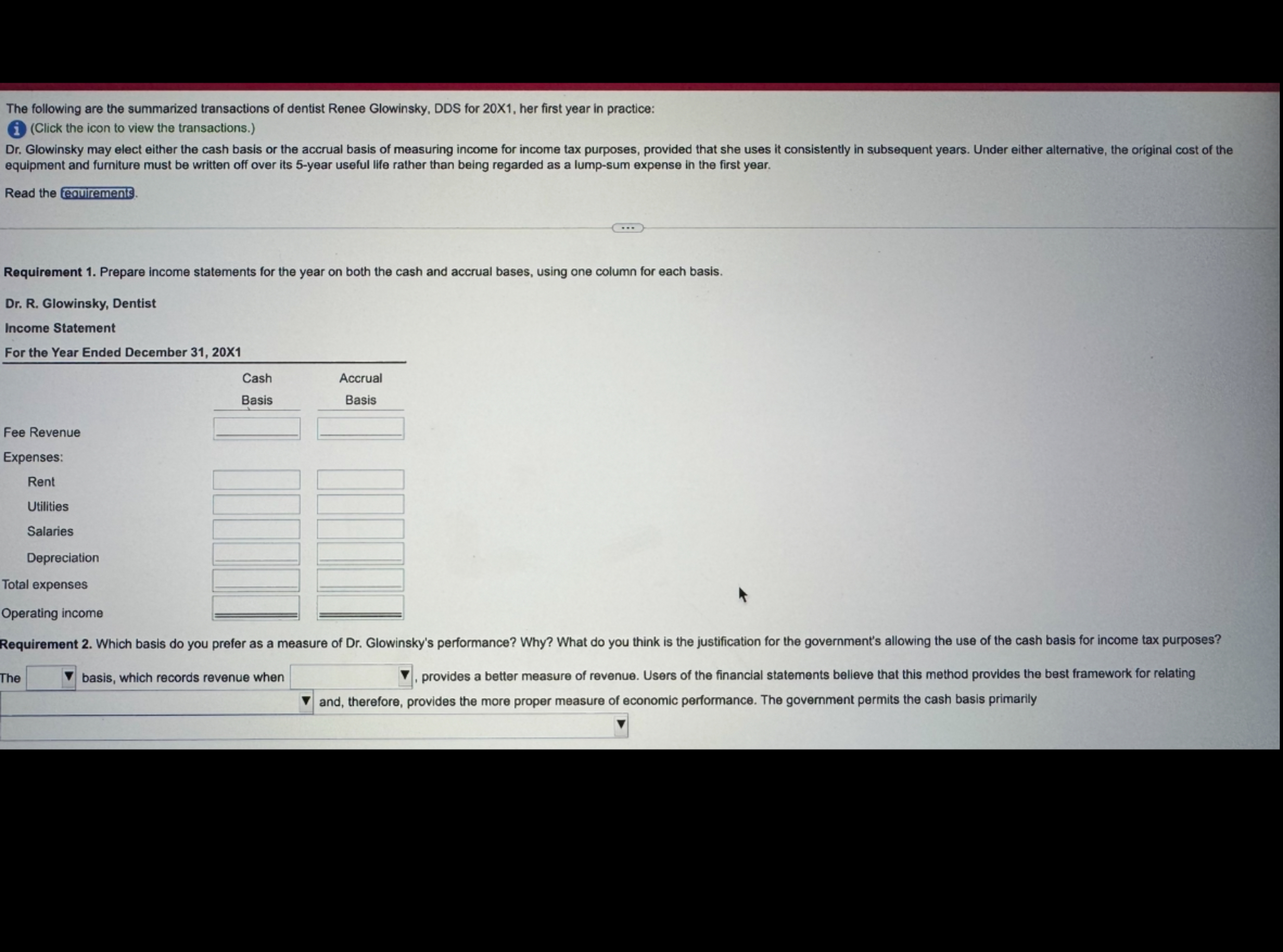

earned but unpaid on December XThe following are the summarized transactions of dentist Renee Glowinsky, DDS for X her first year in practice:

iClick the icon to view the transactions.

Dr Glowinsky may elect either the cash basis or the accrual basis of measuring income for income tax purposes, provided that she uses it consistently in subsequent years. Under either alternative, the original cost of the

equipment and furniture must be written off over its year useful life rather than being regarded as a lumpsum expense in the first year.

Read the eovirements.

Requirement Prepare income statements for the year on both the cash and accrual bases, using one column for each basis.

Dr R Glowinsky, Dentist

Income Statement

For the Year Ended December X

Requirement Which basis do you prefer as a measure of Dr Glowinsky's performance? Why? What do you think is the justification for the government's allowing the use of the cash basis for income tax purposes?

The

basis, which records revenue when

provides a better measure of revenue. Users of the financial statements belleve that this method provides the best framework for relating

and, therefore, provides the more proper measure of economic performance. The government permits the cash basis primarily

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started