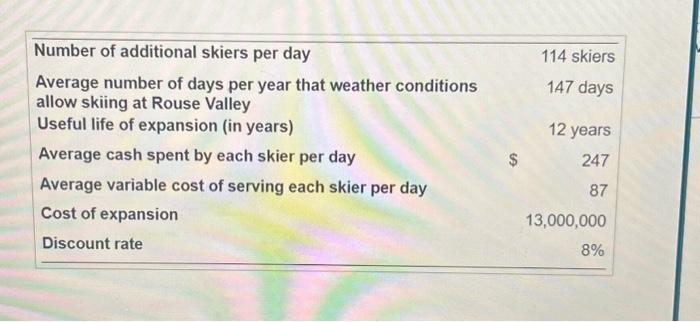

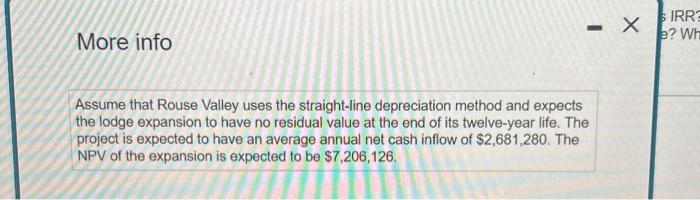

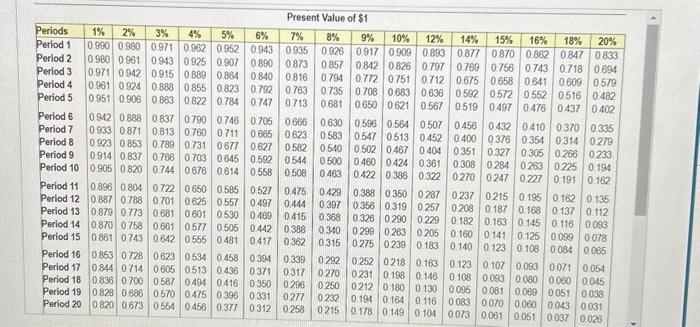

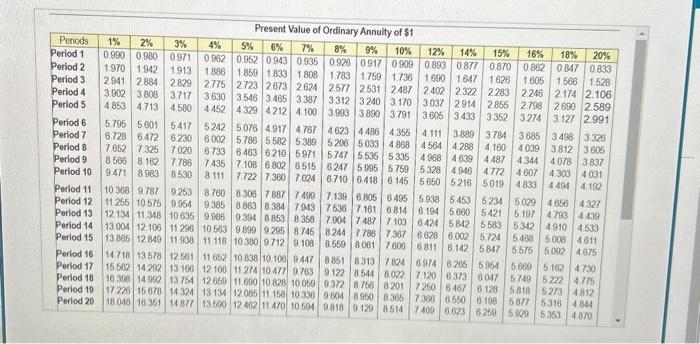

More info Assume that Rouse Valley uses the straight-line depreciation method and expects the lodge expansion to have no residual value at the end of its twelve-year life. The project is expected to have an average annual net cash inflow of $2,681,280. The NPV of the expansion is expected to be $7,206,126. \begin{tabular}{lr} \hline Number of additional skiers per day & 114 skiers \\ AveragenumberofdaysperyearthatweatherconditionsallowskiingatRouseValley & 147 days \\ Useful life of expansion (in years) & 12 years \\ AveragecashspentbyeachskierperdayAveragevariablecostofservingeachskierperday & 247 \\ Cost of expansion & 87 \\ Discount rate & 13,000,000 \\ \hline \end{tabular} Consider how Rouse Valley Waterfall Park Lodge could use capital budgeting to decide whether the $13,000,000 Waterfall Park Lodge expansion would be a good investment. Assume Rouse Valley's managers developed the following estimates concerning the expansion: (Click the icon to view the estimates.) (Click the icon to view additional information.) (Click the icon to view Present Value of \$1 table.) (Click the icon to view Present Value of Ordinary Annuity of $1 table.) What is the project's IRR? Is the investment attractive? Why or why not? The internal rate of return (IRR) of the expansion is Present Value of Ordinary Annulty of \$1 \begin{tabular}{|c|c|c|c|c|c|c|c|c|c|c|c|c|c|c|c|c|} \hline Periods & 1% & 2% & 3% & 4% & 5% & 6% & 7% & 8% & 9% & 10% & 12% & 14% & 15% & 16% & 18% & 20% \\ \hline Period 1 & 0.990 & 0.980 & 0971 & 0962 & 0952 & 0943 & 0.935 & 0926 & 0917 & 0909 & 0.893 & 0.877 & 0.870 & 0.862 & 0847 & 0.833 \\ \hline Period 2 & 1970 & 1.942 & 1.913 & 1886 & 1859 & 1833 & 1.808 & 1783 & 1.759 & 1.736 & 1.690 & 1.647 & 1626 & 1.605 & 1.566 & 1528 \\ \hline Period 3 & 2941 & 2884 & 2829 & 2775 & 2723 & 2673 & 2.624 & 2577 & 2.531 & 2487 & 2402 & 2322 & 2283 & 2246 & 2174 & 2.106 \\ \hline Period 4 & 3902 & 3808 & 3717 & 3630 & 3546 & 3465 & 3387 & 3.312 & 3240 & 3170 & 3037 & 2914 & 2855 & 2788 & 2690 & 2.589 \\ \hline Period 5 & 4853 & 4713 & 4580 & 4452 & 4329 & 4212 & 4.100 & 3993 & 3890 & 3791 & 3005 & 3.433 & 3352 & 3274 & 3.127 & 2.991 \\ \hline Period 6 & 57958778 & 5.601 & 5417 & 5.242 & 5.076 & 4.917 & 4767 & 4623 & 4486 & 4355 & 4.111 & 3889 & 3784 & 3685 & 3498 & 3.326 \\ \hline Period 7 & 6.728 & 6472 & 6230 & 6002 & 5786 & 5.582 & 5389 & 5206 & 5033 & 4868 & 4564 & 4288 & 4.160 & 4.039 & 3812 & 3605 \\ \hline Period 8 & 7.652 & 7325 & 7.020 & 6733 & 6463 & 6210 & 5971 & 5747 & 5536 & 5335 & 4988 & 4639 & 4487 & 4344 & 4078 & 3837 \\ \hline Period 9 & 8566 & 8.162 & 7.786 & 7435 & 7.108 & 6802 & 6515 & 6247 & 5095 & 5759 & 5328 & 4846 & 4772 & 4607 & 4303 & 4031 \\ \hline Period 10 & 9.471 & 8983 & 8530 & 8111 & 7722 & 7360 & 7,024 & 6710 & 6.418 & 6145 & 5650 & 5216 & 5019 & 4833 & 4494 & 4192 \\ \hline Perlod 11 & 10368 & 9787 & 9.253 & 8760 & 8306 & 7887 & 7499 & 7.139 & 6.805 & 6495 & 5938 & 5.453 & 6234 & 5029 & 4656 & 4.327 \\ \hline Period 12 & 11.255 & 10575 & 9954 & 9385 & 8863 & 8384 & 7943 & 7536 & 7.161 & 6814 & 6194 & 5660 & 5421 & 5197 & 4783 & 4.439 \\ \hline Period 13 & 12134 & 11348 & 10635 & 9986 & 9394 & 8.853 & 8.358 & 7004 & 7487 & 7103 & 6424 & 5842 & 5.583 & 5342 & 4.910 & 4533 \\ \hline Period 14 & 13004 & 12106 & 11296 & 10563 & 9899 & 9285 & 8.746 & 8244 & 7788 & 7387 & 6628 & 8002 & 5724 & 5.408 & 5008 & 4611 \\ \hline Period 15 & 13805 & 12849 & 11.938 & 11118 & 10380 & 9712 & 9.108 & 8.569 & 8061 & 7606 & 6811 & 6.142 & 5847 & 5575 & 5002 & 4675 \\ \hline Period 16 & 14718 & 13.578 & 12501 & 11652 & 10838 & 10.106 & 9.447 & 8.851 & 8313 & 7824 & 6974 & 6.205 & 5964 & 5600 & 5.162 & 4700 \\ \hline Period 17 & 15660 & 14292 & 13108 & 12160 & 11.274 & 10477 & 9703 & 9.122 & 8.544 & 8022 & 7120 & 6.373 & 6047 & 5749 & 5222 & 4775 \\ \hline Period 18 & 16.386 & 14908 & 13754 & 12650 & 11.660 & 10828 & 10059 & 9.372 & 8766 & 8201 & 7260 & 6467 & 6.128 & 5818 & 5273 & 4812 \\ \hline Period 19 & 172280 & 16678 & 14324 & 13134 & 12005 & 11.158 & 10396 & 9604 & 8950 & 8365 & 7300 & 6550 & 6. 198 & 5877 & 5316 & 4844 \\ \hline Period 20 & 18040 & 16351 & 1487 & 13560 & 12.462 & 11470 & 10694 & 9818 & 9.129 & 8514 & 7400 & 6023 & 6260 & 5920 & 5353 & 4870 \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|c|c|c|c|c|c|c|c|c|c|c|c|} \hline \multicolumn{17}{|c|}{ Present Value of \$1 } \\ \hline Periods & 1% & 2% & 3% & 4% & 5% & 6% & 7% & 8% & 9% & 10% & 12% & 14% & 15% & 16% & 18% & 20% \\ \hline Period 1 & 0.980 & 0980 & 0.971 & 0.982 & 0952 & 0943 & 0935 & 0.926 & 0.917 & 0.909 & 0893 & 0877 & 0.870 & 0862 & 0847 & 0.833 \\ \hline Period 2 & 0980 & 0.961 & 0.943 & 0.825 & 0907 & 0880 & 0.873 & 0.857 & 0.842 & 0.826 & 0.797 & 0769 & 0756 & 0.743 & 0718 & 0.694 \\ \hline Period 3 & 0.971 & 0942 & 0915 & 0.889 & 0884 & 0840 & 0.816 & 0.794 & 0772 & 0751 & 0.712 & 0.675 & 0658 & 0641 & 0.609 & 0579 \\ \hline Period 4 & 0.861 & 0.924 & 0888 & 0.855 & 0.823 & 0792 & 0763 & 0.735 & 0708 & 0.683 & 0.636 & 0.592 & 0.572 & 0552 & 0.516 & 0.482 \\ \hline Period 5 & 0.951 & 0.906 & 0.863 & 0822 & 0784 & 0747 & 0713 & 0681 & 0650 & 0621 & 0.567 & 0.519 & 0.497 & 0.476 & 0.437 & 0.402 \\ \hline Period6Period7 & 0.9420.933 & 0888 & 0837 & 0790 & 0746 & 0705 & 0666 & 0.630 & 0.596 & 0.564 & 0507 & 0.456 & 0.432 & 0.410 & 0.370 & 0.335 \\ \hline Period7Period8 & 0.9330.923 & 0.871 & 0.813 & 0760 & 0711 & 0.665 & 0623 & 0.583 & 0547 & 0513 & 0452 & 0400 & 0376 & 0.354 & 0.314 & 0.279 \\ \hline Period8Period9 & 09830914 & 0853 & 0789 & 0731 & 0677 & 0627 & 0582 & 0540 & 0.502 & 0.467 & 0.404 & 0351 & 0.327 & 0.305 & 0.266 & 0.233 \\ \hline Period9Period10 & 0.9140.905 & 0837 & 0766 & 0703 & 0645 & 0.592 & 0.514 & 0500 & 0460 & 0.424 & 0.361 & 0308 & 0284 & 0.263 & 0.225 & 0194 \\ \hline & 0.905 & 0.820 & 0744 & 0.876 & 0.614 & 0558 & 0508 & 0463 & 0422 & 0386 & 0322 & 0270 & 0247 & 0.227 & 0.191 & 0.162 \\ \hline Period11Period12 & 08960887 & & 0722 & 0650 & 0.585 & 0.527 & 0.475 & 0429 & 0.388 & 0350 & 0.287 & 0237 & 0.215 & 0.195 & 0162 & 0135 \\ \hline Period 13 & 0.879 & 07880773 & 0.7010.581 & 0625 & 0557 & 0.497 & 0.444 & 0397 & 0356 & 0319 & 0.257 & 0208 & 0.187 & 0.168 & 0137 & 0.112 \\ \hline & 0.870 & 0.758 & 06810681 & 06010577 & 0.5300505 & 0469 & 0415 & 0368 & 0326 & 0290 & 0229 & 0.182 & 0.163 & 0.145 & 0.116 & 0.093 \\ \hline Period 15 & 0881 & 0.743 & 06610642 & 05770555 & 0.505 & 0.442 & 0398 & 0.340 & 0.299 & 0263 & 0205 & 0.160 & 0.141 & 0.125 & 0099 & 0.078 \\ \hline Period 16 & 0853 & 0.728 & 0623 & & 0481 & 0417 & 0362 & 0315 & 0.275 & 0239 & 0.183 & 0.140 & 0.123 & 0.108 & 0004 & 0.065 \\ \hlined17 & 0844 & 0.714 & 0605 & 05340513 & 0.4580.436 & 0394 & 0339 & 0.292 & 0.252 & 0218 & 0.163 & 0.123 & 0.107 & 0.093 & 0071 . & 0.054 \\ \hline Period 18 & 0836 & 0700 & 0.587 & 0.494 & 0.4360.416 & 03710350 & 0317 & 0270 & 0231 & 0.198 & 0.146 & 0.108 & 0093 & 0000 & 0060 & 0.045 \\ \hline Period 19 & 0.828 & 0,886 & 0.570 & 0475 & 04160396 & 03500331 & 0.296 & 0.250 & 0212 & 0180 & 0.130 & 0095 & 0.081 & 0.009 & 0051 & 0038 \\ \hline Period 20 & 0820 & 0673 & 0564 & 0456 & 0.377 & 0.3310.312 & 02770258 & 0232 & 0.184 & 0164 & 0.116 & 0083 & 0070 & 0060 & 0.043 & 0.031 \\ \hline & & & & & & & & 0215 & 0.178 & 0.149 & 0.104 & 0.073 & 0081 & 2051 & 0.037 & 28 \\ \hline \end{tabular}