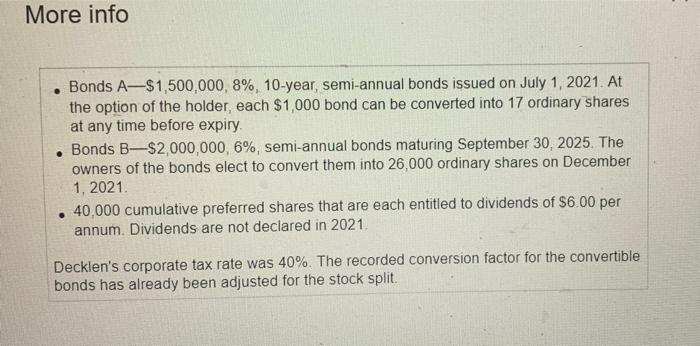

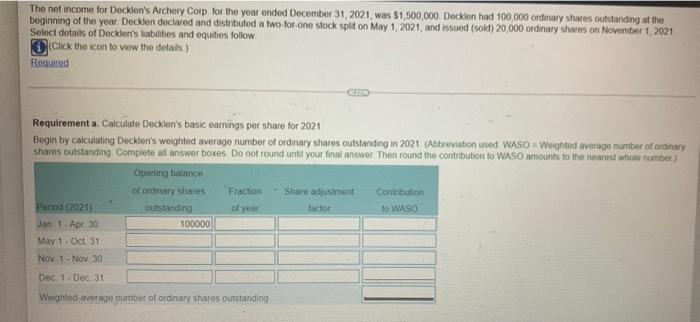

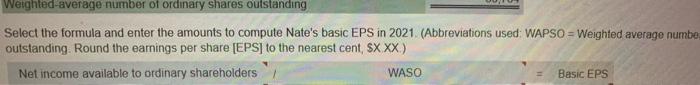

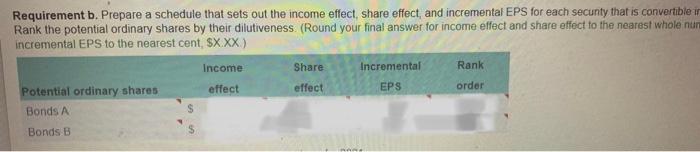

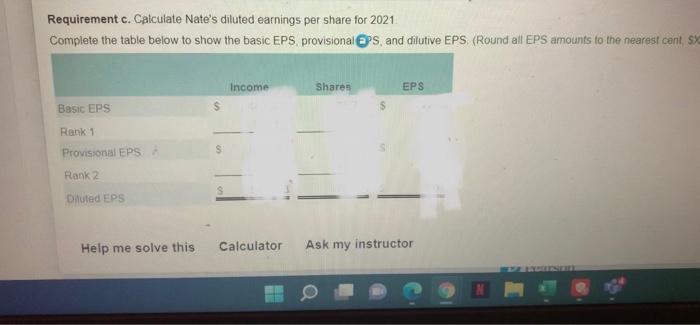

More info . Bonds A-$1,500,000, 8%, 10-year, semi-annual bonds issued on July 1, 2021. At the option of the holder, each $1,000 bond can be converted into 17 ordinary shares at any time before expiry Bonds B$2,000,000, 6%, semi-annual bonds maturing September 30, 2025. The owners of the bonds elect to convert them into 26,000 ordinary shares on December 1, 2021 . 40,000 cumulative preferred shares that are each entitled to dividends of $6.00 per annum. Dividends are not declared in 2021 Decklen's corporate tax rate was 40%. The recorded conversion factor for the convertible bonds has already been adjusted for the stock split. The not income for Decklen's Archery Corp. for the year ended December 31, 2021, was $1,500,000 Dockon had 100,000 ordinary shares outstanding at the beginning of the year Decklen declared and distributed a two for one stock split on May 1, 2021, and issued (sold) 20,000 ordinary shares on November 1, 2021 Select details of Decklen's liabilities and equities follow Click the icon to view the details) Required Requirement a. Calculate Decklen's basic earnings por share for 2021 Bogin by calculating Deckien's weighted average number of ordinary shares outstanding in 2021 (Abbreviation used WASO - Woighted average number of ordinary Sharos outstanding Complete all answer boxes Do not found until your final answer. Then found the contribution to WASO amounts to the nearest whole number Opening balance of ordinary shares Fraction Shure adjustment Contribution Ponod (2021) outstanding of year tactor to WASO Jan 1 - Apr 30 100000 May 1 - Oct 31 Nov. 1 - Nov 30 Dec 1 - Dec 31 Woughted average number of ordinary shares outstanding Weighted average number of ordinary shares outstanding Select the formula and enter the amounts to compute Nate's basic EPS in 2021 (Abbreviations used: WAPSO = Weighted average numbe outstanding. Round the earnings per share [EPS] to the nearest cent, $XXX) Net income available to ordinary shareholders WASO Basic EPS Requirement b. Prepare a schedule that sets out the income effect, share effect, and incremental EPS for each secunty that is convertible ir Rank the potential ordinary shares by their dilutiveness. (Round your final answer for income effect and share effect to the nearest whole nur incremental EPS to the nearest cent, $X.XX) Income Share Incremental Rank Potential ordinary shares effect effect EPS Bonds A Bonds B order Requirement c. Calculate Nate's diluted earnings per share for 2021 Complete the table below to show the basic EPS provisional EPS, and dilutive EPS (Round all EPS amounts to the nearest cant sx Income Shares EPS Basic EPS Rank 1 S Provisional EPS Rank2 Duted EPS Help me solve this Calculator Ask my instructor