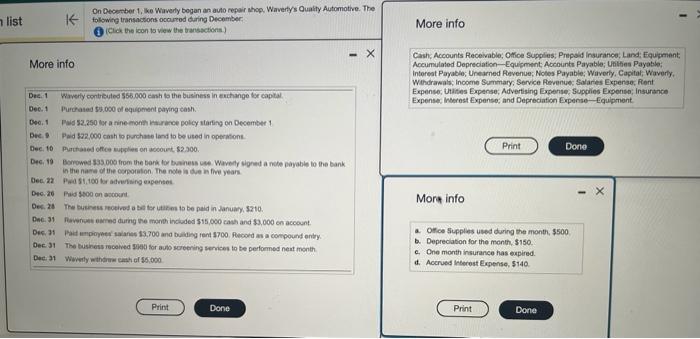

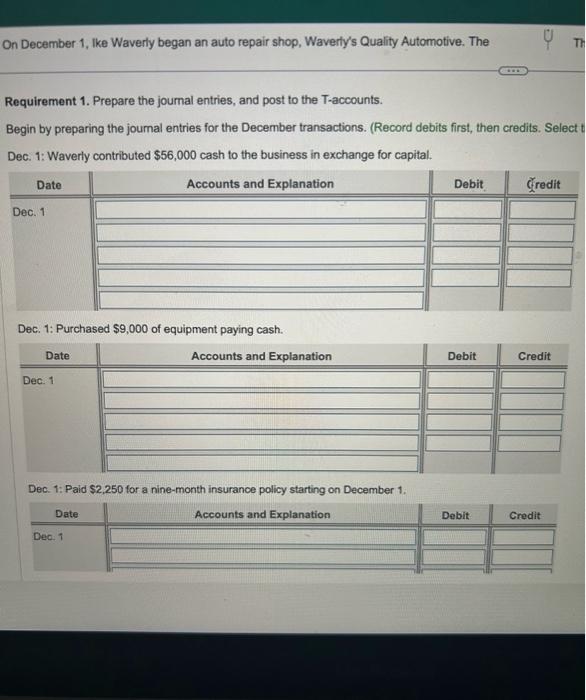

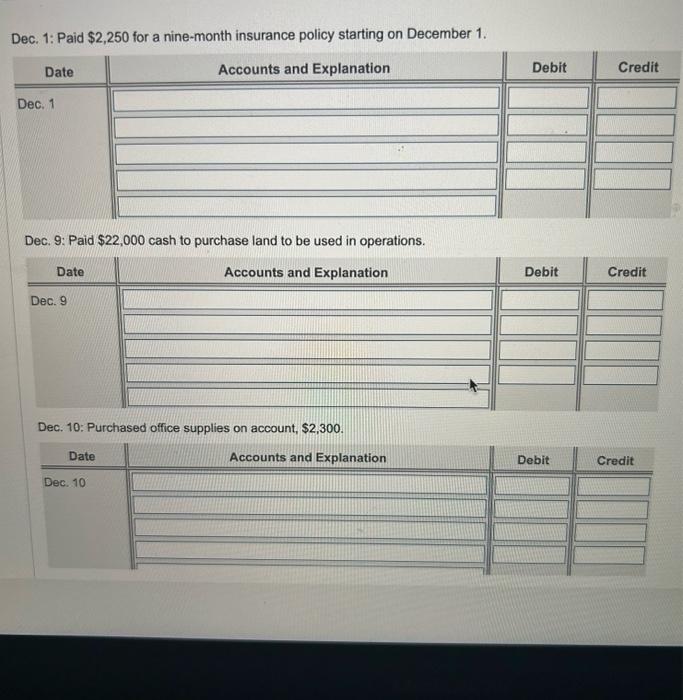

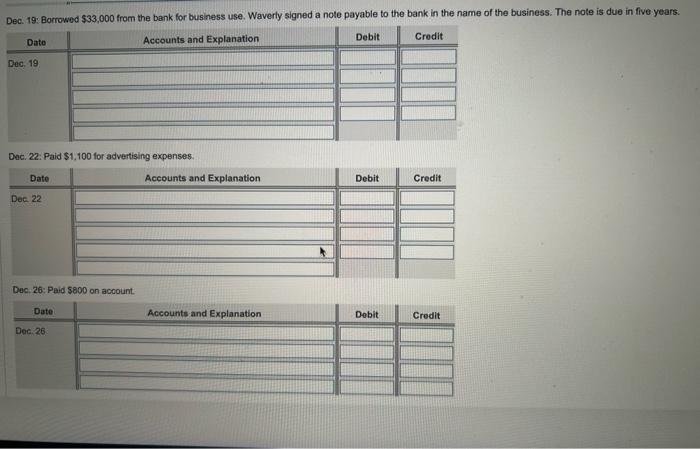

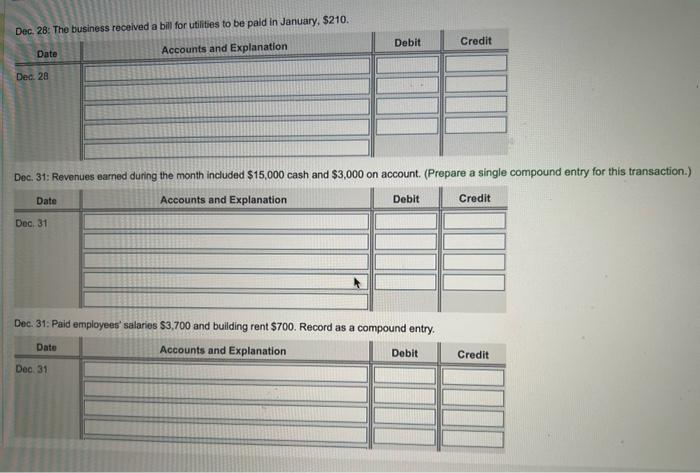

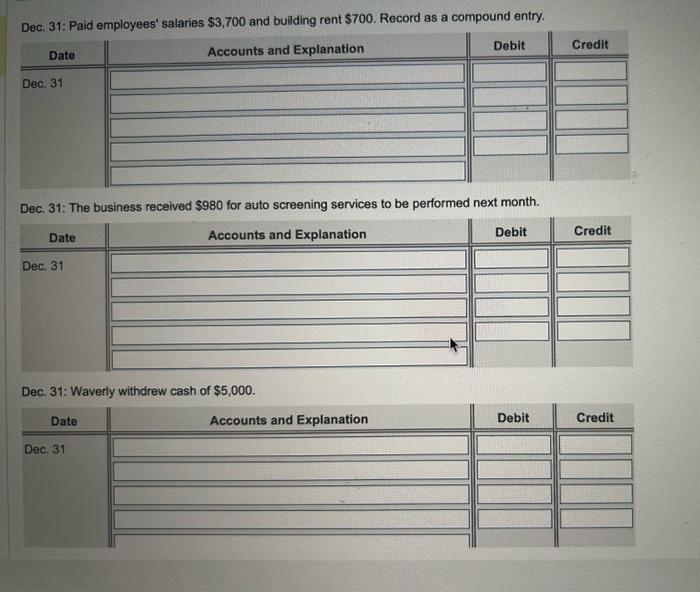

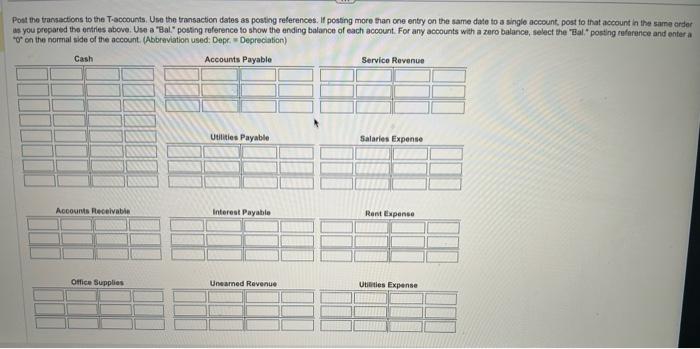

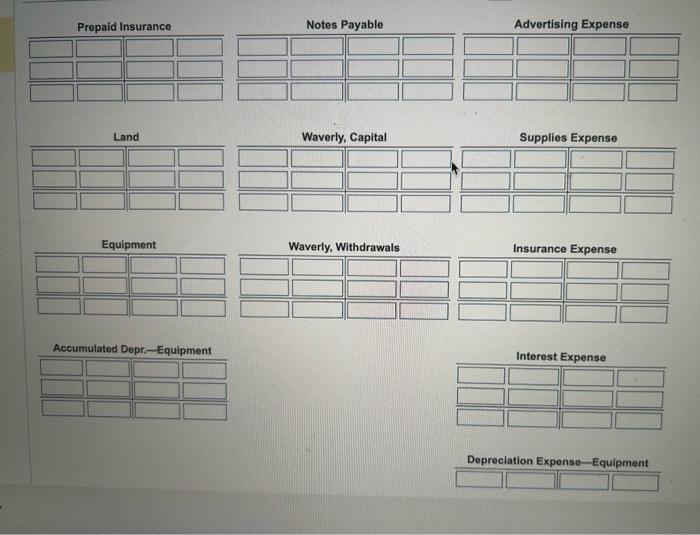

More info Cash; Accounts Recevablo; Otfoe Supples; Prepsid Insurance, Land: Equement, More info Accumulated Depreciation - Equoment Accounts Payable; Unities Payabie: interest Payable; Uneaged Revenue; Noles Payable; Wiverly, Capital, Waverty, Withdrawals, Income Summary, Sorvice Perenue: Solares Expense, Ront Dec. 1 Waverly contreuted 556.000 cash os the business in euchange ber captal. Expense, Utitites Expense, Advertising Expense, Supgios Expenso, insurtence Expense, inserost Expense; and Depreciation Expense-Equpment. Dec. 1 Purchated 55.050 of equioment payng tash. Dee. Pad 32.000 cash to parchate land to be uted in operitont. Dec. 10 Partased ofice muptes on acouent 52.200. Print Done Dec, 19 Bonowed 335000 from the Darit for bueness cae. Wavedy signed a mote payable to the bank. in the nate of the comolation. The note in die in fre yean. Oec. 2z Pials1,100 br advering eapenset. Dec. 20 Pas 400 on ascount Oes. 28 The Buthess rectired a be tor itaken is be peid in January, $210. Dec. 31 Faverives eimed durng the monetinolided 515,000 cash and 59,000 on account a. Orfoe supples uied during the month, $500. Oec 31 The bushess rocened siab sor aus sueering senices to te performed neat month. b. Depreciaton for the menth. 5150 . c. One month insurance has eupired. ti. Accried inerest Expense, $140. On December 1, Ike Waverly began an auto repair shop, Waverly's Quality Automotive. The Requirement 1. Prepare the journal entries, and post to the T-accounts. Begin by preparing the joumal entries for the December transactions. (Record debits first, then credits. Select Dec. 1: Waverly contributed $56,000 cash to the business in exchange for capital. Dec. 1: Purchased $9,000 of equipment paying cash. Dec. 1: Paid $2,250 for a nine-month insurance policy starting on December 1. Dec. 9: Paid $22,000 cash to purchase land to be used in operations. Dec. 10: Purchased office supplies on account, $2,300. Dec. 22: Paid $1.100 for advertising expenses. Dec. 26: Paid $800 on account. Dec. 31: Revenues earned during the month included $15,000 cash and $3,000 on account. (Prep Dec. 31: Paid employees' salaries $3,700 and building rent $700. Record as a compound entry. Dec. 31: Paid employees' salaries $3,700 and building rent $700. Record as a compound entry. Dec. 31: The business received $980 for auto screening services to be performed next month. Dec. 31: Waverly withdrew cash of $5,000. Post the trarsactions to the T-accounts. Use the transaction dates as posting references. If posting more tran one entry on the same date to a single account, post fo that account in the sarne arder as you prepared the ontries above. Use a "Hal." posting reference to ohow the ending balance of each account. For any accounts with a zaro balance, select the "Zal." posting tefarence and enter a or co the normal side of the account. (Abbreviation used: Depr. = Depreciation) Advertising Expense Waverly, Capital Supplies Expense Equipment Waverly, Withdrawals Insurance Expense Accumulated Depr-Equipment Interest Expense Depreciation Expense-Equipment Ri On December 1 , Ike Waverly began an auto repair shop, Waverly's Quality Automotive. The following transactions occurred during December