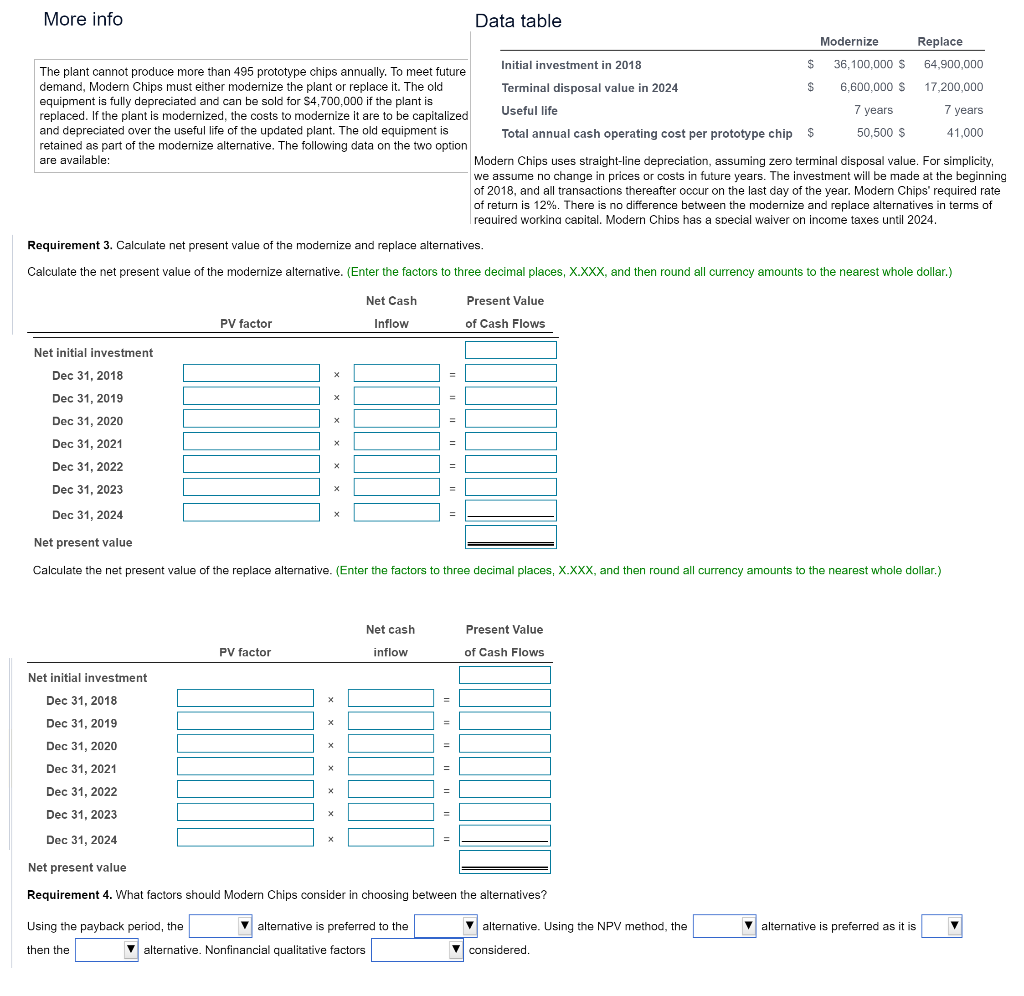

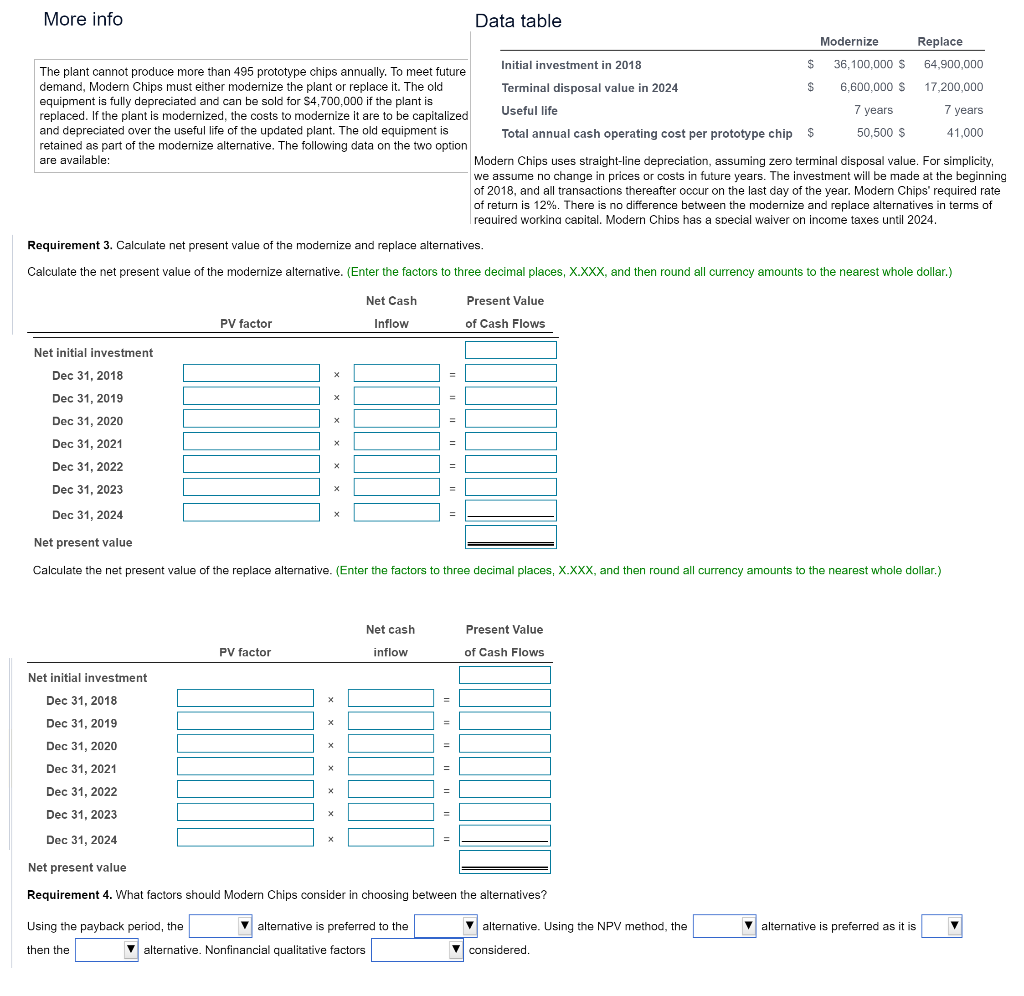

More info Data table The plant cannot produce more than 495 prototype chips annually. To meet future demand, Modern Chips must either modemize the plant or replace it. The old equipment is fully depreciated and can be sold for $4,700,000 if the plant is replaced. If the plant is modernized, the costs to modernize it are to be capitalized and depreciated over the useful life of the updated plant. The old equipment is retained as part of the modernize alternative. The following data on the two option Modern Chips uses straight-line depreciation, assuming zero terminal disposal value. For simplicity, we assume no change in prices or costs in future years. The investment will be made at the beginning of 2018, and all transactions thereafter occur on the last day of the year. Modern Chips' required rate of return is 12%. There is no difference between the modernize and replace alternatives in terms of reauired workina capital. Modern Chips has a special waiver on income taxes until 2024. Requirement 3. Calculate net present value of the modernize and replace alternatives. Calculate the net present value of the modernize alternative. (Enter the factors to three decimal places, X.XXX, and then round all currency amounts to the nearest whole dollar.) Net present value Requirement 4. What factors should Modern Chips consider in choosing between the alternatives? Using the payback period, the alternative is preferred to the alternative is preferred as it is then the alternative. Nonfinancial qualitative factors considered. More info Data table The plant cannot produce more than 495 prototype chips annually. To meet future demand, Modern Chips must either modemize the plant or replace it. The old equipment is fully depreciated and can be sold for $4,700,000 if the plant is replaced. If the plant is modernized, the costs to modernize it are to be capitalized and depreciated over the useful life of the updated plant. The old equipment is retained as part of the modernize alternative. The following data on the two option Modern Chips uses straight-line depreciation, assuming zero terminal disposal value. For simplicity, we assume no change in prices or costs in future years. The investment will be made at the beginning of 2018, and all transactions thereafter occur on the last day of the year. Modern Chips' required rate of return is 12%. There is no difference between the modernize and replace alternatives in terms of reauired workina capital. Modern Chips has a special waiver on income taxes until 2024. Requirement 3. Calculate net present value of the modernize and replace alternatives. Calculate the net present value of the modernize alternative. (Enter the factors to three decimal places, X.XXX, and then round all currency amounts to the nearest whole dollar.) Net present value Requirement 4. What factors should Modern Chips consider in choosing between the alternatives? Using the payback period, the alternative is preferred to the alternative is preferred as it is then the alternative. Nonfinancial qualitative factors considered