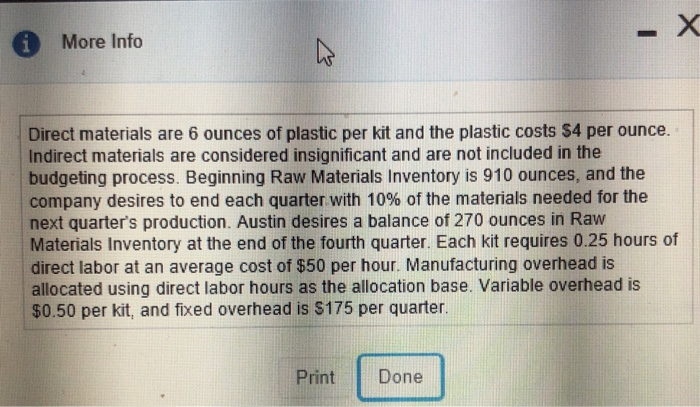

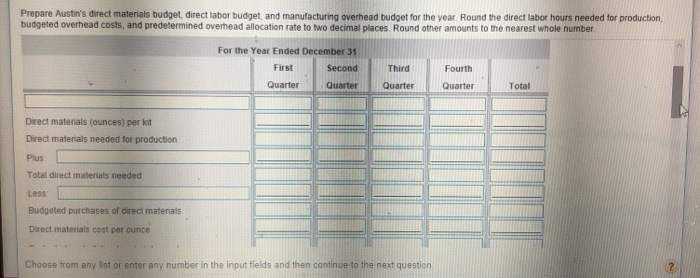

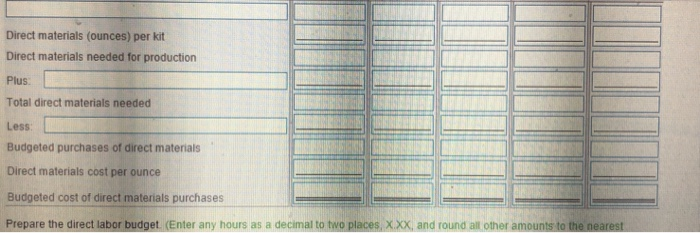

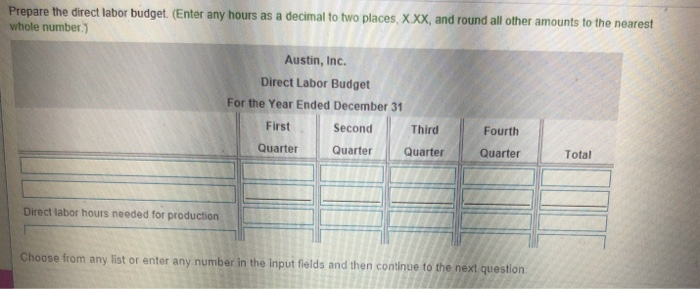

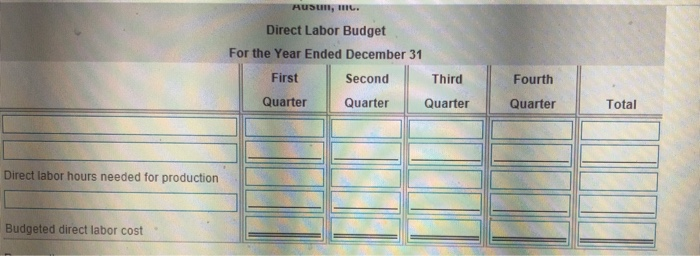

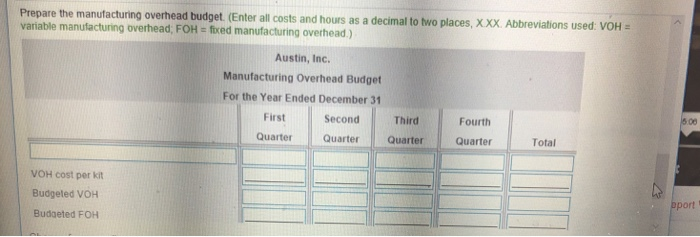

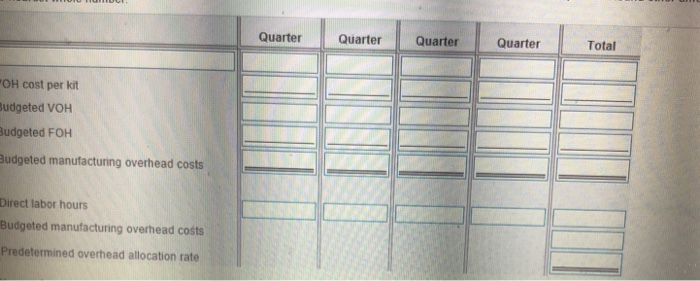

More Info Direct materials are 6 ounces of plastic per kit and the plastic costs $4 per ounce. Indirect materials are considered insignificant and are not included in the budgeting process. Beginning Raw Materials Inventory is 910 ounces, and the company desires to end each quarter with 10% of the materials needed for the next quarter's production. Austin desires a balance of 270 ounces in Raw Materials Inventory at the end of the fourth quarter. Each kit requires 0.25 hours of direct labor at an average cost of $50 per hour. Manufacturing overhead is allocated using direct labor hours as the allocation base. Variable overhead is $0.50 per kit, and fixed overhead is $175 per quarter. Print Done Prepare Austin's direct materials budget, direct labor budget, and manufacturing overhead budget for the year. Round the direct labor hours needed tor production, budgeted overhead costs, and predetermined overhead allocation rate to two decimal places. Round other amounts to the nearest whole number For the Year Ended December 31 Third Fourth First Second Quarter QuarterQuarter Quarter Total Direct materials (ounces) per kt Direct materials needed for production Plus Total direct materials needed Less Budgeted purchases of direct materials Direct materials cost per ounce Choose from any Ist or enter any number in the input fields and then continue to the next question Direct materials (ounces) per kit Direct materials needed for production Plus. Total direct materials needed Less: Budgeted purchases of direct materials Direct materials cost per ounce Budgeted cost of direct materials purchases Prepare the direct labor budget. (Enter any hours as a decimal to two places, X.XX, and round all other amounts to the nearest Prepare the direct labor budget. (Enter any hours as a decimal to two places, XXx, and round all other amo whole number.) Austin, Inc. Direct Labor Budget For the Year Ended December 31 ond Third Quarter QuarterQ Quarter First Fourth Total Direct labor hours needed for production Choose from any list or enter any number in the input fields and then continue to the next question Direct Labor Budget For the Year Ended December 31 Second Third QuarterQuarter Quarter First Fourth Quarter Total Direct labor hours needed for production Budgeted direct labor cost Prepare the manufacturing overhead budget. (Enter all costs and hours as a decimal to two places, xXx. Abbreviations used: VOH variable manufacturing overhead, FOH- fixed manufacturing overhead) Austin, Inc. Manufacturing Overhead Budget For the Year Ended December 31 Second Third QuarterQuarter Quarter First Fourth Quarter Total VOH cost per kit Budgeted VOH Budaeted FOH port Quarter Quarter Quarter Quarter Total OH cost per kit udgeted VOH Budgeted FOH Budgeted manufacturing overhead costs Direct labor hours Budgeted manufacturing overhead costs Predetermined overhead allocation rate