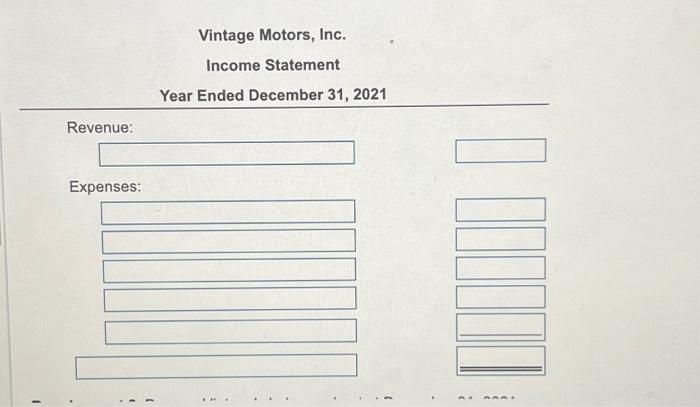

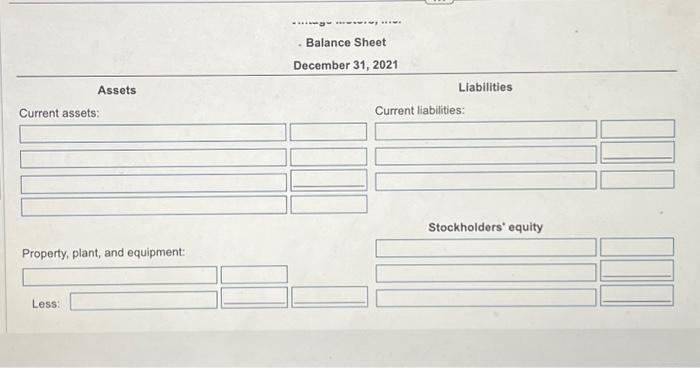

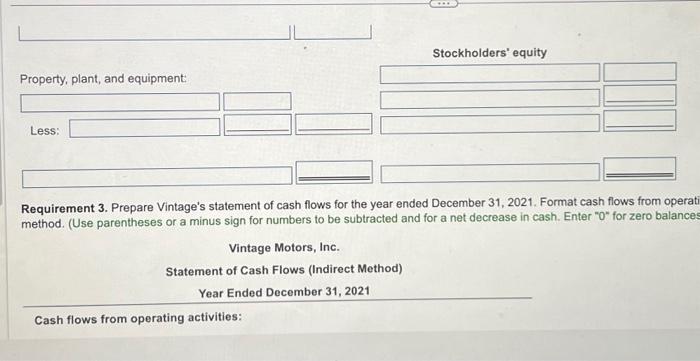

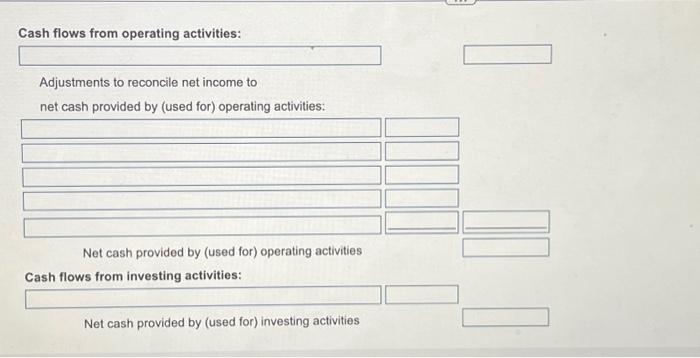

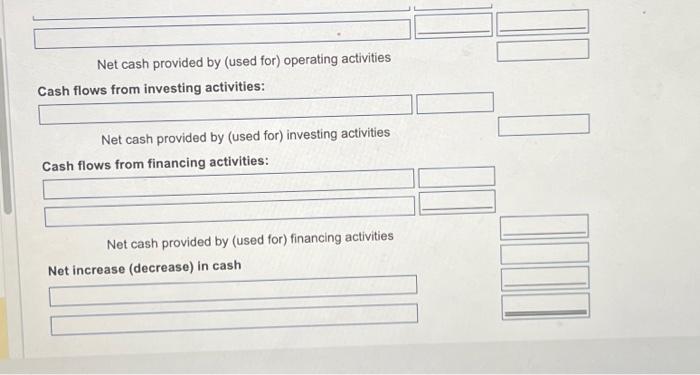

More info On January 1,2021 , Vintage issued its common stock for $430,000. Early in January, Vintage made the following cash payments: a. $160,000 for equipment b. $234,000 for inventory (six cars at $39,000 each) c. $18,000 for 2021 rent on a store building In February, Vintage purchased four cars for inventory on account. The cost of this inventory was $192,000 ( $48,000 per car). Before year-end, the company paid off $134,400 of this debt. The company uses the first-in, first-out (FIFO) method to account for its inventory. During 2021, Vintage sold seven autos for a total of $504,000. Befo year-end, it had collected 70% of this amount. The business employs two people. The combined annual payroll is $60,000, of which Vintage owes $8,000 at year-end. At the end of the year, the company paid income taxes of $22,000. Late in 2021, Vintage declared and paid cash dividends of $14,000. For equipment, Vintage uses the straight-line depreciation method, over five years, with zero residual value. Vintage Motors, Inc. Income Statement Year Ended December 31, 2021 Revenue: Expenses: - Balance Sheet December 31, 2021 Assets Liabilities Current assets: Current liabilities: Stockholders' equity Property, plant, and equipment: Less: Requirement 3. Prepare Vintage's statement of cash flows for the year ended December 31, 2021. Format cash flows from operati method. (Use parentheses or a minus sign for numbers to be subtracted and for a net decrease in cash. Enter "0" for zero balance Vintage Motors, Inc. Statement of Cash Flows (Indirect Method) Year Ended December 31, 2021 Cash flows from operating activities: Cash flows from operating activities: Adjustments to reconcile net income to net cash provided by (used for) operating activities: Net cash provided by (used for) operating activities Cash flows from investing activities: Net cash provided by (used for) investing activities Net cash provided by (used for) operating activities Cash flows from investing activities: Net cash provided by (used for) investing activities Cash flows from financing activities: Net cash provided by (used for) financing activities Net increase (decrease) in cash