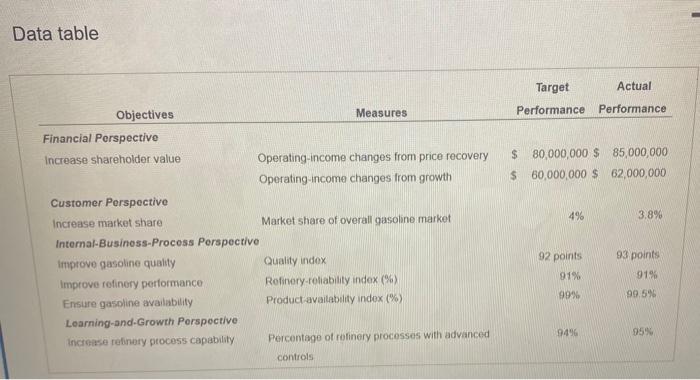

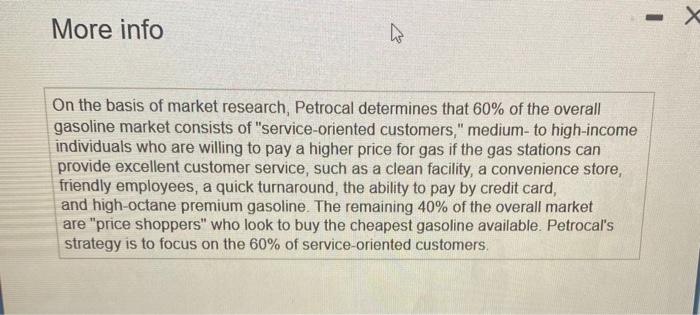

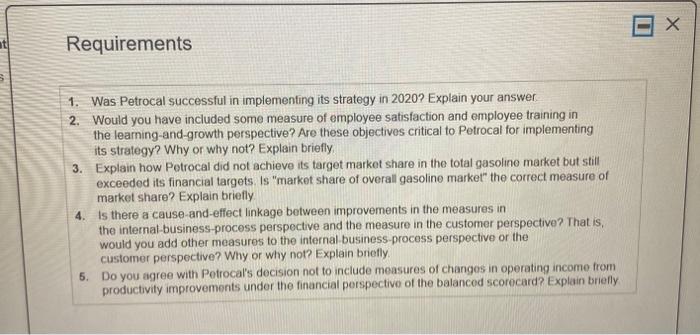

More info On the basis of market research, Petrocal determines that 60% of the overall gasoline market consists of "service-oriented customers," medium- to high-income individuals who are willing to pay a higher price for gas if the gas stations can provide excellent customer service, such as a clean facility, a convenience store, friendly employees, a quick turnaround, the ability to pay by credit card, and high-octane premium gasoline. The remaining 40% of the overall market are "price shoppers" who look to buy the cheapest gasoline available. Petrocal's strategy is to focus on the 60% of service-oriented customers. Petrocal, Inc., refines gasoline and sells it through its own Petrocal gas stations. (Click the icon to view additional information.) Petrocal's balanced scorecard for 2020 follows. For brevity, the initiatives taken under each objective are omitted. (Click the icon to view the balanced scorecard.) Read the Requirement 1. Was Petrocal successful in implementing its strategy in 2020? Explain your answer Petrocal was at implementing its strategy in 2020 for many reasons. Requirements 1. Was Petrocal successful in implementing its strategy in 2020 ? Explain your answer 2. Would you have included some measure of employee satisfaction and employee training in the learning-and-growth perspective? Are these objectives critical to Petrocal for implementing its strategy? Why or why not? Explain briefly. 3. Explain how Petrocal did not achieve its target market share in the total gasoline market but stilt exceeded its financial targets. Is "market share of overall gasoline market" the correct measure of market share? Explain briefly. 4. Is there a cause-and-effect linkage between improvements in the measures in the internal-business-process perspective and the measure in the customer perspective? That is, would you add other measures to the internal-business-process perspective or the customer perspective? Why or why not? Explain briefly. 5. Do you agree with Petrocal's decision not to include measures of changes in operating income from productivity improvements under the financial perspective of the balanced scorecard? Explain briefly Data table