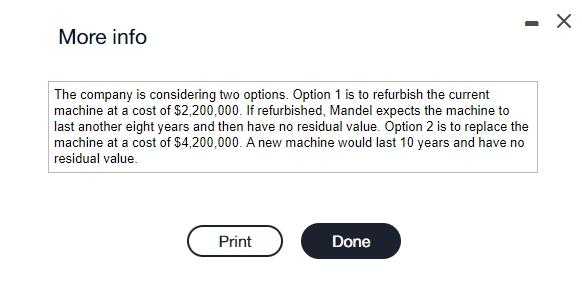

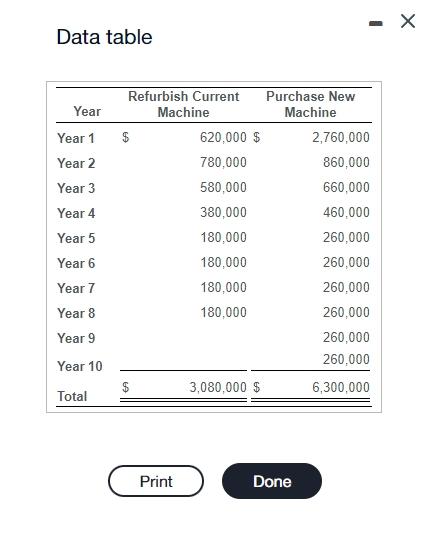

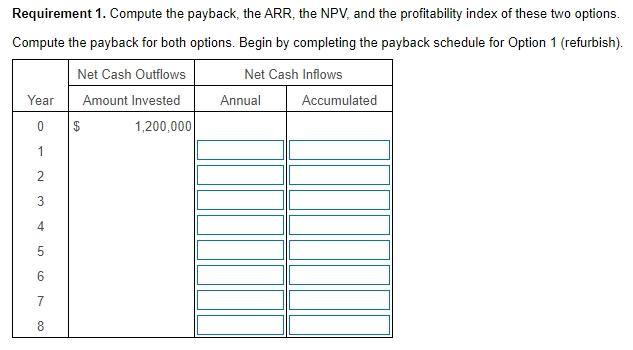

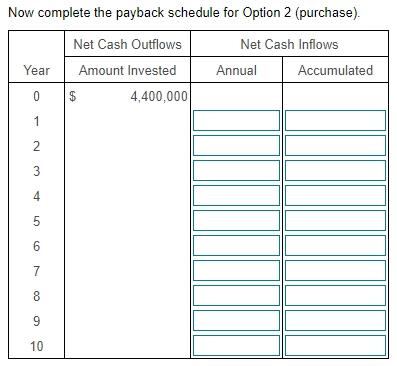

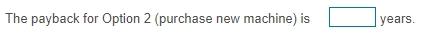

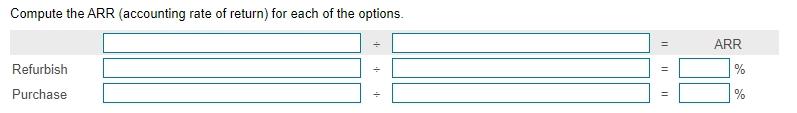

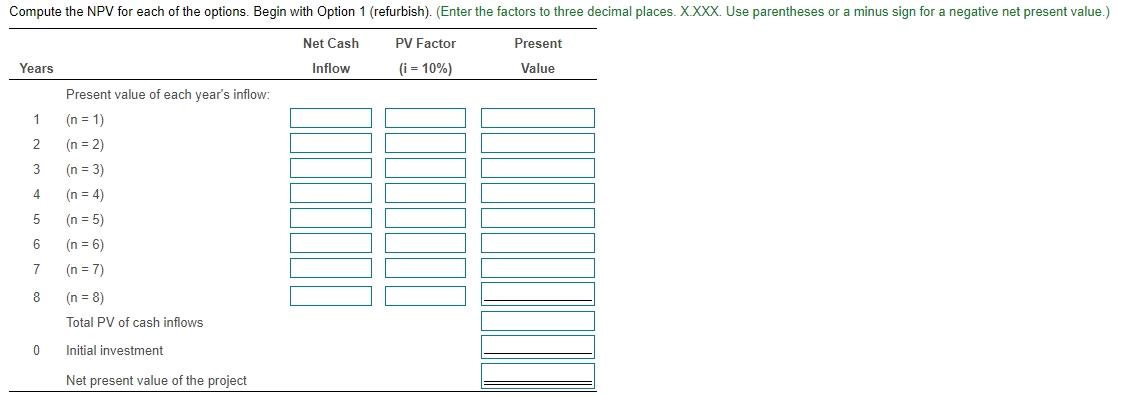

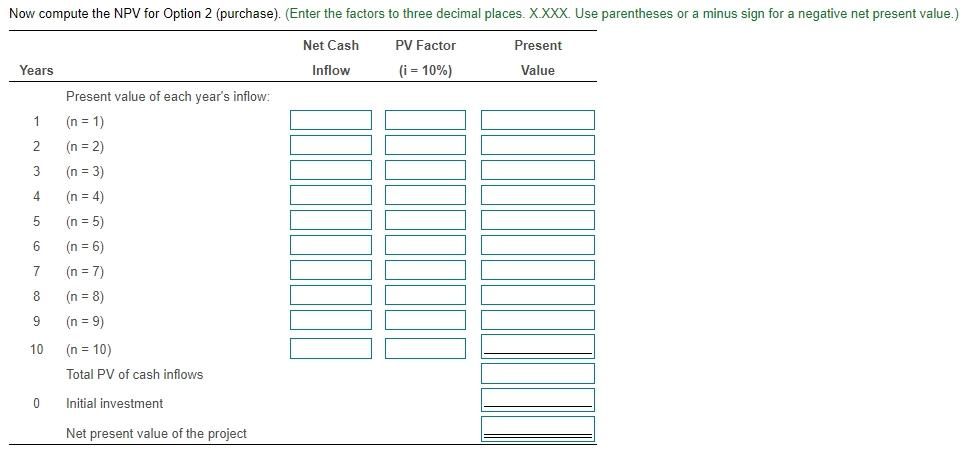

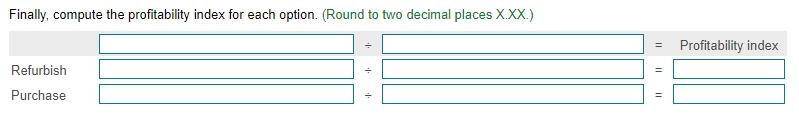

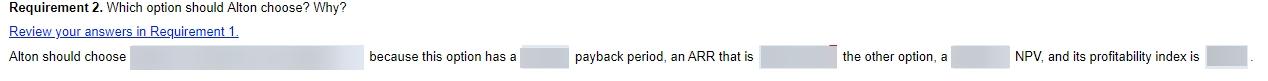

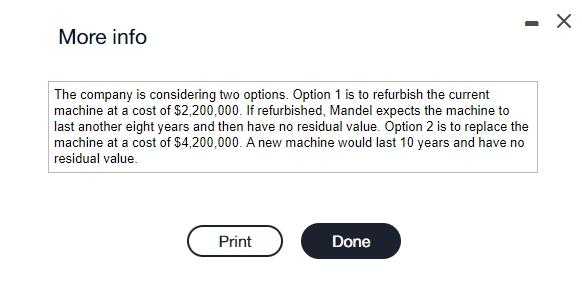

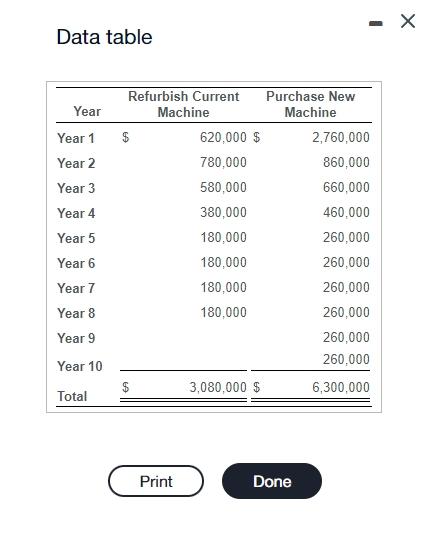

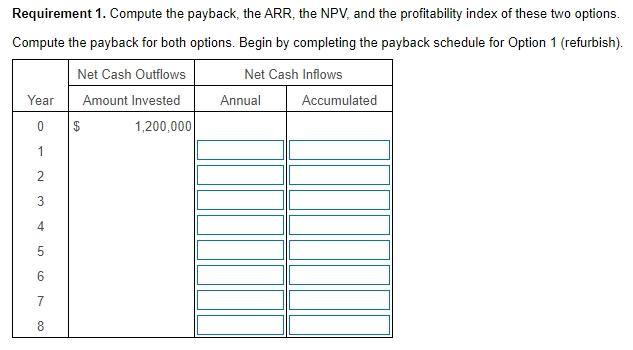

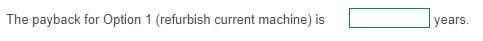

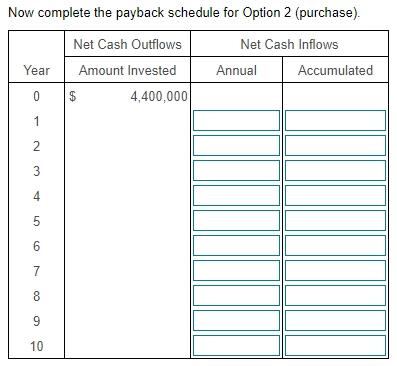

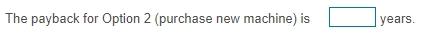

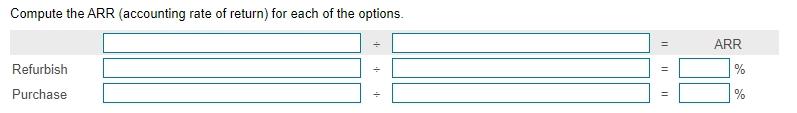

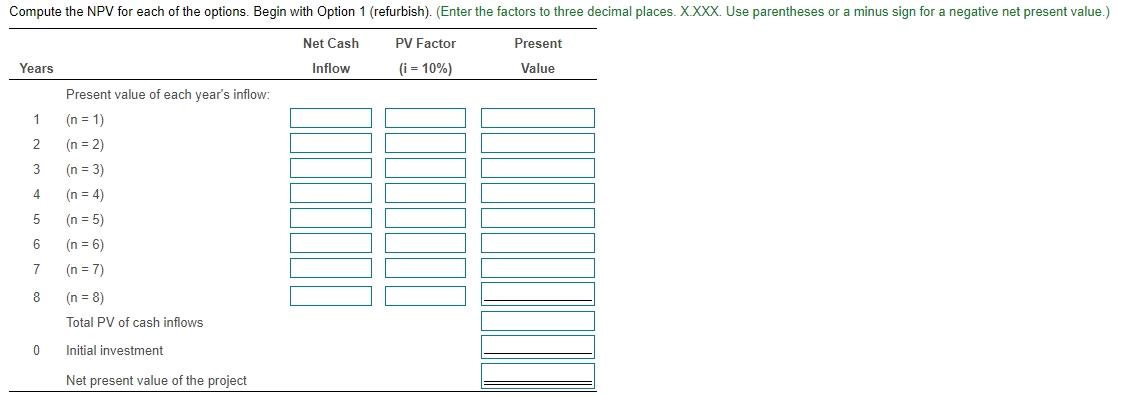

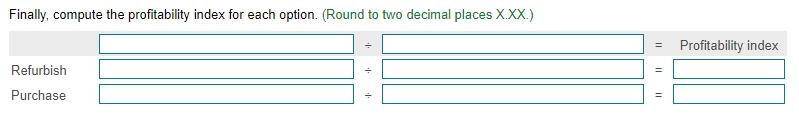

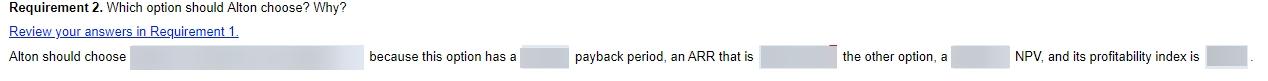

More info The company is considering two options. Option 1 is to refurbish the current machine at a cost of $2,200,000. If refurbished, Mandel expects the machine to last another eight years and then have no residual value. Option 2 is to replace the machine at a cost of $4,200,000. A new machine would last 10 years and have no residual value. Data table Requirement 1. Compute the payback, the ARR, the NPV, and the profitability index of these two options. Compute the payback for both options. Begin by completing the payback schedule for Option 1 (refurbish). The payback for Option 1 (refurbish current machine) is years. Now complete the payback schedule for Option 2 (purchase). The payback for Option 2 (purchase new machine) is years. Compute the ARR (accounting rate of return) for each of the options. Compute the NPV for each of the options. Begin with Option 1 (refurbish). (Enter the factors to three decimal places. X.XXX. Use parentheses or a minus sign for a negative net present value.) \begin{tabular}{clll} \hline Years & & Net Cash & PV Factor \\ \hline Inflow & (i=10%) & Present \\ Value \end{tabular} Now compute the NPV for Option 2 (purchase). (Enter the factors to three decimal places. X.XXX. Use parentheses or a minus sign for a negative net present value.) \begin{tabular}{cll} \hline Years & & Net Cash \end{tabular} Finally, compute the profitability index for each option. (Round to two decimal places X.XX.) Requirement 2. Which option should Alton choose? Why? Review your answers in Requirement 1. Alton should choose because this option has a payback period, an ARR that is the other option, a NPV, and its profitability index is More info The company is considering two options. Option 1 is to refurbish the current machine at a cost of $2,200,000. If refurbished, Mandel expects the machine to last another eight years and then have no residual value. Option 2 is to replace the machine at a cost of $4,200,000. A new machine would last 10 years and have no residual value. Data table Requirement 1. Compute the payback, the ARR, the NPV, and the profitability index of these two options. Compute the payback for both options. Begin by completing the payback schedule for Option 1 (refurbish). The payback for Option 1 (refurbish current machine) is years. Now complete the payback schedule for Option 2 (purchase). The payback for Option 2 (purchase new machine) is years. Compute the ARR (accounting rate of return) for each of the options. Compute the NPV for each of the options. Begin with Option 1 (refurbish). (Enter the factors to three decimal places. X.XXX. Use parentheses or a minus sign for a negative net present value.) \begin{tabular}{clll} \hline Years & & Net Cash & PV Factor \\ \hline Inflow & (i=10%) & Present \\ Value \end{tabular} Now compute the NPV for Option 2 (purchase). (Enter the factors to three decimal places. X.XXX. Use parentheses or a minus sign for a negative net present value.) \begin{tabular}{cll} \hline Years & & Net Cash \end{tabular} Finally, compute the profitability index for each option. (Round to two decimal places X.XX.) Requirement 2. Which option should Alton choose? Why? Review your answers in Requirement 1. Alton should choose because this option has a payback period, an ARR that is the other option, a NPV, and its profitability index is