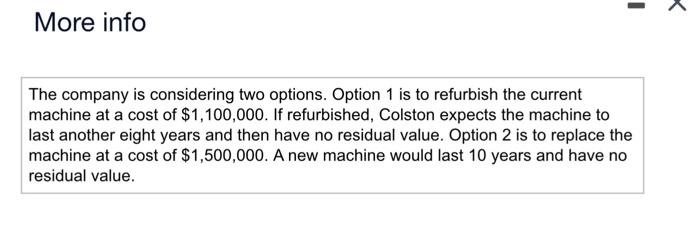

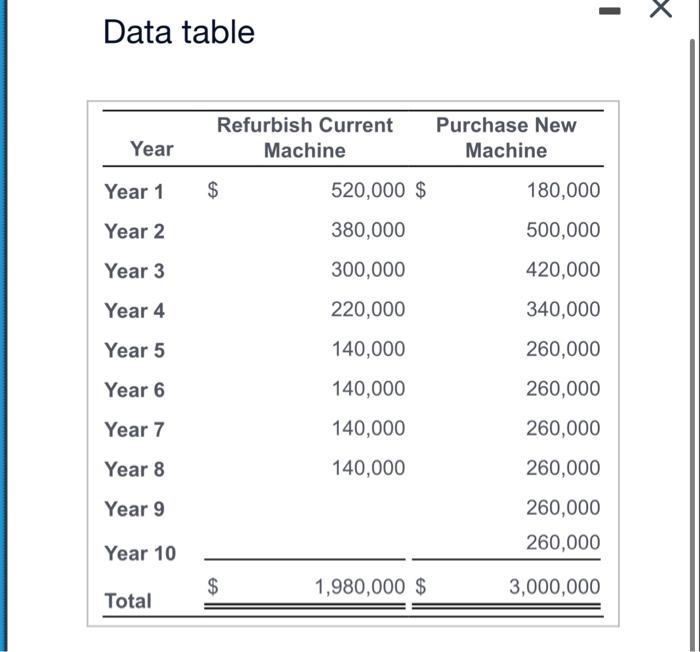

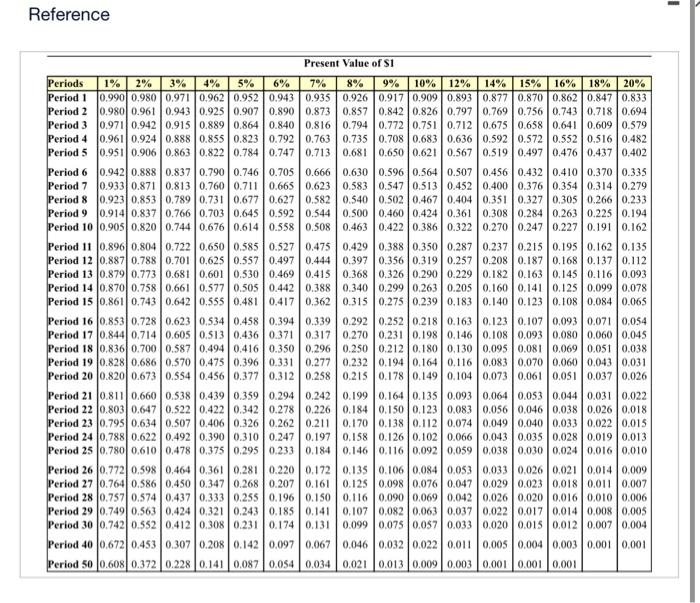

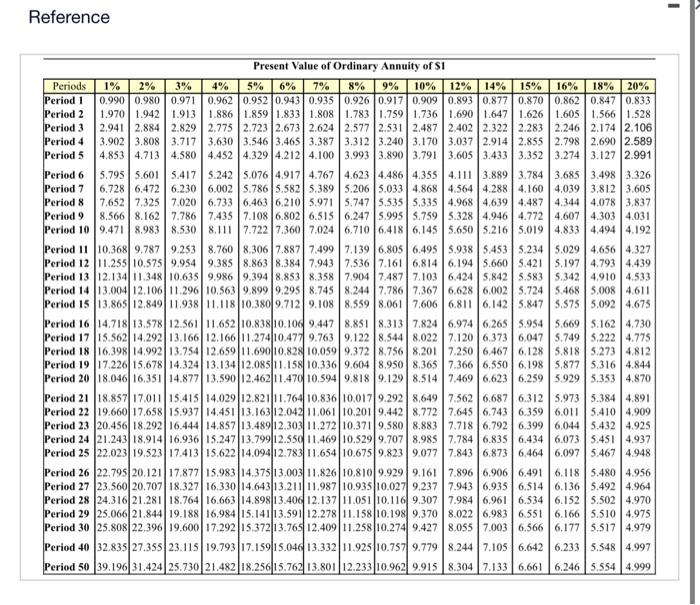

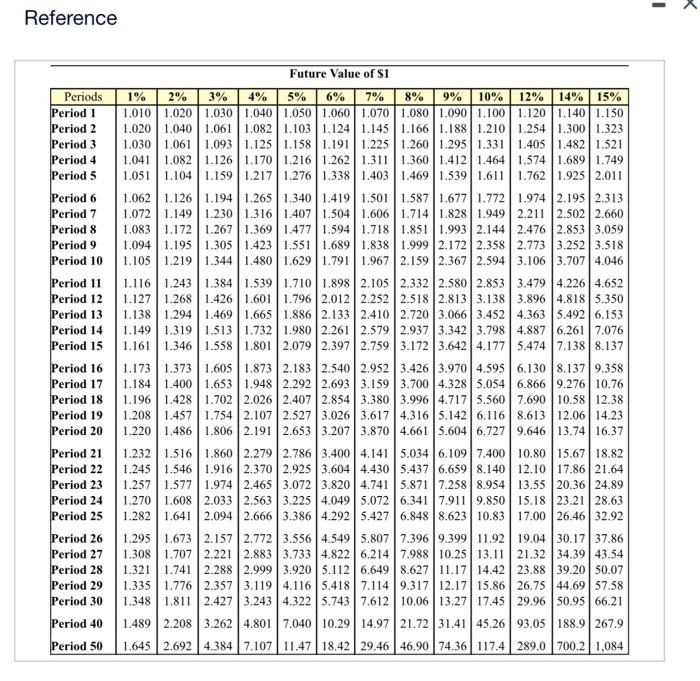

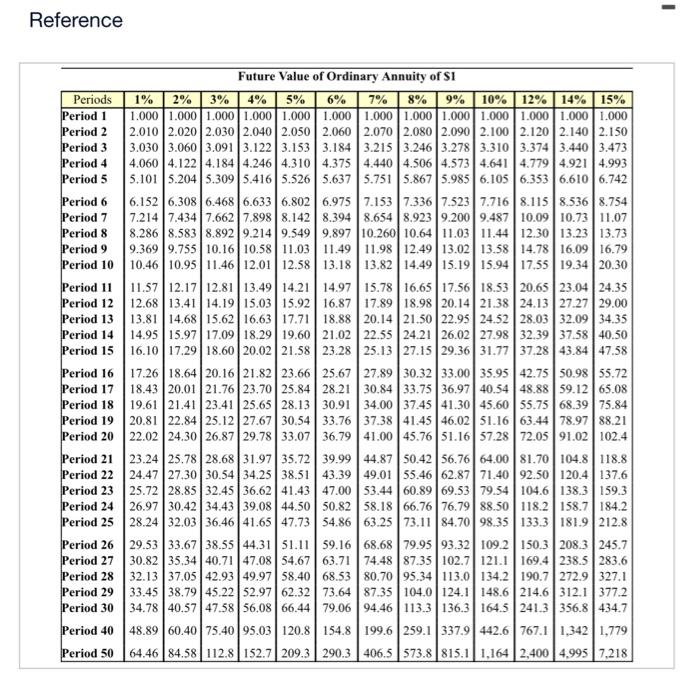

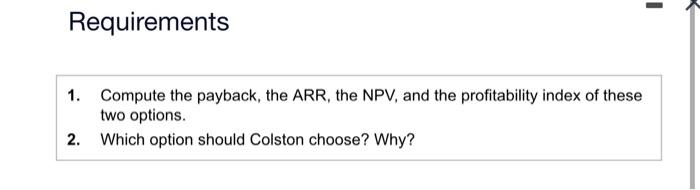

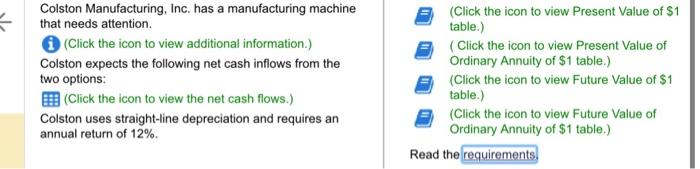

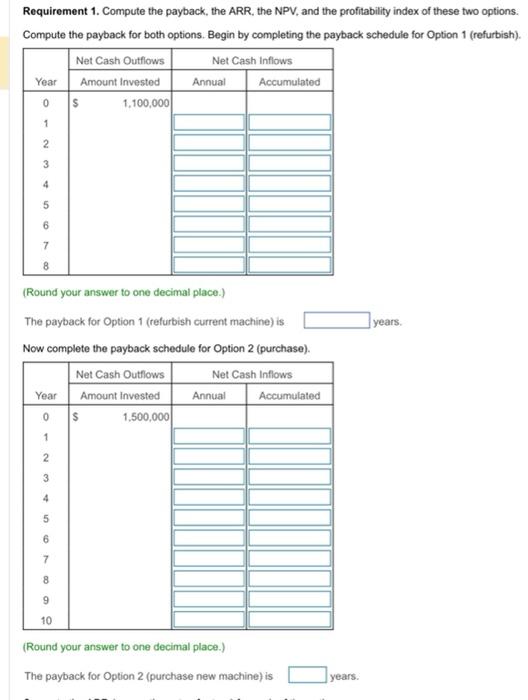

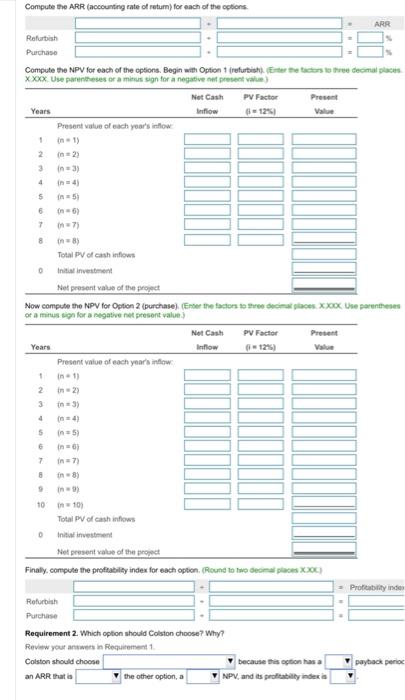

More info The company is considering two options. Option 1 is to refurbish the current machine at a cost of $1,100,000. If refurbished, Colston expects the machine to last another eight years and then have no residual value. Option 2 is to replace the machine at a cost of $1,500,000. A new machine would last 10 years and have no residual value. Data table Reference Reference Reference Reference Requirements 1. Compute the payback, the ARR, the NPV, and the profitability index of these two options. 2. Which option should Colston choose? Why? Colston Manufacturing, Inc. has a manufacturing machine (Click the icon to view Present Value of $1 that needs attention. table.) (Click the icon to view Present Value of Colston expects the following net cash inflows from the Ordinary Annuity of $1 table.) two options: (Click the icon to view Future Value of $1 (Click the icon to view the net cash flows.) table.) Colston uses straight-line depreciation and requires an (Click the icon to view Future Value of annual return of 12%. Ordinary Annuity of $1 table.) Read the Requirement 1. Compute the payback, the ARR, the NPV, and the profitability index of these two options. Compute the payback for both options. Begin by completing the payback schedule for Option 1 (refurbish). (Round your answer to one decimal place.) The payback for Option 1 (refurbish current machine) is years. Now complete the payback schedule for Option 2 (purchase). (Round your answer to one decimal place.) The payback for Option 2 (purchase new machine) is years. x. Use piarentheses or a mienis sign for a negifive ont present value ) Now compute the NPV for Opticn 2 (purchase). (fnoer the factorn so three decimag piaces. X xorx. Use parentheses or a minus siga for a ngative net piresont qalue. ) Finaly, compuhe the protrakilay index for toach opticn. (Round lo two deramal placen x.xox.) Returbish Purchase Requirement 2. Which option should Colston choose? Why? Review your anawers in foequitement 1. Colston should choose because thes ogibon has a paybock perioc an ARR that is the othecr option, a NPY, and its grofitabilty inder is