Answered step by step

Verified Expert Solution

Question

1 Approved Answer

More info: (use to answer question above) Simple investment: An investment with only one sign change in the net cash flow series Non-simple investment: An

More info: (use to answer question above)

Simple investment: An investment with only one sign change in the net cash flow series

Non-simple investment: An investment with more than one sign change occurring in the net cash flow series

i* = break even interest

Please complete question 3. Show all steps

Please complete question 3. Show all steps

DO THE BEST YOU CAN WITH THE GIVEN INFORMATION. NO MORE WILL BE PROVIDED.

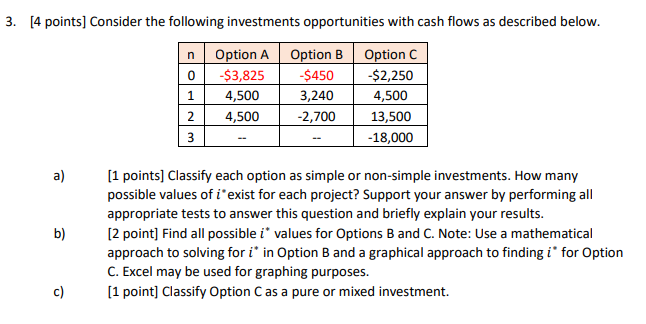

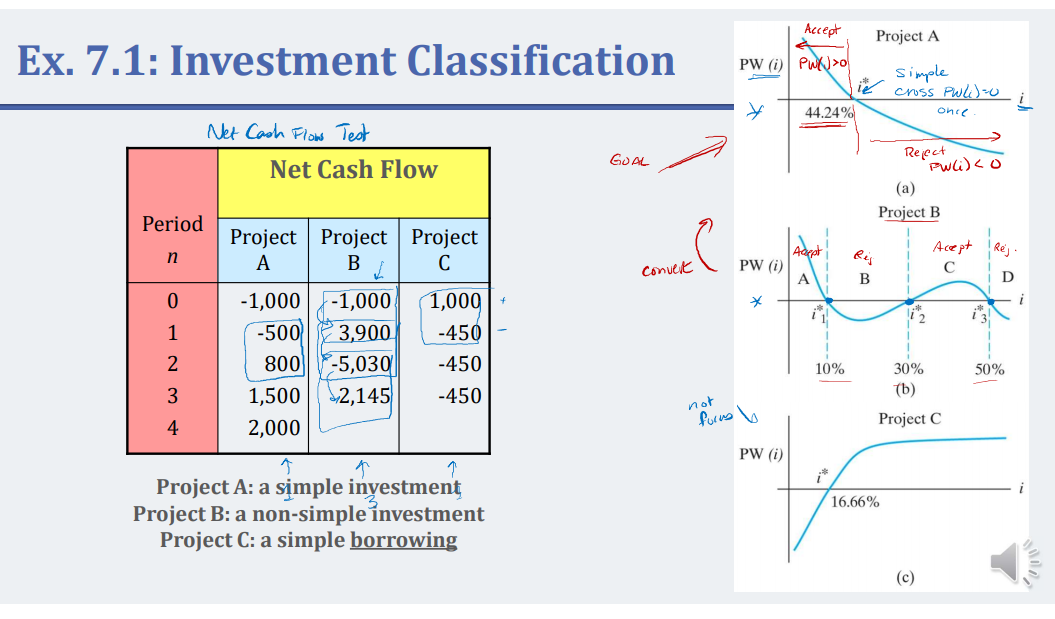

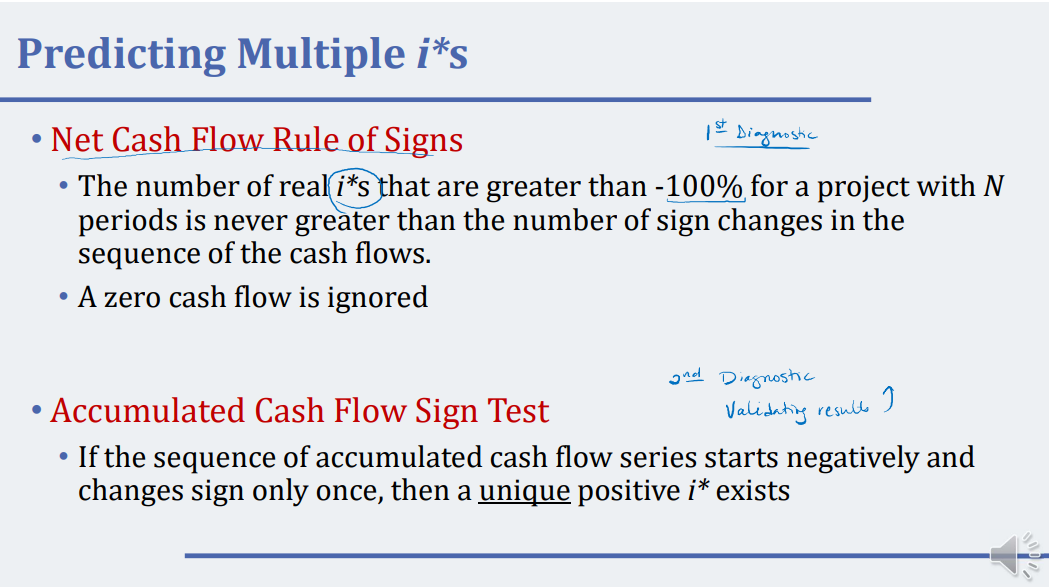

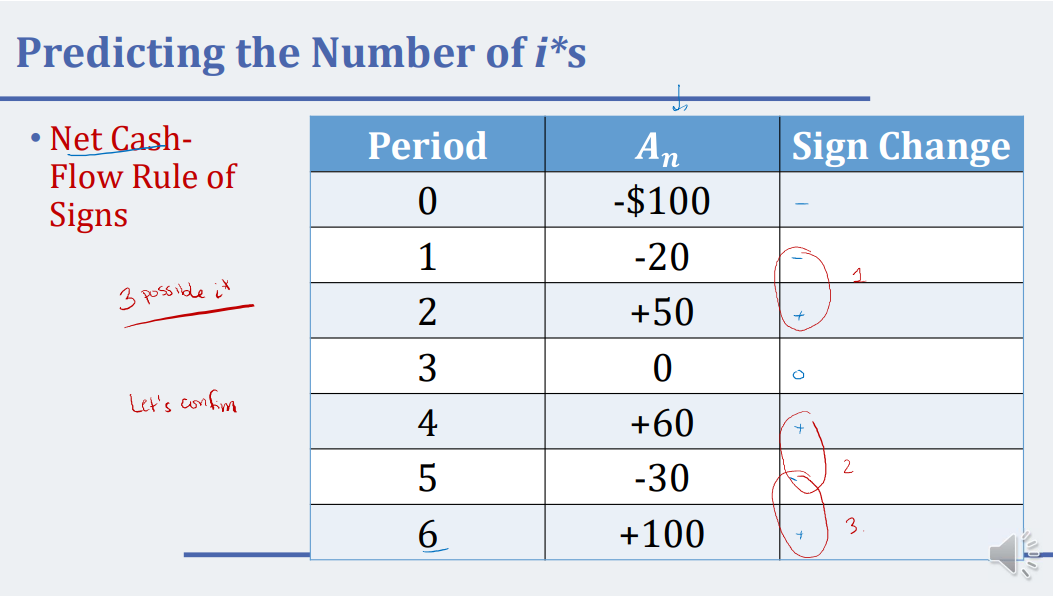

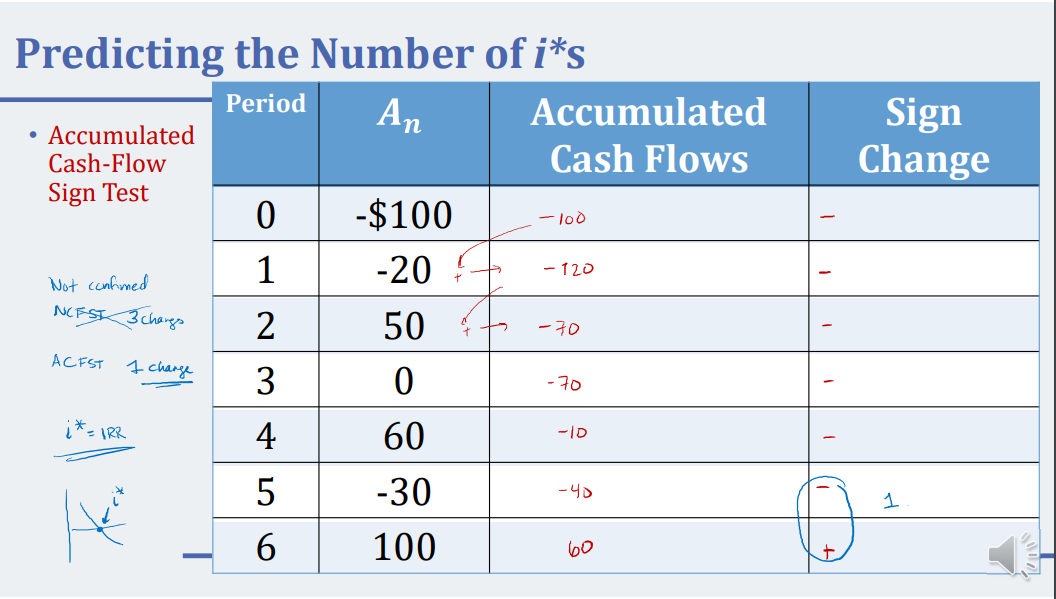

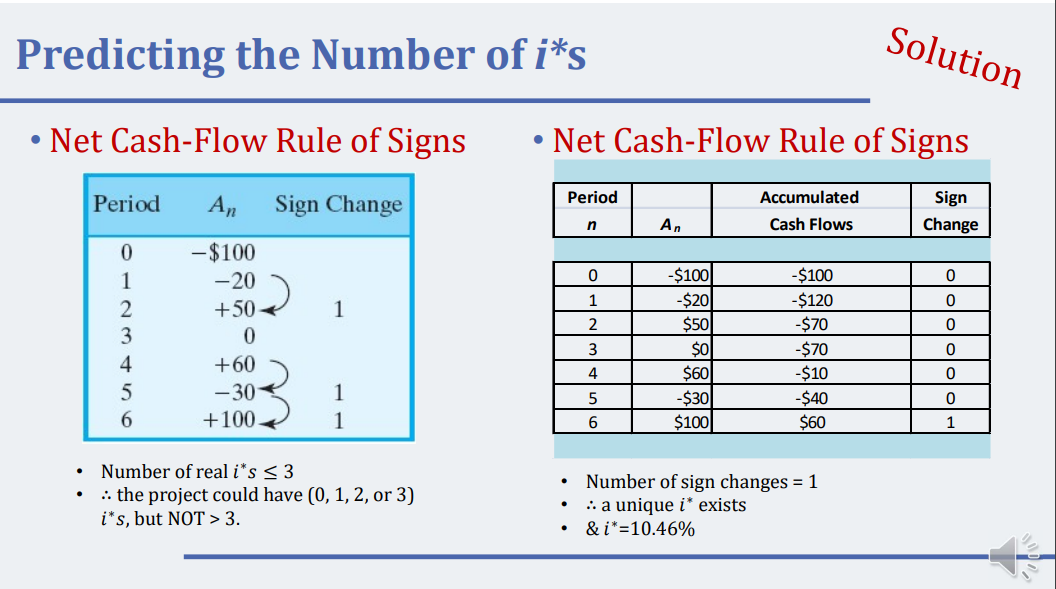

3. [4 points) Consider the following investments opportunities with cash flows as described below. n Option A Option B Optionc 0 $3,825 $450 $2,250 4,500 3,240 4,500 | 2 4,500 -2,700 13,500 -18,000 (1 points) Classify each option as simple or non-simple investments. How many possible values of i* exist for each project? Support your answer by performing all appropriate tests to answer this question and briefly explain your results. [2 point) Find all possible i* values for Options B and C. Note: Use a mathematical approach to solving for i' in Option B and a graphical approach to finding i for Option C. Excel may be used for graphing purposes. [1 point] Classify Option C as a pure or mixed investment. c) Accept Project A Ex. 7.1: Investment Classification PW (i) PWJ>o it simple cross PWL)=0 once. i 44.24% - Net Cash Flome Test Net Cash Flow GUAL Reject (a) Project B Period Acept {Rej Convert PW (i) Accept A i B 1 Project Project Project A B C - 1,000 -1,000 1,000 -500 3,900 -450 800 -450 1,500 52,145 -450 2,000 11-5,030 10% 30% (6) not forus V Project C PW (i) 16.66% Project A: a simple inyestment Project B: a non-simple investment Project C: a simple borrowing Predicting Multiple i*s 1st Diagnostic Net Cash Flow Rule of Signs The number of real i*s that are greater than -100% for a project with N periods is never greater than the number of sign changes in the sequence of the cash flows. A zero cash flow is ignored and Diagnostic Accumulated Cash Flow Sign Test Validating results ] If the sequence of accumulated cash flow series starts negatively and changes sign only once, then a unique positive i* exists Predicting the Number of i*s Period Sign Change Net Cash- Flow Rule of Signs An -$100 -20 +50 B 3 possible it 1 2 3 4 0 Let's confim - 5 +60 -30 +100 6 Period An Accumulated Cash-Flow Sign Test Sign Change 0 Not confined Predicting the Number of i*s Accumulated Cash Flows -$100 - -100 -20 -120 50 to - ACFST 7 change 3. 0 -70 i*=122 4 6 0 -10 -30 T - 6 100 60 NCES 3 changs W Predicting the Number of its Solution Net Cash-Flow Rule of Signs .Net Cash-Flow Rule of Signs Period Accumulates Period An Sign Change Period Accumulated Cash Flows Sign Change - $100 -20 +50 0 +60 -304 +100 2 -$100 -$20 $50 SOY -$100 -$120 -$70 -$70 -$10 -$40 $60 $60) 1 1 -$30 $100 6 11 Number of real i*s 3. Number of sign changes = 1 .:: a unique i* exists &i*=10.46% 3. [4 points) Consider the following investments opportunities with cash flows as described below. n Option A Option B Optionc 0 $3,825 $450 $2,250 4,500 3,240 4,500 | 2 4,500 -2,700 13,500 -18,000 (1 points) Classify each option as simple or non-simple investments. How many possible values of i* exist for each project? Support your answer by performing all appropriate tests to answer this question and briefly explain your results. [2 point) Find all possible i* values for Options B and C. Note: Use a mathematical approach to solving for i' in Option B and a graphical approach to finding i for Option C. Excel may be used for graphing purposes. [1 point] Classify Option C as a pure or mixed investment. c) Accept Project A Ex. 7.1: Investment Classification PW (i) PWJ>o it simple cross PWL)=0 once. i 44.24% - Net Cash Flome Test Net Cash Flow GUAL Reject (a) Project B Period Acept {Rej Convert PW (i) Accept A i B 1 Project Project Project A B C - 1,000 -1,000 1,000 -500 3,900 -450 800 -450 1,500 52,145 -450 2,000 11-5,030 10% 30% (6) not forus V Project C PW (i) 16.66% Project A: a simple inyestment Project B: a non-simple investment Project C: a simple borrowing Predicting Multiple i*s 1st Diagnostic Net Cash Flow Rule of Signs The number of real i*s that are greater than -100% for a project with N periods is never greater than the number of sign changes in the sequence of the cash flows. A zero cash flow is ignored and Diagnostic Accumulated Cash Flow Sign Test Validating results ] If the sequence of accumulated cash flow series starts negatively and changes sign only once, then a unique positive i* exists Predicting the Number of i*s Period Sign Change Net Cash- Flow Rule of Signs An -$100 -20 +50 B 3 possible it 1 2 3 4 0 Let's confim - 5 +60 -30 +100 6 Period An Accumulated Cash-Flow Sign Test Sign Change 0 Not confined Predicting the Number of i*s Accumulated Cash Flows -$100 - -100 -20 -120 50 to - ACFST 7 change 3. 0 -70 i*=122 4 6 0 -10 -30 T - 6 100 60 NCES 3 changs W Predicting the Number of its Solution Net Cash-Flow Rule of Signs .Net Cash-Flow Rule of Signs Period Accumulates Period An Sign Change Period Accumulated Cash Flows Sign Change - $100 -20 +50 0 +60 -304 +100 2 -$100 -$20 $50 SOY -$100 -$120 -$70 -$70 -$10 -$40 $60 $60) 1 1 -$30 $100 6 11 Number of real i*s 3. Number of sign changes = 1 .:: a unique i* exists &i*=10.46%Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started