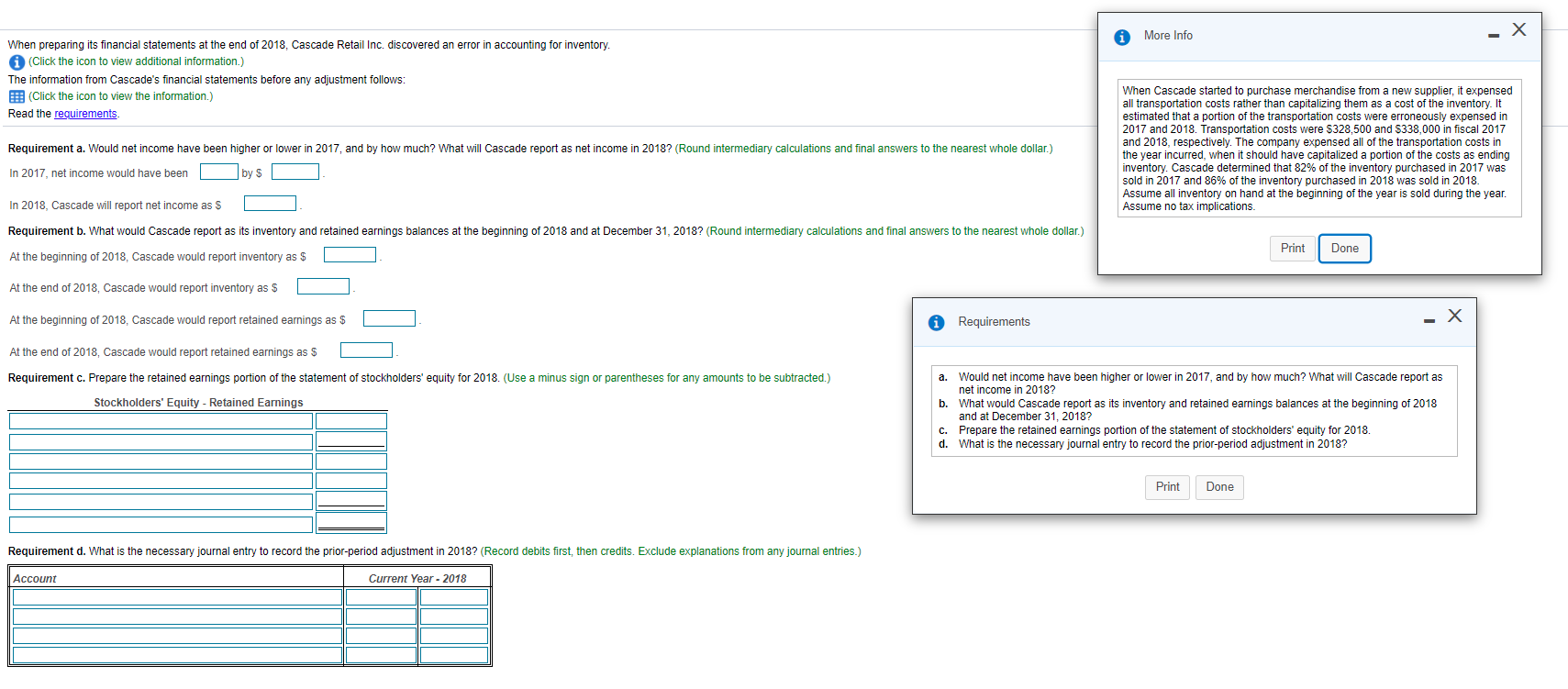

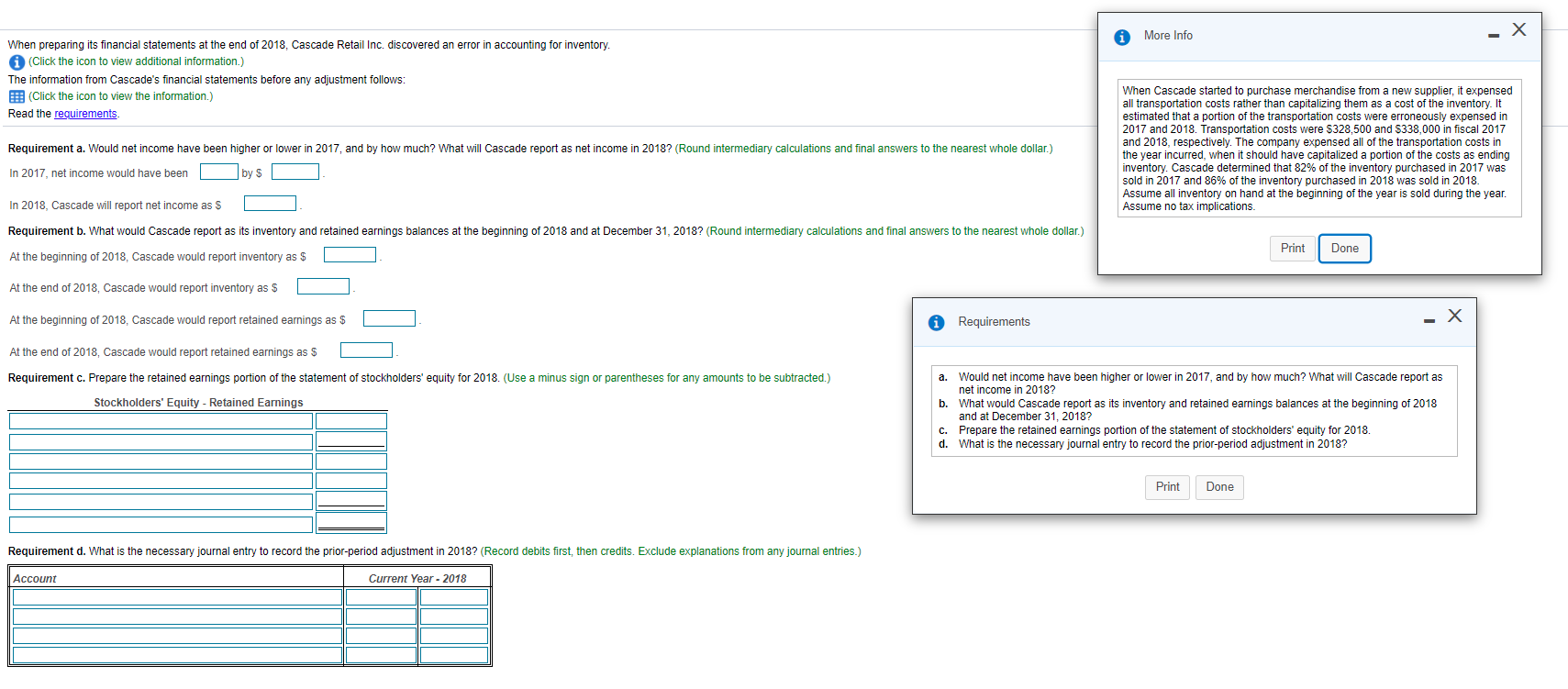

More Info When preparing its financial statements at the end of 2018, Cascade Retail Inc. discovered an error in accounting for inventory. (Click the icon to view additional information.) The information from Cascade's financial statements before any adjustment follows: B (Click the icon to view the information.) Read the requirements Requirement a. Would net income have been higher or lower in 2017, and by how much? What will Cascade report as net income in 2018? (Round intermediary calculations and final answers the nearest whole dollar) When Cascade started to purchase merchandise from a new supplier, it expensed all transportation costs rather than capitalizing them as a cost of the inventory. It estimated that a portion of the transportation costs were erroneously expensed in 2017 and 2018. Transportation costs were $328,500 and $338,000 in fiscal 2017 and 2018, respectively. The company expensed all of the transportation costs in the year incurred, when it should have capitalized a portion of the costs as ending inventory. Cascade determined that 82% of the inventory purchased in 2017 was sold in 2017 and 86% of the inventory purchased in 2018 was sold in 2018. Assume all inventory on hand at the beginning of the year is sold during the year. Assume no tax implications. In 2017, net income would have been by S In 2018, Cascade will report net income as $ Requirement b. What would Cascade report as its inventory and retained earnings balances at the beginning of 2018 and at December 31, 2018? (Round intermediary calculations and final answers to the nearest whole dollar.) At the beginning of 2018, Cascade would report inventory as $ Print Done At the end of 2018, Cascade would report inventory as $ At the beginning of 2018, Cascade would report retained earnings as $ Requirements At the end of 2018, Cascade would report retained earnings as $ Requirement c. Prepare the retained earnings portion of the statement of stockholders' equity for 2018. (Use a minus sign or parentheses for any amounts to be subtracted.) Stockholders' Equity - Retained Earnings a. Would net income have been higher or lower in 2017, and by how much? What will Cascade report as net income in 2018? b. What would Cascade report as its inventory and retained earnings balances at the beginning of 2018 and at December 31, 2018? C. Prepare the retained earnings portion of the statement of stockholders' equity for 2018. d. What is the necessary journal entry to record the prior-period adjustment in 2018? Print Done Requirement d. What is the necessary journal entry to record the prior-period adjustment in 2018? (Record debits first, then credits. Exclude explanations from any journal entries.) Account Current Year - 2018 More Info When preparing its financial statements at the end of 2018, Cascade Retail Inc. discovered an error in accounting for inventory. (Click the icon to view additional information.) The information from Cascade's financial statements before any adjustment follows: B (Click the icon to view the information.) Read the requirements Requirement a. Would net income have been higher or lower in 2017, and by how much? What will Cascade report as net income in 2018? (Round intermediary calculations and final answers the nearest whole dollar) When Cascade started to purchase merchandise from a new supplier, it expensed all transportation costs rather than capitalizing them as a cost of the inventory. It estimated that a portion of the transportation costs were erroneously expensed in 2017 and 2018. Transportation costs were $328,500 and $338,000 in fiscal 2017 and 2018, respectively. The company expensed all of the transportation costs in the year incurred, when it should have capitalized a portion of the costs as ending inventory. Cascade determined that 82% of the inventory purchased in 2017 was sold in 2017 and 86% of the inventory purchased in 2018 was sold in 2018. Assume all inventory on hand at the beginning of the year is sold during the year. Assume no tax implications. In 2017, net income would have been by S In 2018, Cascade will report net income as $ Requirement b. What would Cascade report as its inventory and retained earnings balances at the beginning of 2018 and at December 31, 2018? (Round intermediary calculations and final answers to the nearest whole dollar.) At the beginning of 2018, Cascade would report inventory as $ Print Done At the end of 2018, Cascade would report inventory as $ At the beginning of 2018, Cascade would report retained earnings as $ Requirements At the end of 2018, Cascade would report retained earnings as $ Requirement c. Prepare the retained earnings portion of the statement of stockholders' equity for 2018. (Use a minus sign or parentheses for any amounts to be subtracted.) Stockholders' Equity - Retained Earnings a. Would net income have been higher or lower in 2017, and by how much? What will Cascade report as net income in 2018? b. What would Cascade report as its inventory and retained earnings balances at the beginning of 2018 and at December 31, 2018? C. Prepare the retained earnings portion of the statement of stockholders' equity for 2018. d. What is the necessary journal entry to record the prior-period adjustment in 2018? Print Done Requirement d. What is the necessary journal entry to record the prior-period adjustment in 2018? (Record debits first, then credits. Exclude explanations from any journal entries.) Account Current Year - 2018