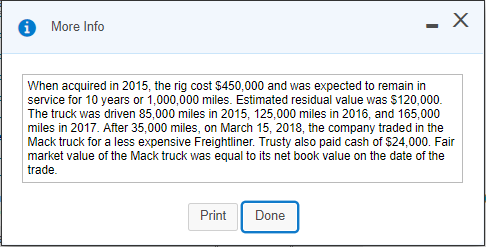

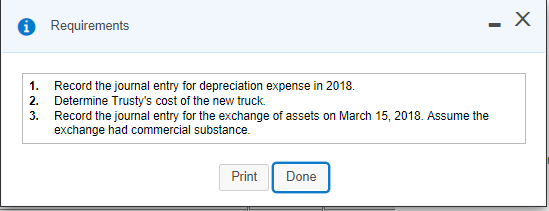

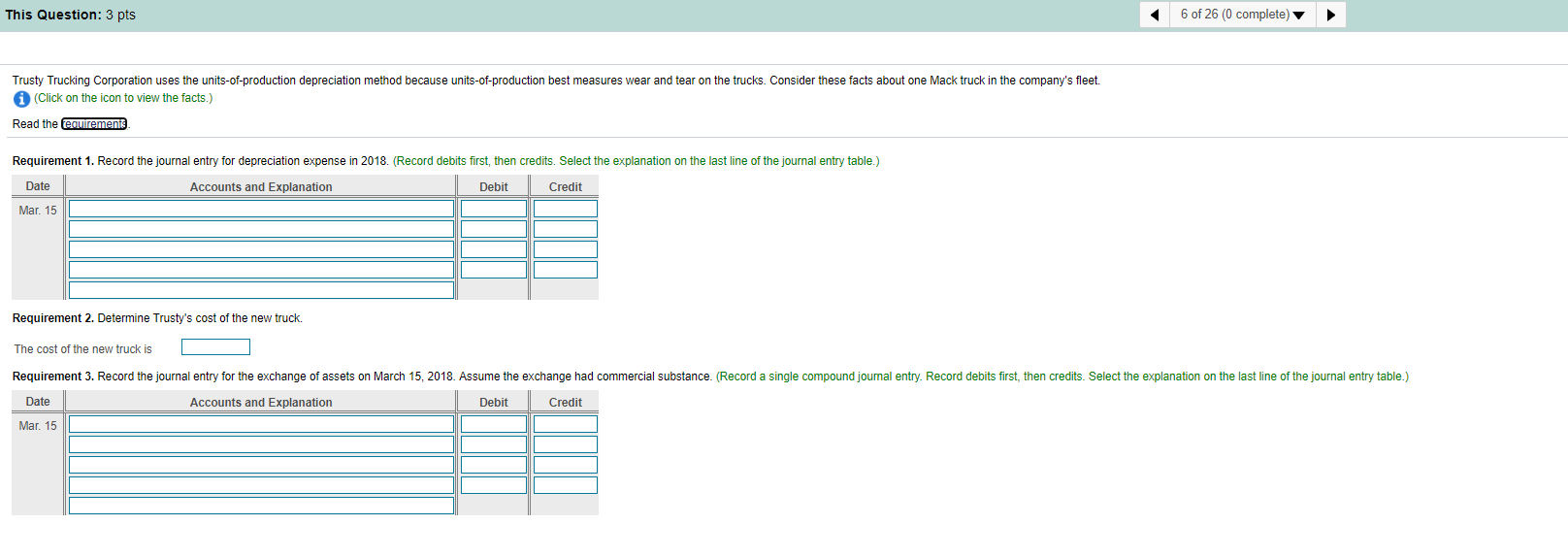

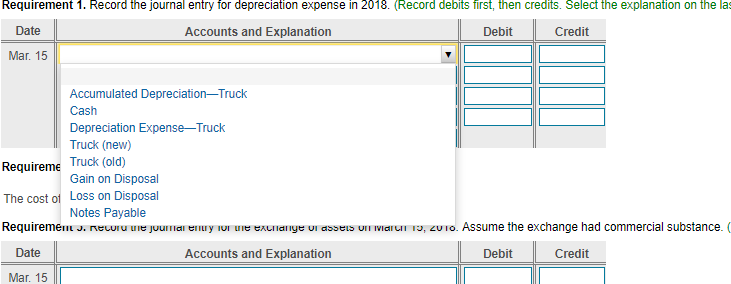

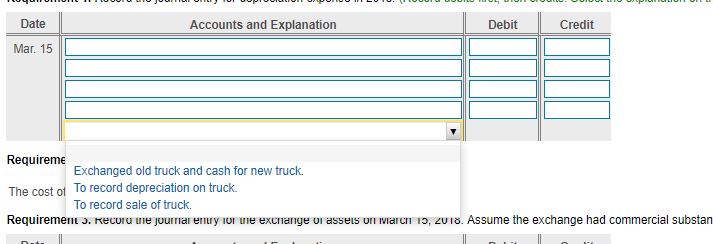

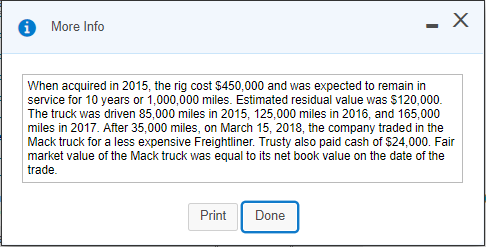

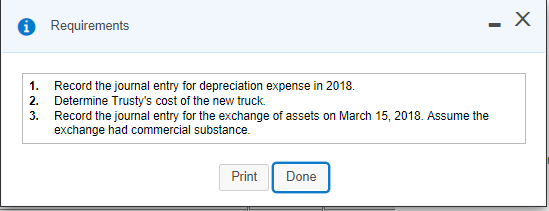

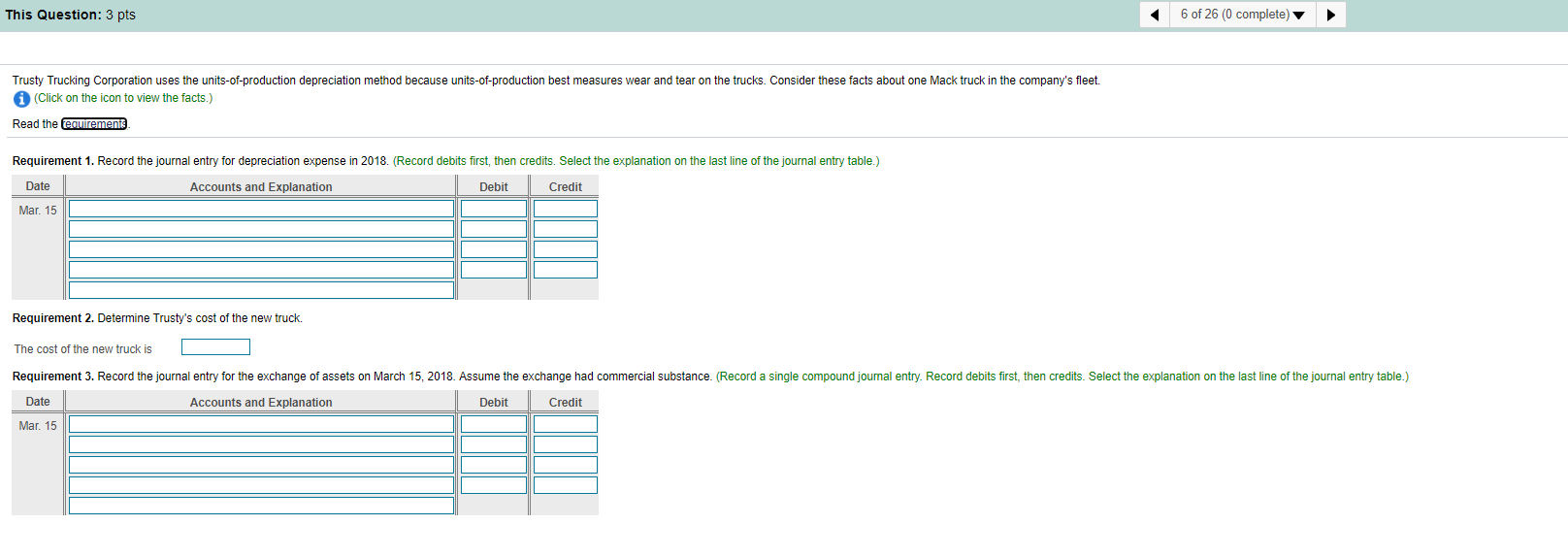

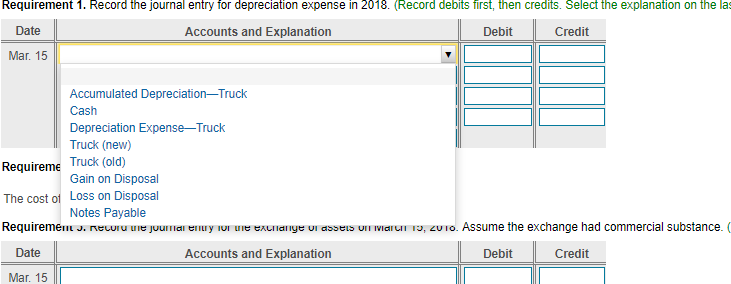

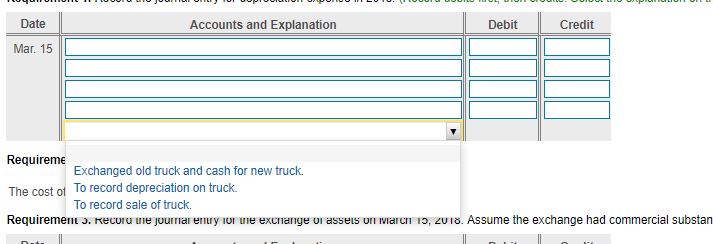

More Info -X When acquired in 2015, the rig cost $450,000 and was expected to remain in service for 10 years or 1,000,000 miles. Estimated residual value was $120,000. The truck was driven 85,000 miles in 2015, 125,000 miles in 2016, and 165,000 miles in 2017. After 35,000 miles, on March 15, 2018, the company traded in the Mack truck for a less expensive Freightliner. Trusty also paid cash of $24,000. Fair market value of the Mack truck was equal to its net book value on the date of the trade Print Done Requirements i 1. 2. 3. Record the journal entry for depreciation expense in 2018. Determine Trusty's cost of the new truck. Record the journal entry for the exchange of assets on March 15, 2018. Assume the exchange had commercial substance. Print Done This Question: 3 pts 6 of 26 (0 complete) Trusty Trucking Corporation uses the units-of-production depreciation method because units-of-production best measures wear and tear on the trucks. Consider these facts about one Mack truck in the company's fleet. (Click on the icon to view the facts.) Read the requirements Requirement 1. Record the journal entry for depreciation expense in 2018. (Record debits first, then credits. Select the explanation on the last line of the journal entry table.) Date Accounts and Explanation Debit Credit Mar. 15 Requirement 2. Determine Trusty's cost of the new truck. The cost of the new truck is Requirement 3. Record the journal entry for the exchange of assets on March 15, 2018. Assume the exchange had commercial substance. (Record a single compound journal entry. Record debits first, then credits. Select the explanation on the last line of the journal entry table.) Date Accounts and Explanation Debit Credit Mar. 15 Requirement 1. Record the journal entry for depreciation expense in 2018. (Record debits first, then credits. Select the explanation on the las Date Accounts and Explanation Debit Credit Mar. 15 Accumulated DepreciationTruck Cash Depreciation Expense-Truck Truck (new) Requireme Truck (old) Gain on Disposal The cost of Loss on Disposal Notes Payable Requiremem J. RECUIU VIe journal entry w uie en UI ASSELS UIT VIGILII 19, 2010. Assume the exchange had commercial substance. Date Accounts and Explanation Debit Credit Mar. 15 Date Accounts and Explanation Debit Credit Mar. 15 Requireme Exchanged old truck and cash for new truck. The cost of To record depreciation on truck. To record sale of truck. Requirements. Recuru ule journar eruyur vie excrange or assets un var 19, 2018. Assume the exchange had commercial substan