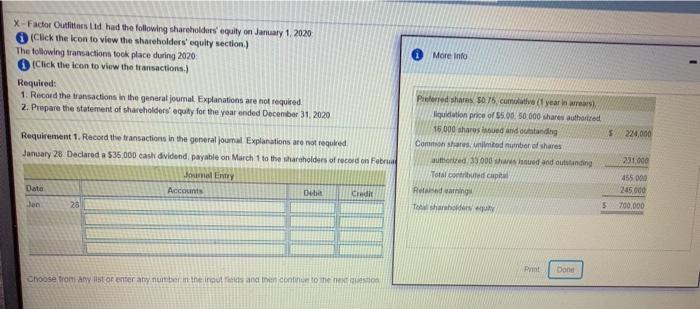

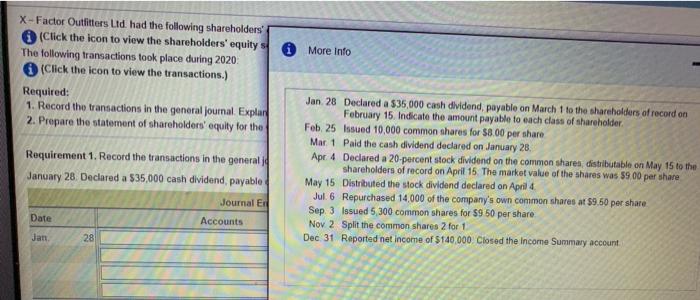

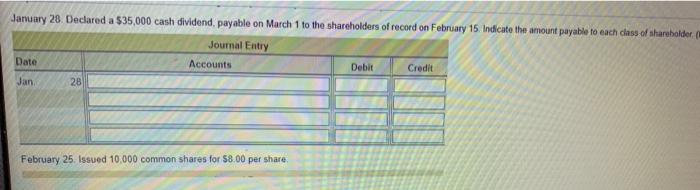

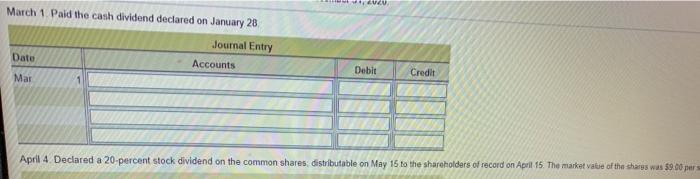

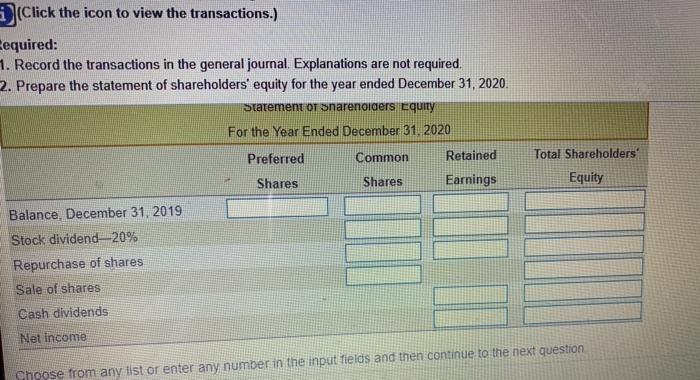

More Info X-Factor Outfitters Ltd had the following shareholders equity on January 1, 2020 Click the icon to view the shareholders equity section) The following transactions took place during 2020 Click the icon to view the transactions) Required: 1. Record the transactions in the general Journal Explanations are not required 2. Prepare the statement of shareholders' equity for the year ended December 31, 2020 220,000 Pierred shares 50 75 cumulative (t year in was liquidation price of $5.00 50.000 shares authorized 15.000 shares and standing Com shares united number of shares authentre 35.000 hasued and outstanding Total contributed Resedaming 5 to share Requirement 1. Record the transactions in the general joumal Explanations are not required January 28 Declared a 535,000 cash dividend payable on March 1 to the shareholders of record on Februa Journal Entry Dato Accounts Dube Credit 28 231.000 455 000 245.000 700.000 Paint Done Choose from a list of enter any number in the intend the continue to the * More Info X-Factor Outfitters Lid had the following shareholders' (Click the icon to view the shareholders' equity The following transactions took place during 2020 (Click the icon to view the transactions.) Required: 1. Record the transactions in the general Journal. Explar 2. Prepare the statement of shareholders' equity for the Requirement 1. Record the transactions in the generali January 28 Declared a $35,000 cash dividend, payable Jan 28 Declared a $35.000 cash dividend payable on March 1 to the shareholders of record on February 15. Indicate the amount payable to each class of shareholder Feb 25 Issued 10,000 common shares for $8.00 per share Mar 1 Paid the cash dividend declared on January 28 Apr 4 Declared a 20-percent stock dividend on the common shares, distributable on May 15 to the shareholders of record on April 15. The market value of the shares was $9.00 per share May 15 Distributed the stock dividend declared on April 4 Jul 6 Repurchased 14.000 of the company's own common shares at $9.50 per share Sep. 3 Issued 5 300 common shares for $9 50 per share Nov 2 Split the common shares 2 for 1 Dec 31 Reported net income of $140,000 Closed the income Summary account Journal ER Accounts Date Jan 28 January 28. Declared a $35,000 cash dividend payable on March 1 to the shareholders of record on February 15. Indicate the amount payable to each class of shareholder Journal Entry Date Accounts Debit Credit Jan 28 February 25. Issued 10,000 common shares for $8.00 per share, WAVE March 1 Paid the cash dividend declared on January 28 Journal Entry Date Accounts Debit Mar Credit 1 April 4 Declared a 20-percent stock dividend on the common shares distributable on May 15 to the shareholders of record on April 15. The market value of the shares was $9.00 per (Click the icon to view the transactions.) Eequired: 1. Record the transactions in the general journal. Explanations are not required. 2. Prepare the statement of shareholders' equity for the year ended December 31, 2020. Statement or snarenoiders Equity For the Year Ended December 31, 2020 Preferred Common Retained Total Shareholders Equity Shares Shares Earnings Balance, December 31, 2019 Stock dividend 20% Repurchase of shares Sale of shares Cash dividends Net Income Choose from any list or enter any number in the input fields and then continue to the next