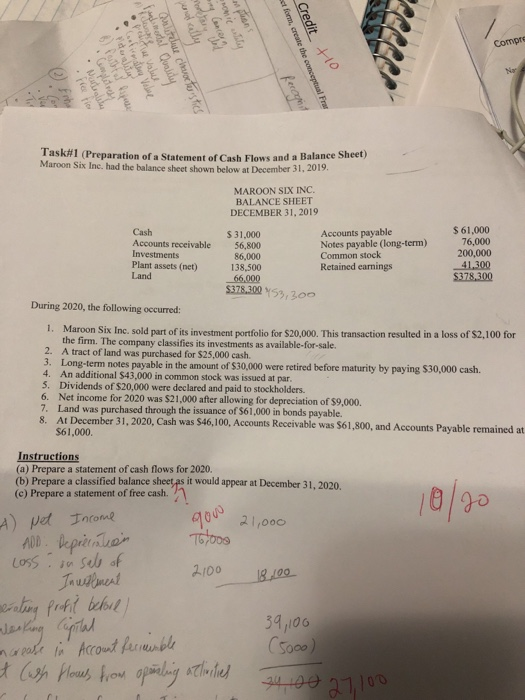

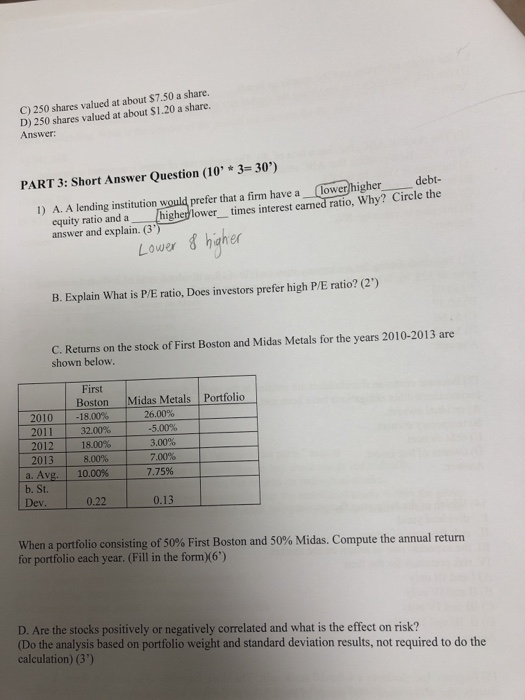

More omie Mon Pertva Web Tindal Quality mo * Compre Credit Ho et form, create the conceptual Fra Quru chevetustos - Warta Culo Na Task#1 (Preparation of a Statement of Cash Flows and a Balance Sheet) Maroon Six Inc. had the balance sheet shown below at December 31, 2019. MAROON SIX INC. BALANCE SHEET DECEMBER 31, 2019 Cash Accounts receivable Investments Plant assets (net) Land $31.000 56,800 86,000 138,500 66.000 Accounts payable Notes payable (long-term) Common stock Retained earnings $ 61,000 76,000 200,000 41.300 $378,300 5378.30053, 3.00 During 2020, the following occurred: 1. Maroon Six Inc. sold part of its investment portfolio for $20,000. This transaction resulted in a loss of $2.100 for the firm. The company classifies its investments as available-for-sale. 2. A tract of land was purchased for $25,000 cash. 3. Long-term notes payable in the amount of $30,000 were retired before maturity by paying $30,000 cash. 4. An additional $43,000 in common stock was issued at par. 5. Dividends of $20,000 were declared and paid to stockholders. 6. Net income for 2020 was $21,000 after allowing for depreciation of $9,000. 7. Land was purchased through the issuance of $61,000 in bonds payable. 8. At December 31, 2020, Cash was $46, 100, Accounts Receivable was $61,800, and Accounts Payable remained at $61,000. 10/20 90 21,000 Instructions (a) Prepare a statement of cash flows for 2020. (b) Prepare a classified balance sheet as it would appear at December 31, 2020, (c) Prepare a statement of free cash. A) Net Income ADD Depreciation 76,000 Loss in sale of 2100 R100 - Inwalment serating profit belie) werking Capital 39,100 increase in Account feciouble (5000) it Cash flows from opening activities 24 100 27,100 T C) 250 shares valued at about $7.50 a share. D) 250 shares valued at about $1.20 a share. Answer: PART 3: Short Answer Question (10'* 3= 30') debt- 1) A. A lending institution would prefer that a firm have a lower higher equity ratio and a higher lower times interest earned ratio, Why? Circle the answer and explain. (3) Lower 8 higher B. Explain What is P/E ratio, Does investors prefer high P/E ratio? (2) C. Returns on the stock of First Boston and Midas Metals for the years 2010-2013 are shown below. First Portfolio 2010 2011 2012 2013 a. Avg. b. St. Dev. Boston -18.00% 32.00% 18.00% 8.00% 10.00% Midas Metals 26.00% -5.00% 20004 3.00% 7.00% 7.75% 0.22 0.13 When a portfolio consisting of 50% First Boston and 50% Midas. Compute the annual return for portfolio each year. (Fill in the form (6) D. Are the stocks positively or negatively correlated and what is the effect on risk? (Do the analysis based on portfolio weight and standard deviation results, not required to do the calculation) (3) More omie Mon Pertva Web Tindal Quality mo * Compre Credit Ho et form, create the conceptual Fra Quru chevetustos - Warta Culo Na Task#1 (Preparation of a Statement of Cash Flows and a Balance Sheet) Maroon Six Inc. had the balance sheet shown below at December 31, 2019. MAROON SIX INC. BALANCE SHEET DECEMBER 31, 2019 Cash Accounts receivable Investments Plant assets (net) Land $31.000 56,800 86,000 138,500 66.000 Accounts payable Notes payable (long-term) Common stock Retained earnings $ 61,000 76,000 200,000 41.300 $378,300 5378.30053, 3.00 During 2020, the following occurred: 1. Maroon Six Inc. sold part of its investment portfolio for $20,000. This transaction resulted in a loss of $2.100 for the firm. The company classifies its investments as available-for-sale. 2. A tract of land was purchased for $25,000 cash. 3. Long-term notes payable in the amount of $30,000 were retired before maturity by paying $30,000 cash. 4. An additional $43,000 in common stock was issued at par. 5. Dividends of $20,000 were declared and paid to stockholders. 6. Net income for 2020 was $21,000 after allowing for depreciation of $9,000. 7. Land was purchased through the issuance of $61,000 in bonds payable. 8. At December 31, 2020, Cash was $46, 100, Accounts Receivable was $61,800, and Accounts Payable remained at $61,000. 10/20 90 21,000 Instructions (a) Prepare a statement of cash flows for 2020. (b) Prepare a classified balance sheet as it would appear at December 31, 2020, (c) Prepare a statement of free cash. A) Net Income ADD Depreciation 76,000 Loss in sale of 2100 R100 - Inwalment serating profit belie) werking Capital 39,100 increase in Account feciouble (5000) it Cash flows from opening activities 24 100 27,100 T C) 250 shares valued at about $7.50 a share. D) 250 shares valued at about $1.20 a share. Answer: PART 3: Short Answer Question (10'* 3= 30') debt- 1) A. A lending institution would prefer that a firm have a lower higher equity ratio and a higher lower times interest earned ratio, Why? Circle the answer and explain. (3) Lower 8 higher B. Explain What is P/E ratio, Does investors prefer high P/E ratio? (2) C. Returns on the stock of First Boston and Midas Metals for the years 2010-2013 are shown below. First Portfolio 2010 2011 2012 2013 a. Avg. b. St. Dev. Boston -18.00% 32.00% 18.00% 8.00% 10.00% Midas Metals 26.00% -5.00% 20004 3.00% 7.00% 7.75% 0.22 0.13 When a portfolio consisting of 50% First Boston and 50% Midas. Compute the annual return for portfolio each year. (Fill in the form (6) D. Are the stocks positively or negatively correlated and what is the effect on risk? (Do the analysis based on portfolio weight and standard deviation results, not required to do the calculation) (3)