More questions=More rates

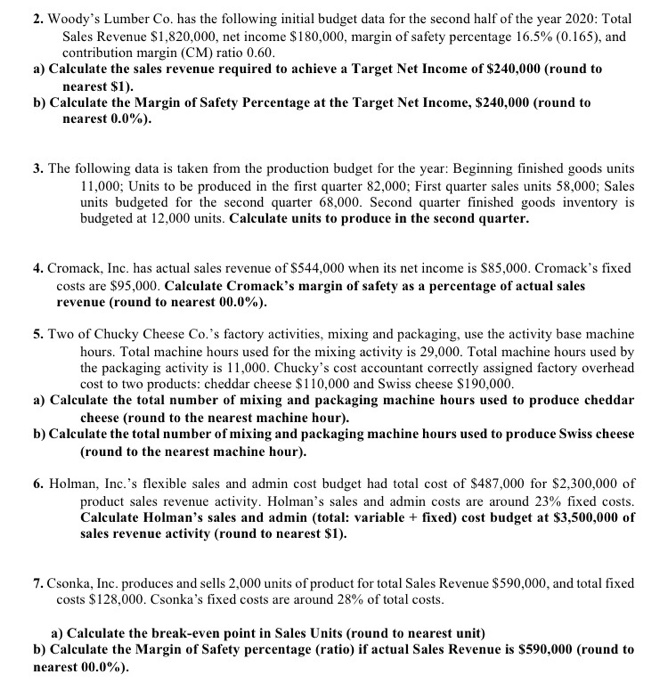

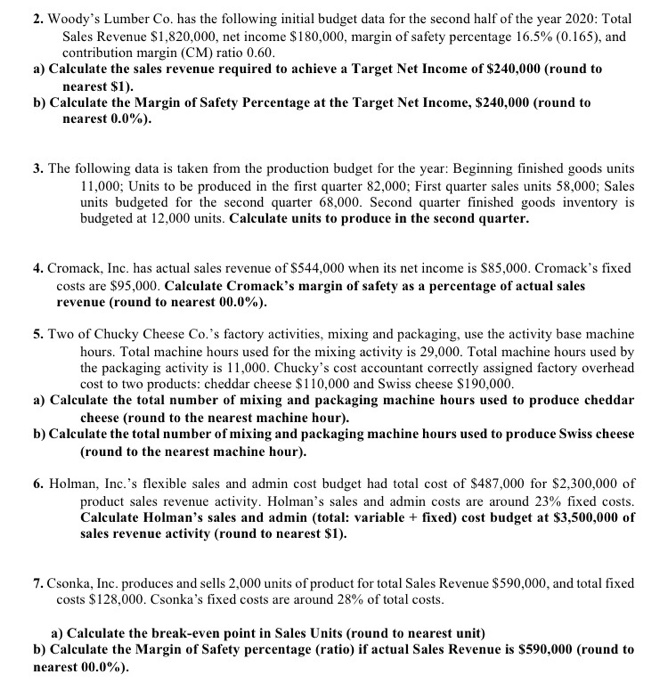

2. Woody's Lumber Co. has the following initial budget data for the second half of the year 2020: Total Sales Revenue $1,820,000, net income $180,000, margin of safety percentage 16.5% (0.165), and contribution margin (CM) ratio 0.60. a) Calculate the sales revenue required to achieve a Target Net Income of $240,000 (round to nearest $1). b) Calculate the Margin of Safety Percentage at the Target Net Income, $240,000 (round to nearest 0.0%). 3. The following data is taken from the production budget for the year: Beginning finished goods units 11,000; Units to be produced in the first quarter 82,000; First quarter sales units 58,000; Sales units budgeted for the second quarter 68,000. Second quarter finished goods inventory is budgeted at 12,000 units. Calculate units to produce in the second quarter. 4. Cromack, Inc. has actual sales revenue of $544,000 when its net income is $85,000. Cromack's fixed costs are $95,000. Calculate Cromack's margin of safety as a percentage of actual sales revenue (round to nearest 00.0%). 5. Two of Chucky Cheese Co.'s factory activities, mixing and packaging, use the activity base machine hours. Total machine hours used for the mixing activity is 29,000. Total machine hours used by the packaging activity is 11,000. Chucky's cost accountant correctly assigned factory overhead cost to two products: cheddar cheese $110,000 and Swiss cheese S190,000. a) Calculate the total number of mixing and packaging machine hours used to produce cheddar cheese (round to the nearest machine hour). b) Calculate the total number of mixing and packaging machine hours used to produce Swiss cheese (round to the nearest machine hour). 6. Holman, Inc.'s flexible sales and admin cost budget had total cost of $487,000 for $2,300,000 of product sales revenue activity. Holman's sales and admin costs are around 23% fixed costs. Calculate Holman's sales and admin (total: variable + fixed) cost budget at $3,500,000 of sales revenue activity (round to nearest $1). 7. Csonka, Inc. produces and sells 2,000 units of product for total Sales Revenue $590,000, and total fixed costs $128,000. Csonka's fixed costs are around 28% of total costs. a) Calculate the break-even point in Sales Units (round to nearest unit) b) Calculate the Margin of Safety percentage (ratio) if actual Sales Revenue is $590,000 (round to nearest 00.0%)

More questions=More rates

More questions=More rates