Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Morgan ( age 4 5 ) is single and provides more than 5 0 % of the support of Tammy ( a family friend )

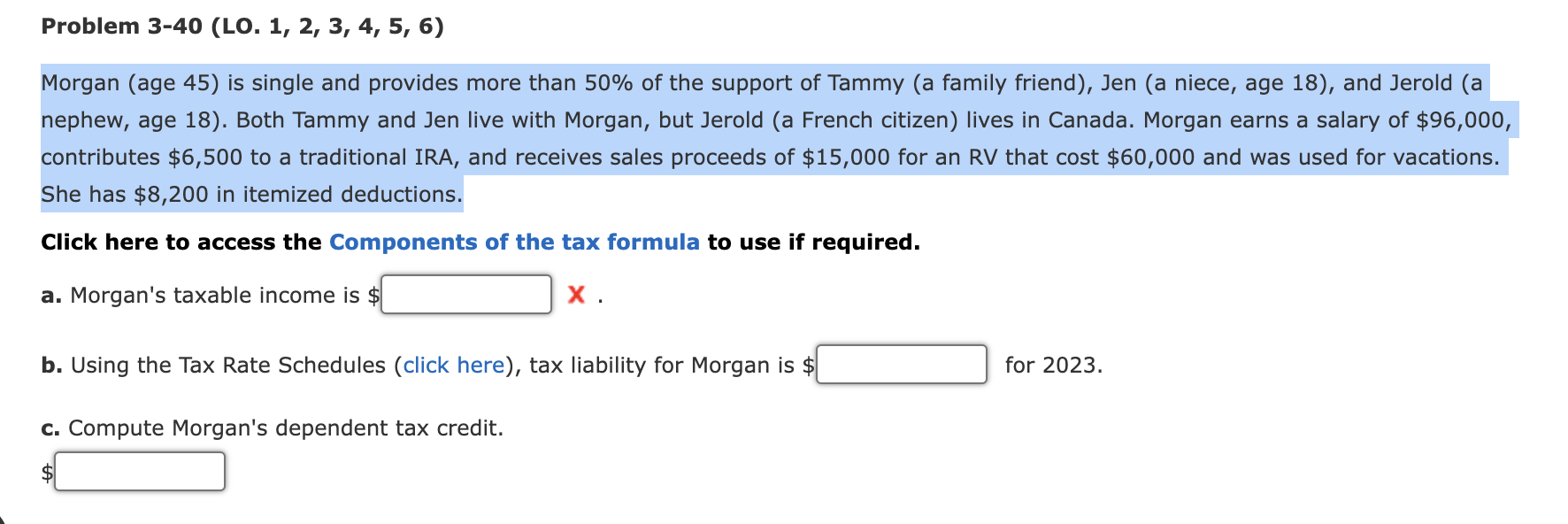

Morgan age is single and provides more than of the support of Tammy a family friend Jen a niece, age and Jerold a nephew, age Both Tammy and Jen live with Morgan, but Jerold a French citizen lives in Canada. Morgan earns a salary of $ contributes $ to a traditional IRA, and receives sales proceeds of $ for an RV that cost $ and was used for vacations. She has $ in itemized deductions.Problem LO

Morgan age is single and provides more than of the support of Tammy a family friend Jen a niece, age and Jerold a

nephew, age Both Tammy and Jen live with Morgan, but Jerold a French citizen lives in Canada. Morgan earns a salary of $

contributes $ to a traditional IRA, and receives sales proceeds of $ for an RV that cost $ and was used for vacations.

She has $ in itemized deductions.

Click here to access the Components of the tax formula to use if required.

a Morgan's taxable income is $

b Using the Tax Rate Schedules click here tax liability for Morgan is $

for

c Compute Morgan's dependent tax credit.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started