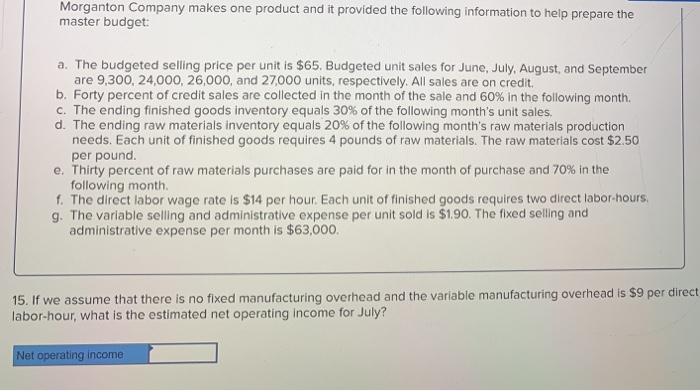

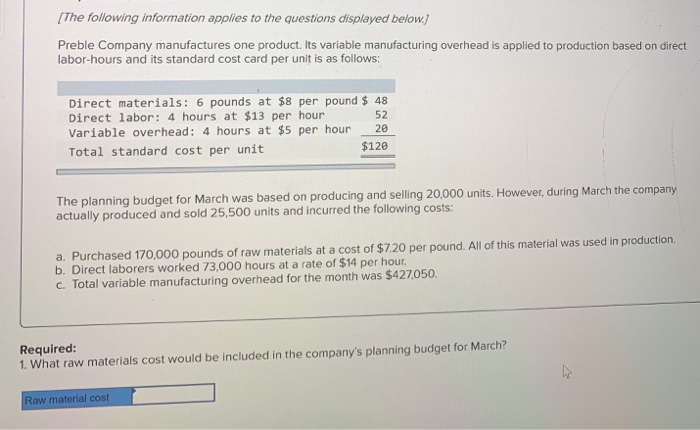

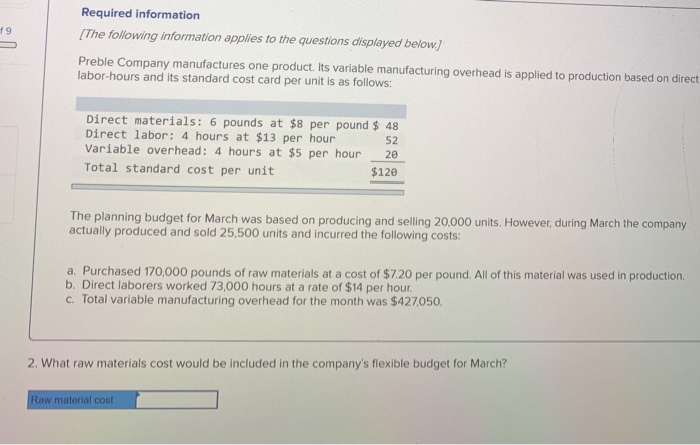

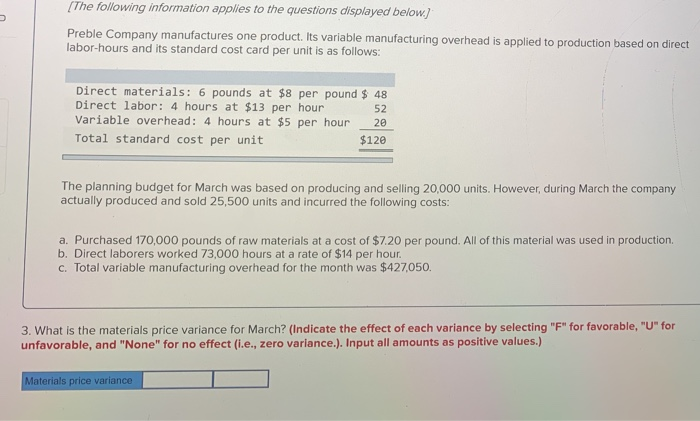

Morganton Company makes one product and it provided the following information to help prepare the master budget: a. The budgeted selling price per unit is $65. Budgeted unit sales for June, July, August, and September are 9,300, 24,000, 26,000, and 27,000 units, respectively. All sales are on credit. b. Forty percent of credit sales are collected in the month of the sale and 60% in the following month. C. The ending finished goods inventory equals 30% of the following month's unit sales. d. The ending raw materials inventory equals 20% of the following month's raw materials production needs. Each unit of finished goods requires 4 pounds of raw materials. The raw materials cost $2.50 per pound. e. Thirty percent of raw materials purchases are paid for in the month of purchase and 70% in the following month f. The direct labor wage rate is $14 per hour. Each unit of finished goods requires two direct labor-hours. g. The variable selling and administrative expense per unit sold is $1.90. The fixed selling and administrative expense per month is $63,000. 15. If we assume that there is no fixed manufacturing overhead and the variable manufacturing overhead is $9 per direct labor-hour, what is the estimated net operating income for July? Net operating income Required information The following information applies to the questions displayed below Preble Company manufactures one product. Its variable manufacturing overhead is applied to production based on direct labor-hours and its standard cost card per unit is as follows: Direct materials: 6 pounds at $8 per pound $ 48 Direct labor: 4 hours at $13 per hour 52 Variable overhead: 4 hours at $5 per hour 20 Total standard cost per unit $120 The planning budget for March was based on producing and selling 20,000 units. However, during March the company actually produced and sold 25,500 units and incurred the following costs: a. Purchased 170,000 pounds of raw materials at a cost of $7.20 per pound. All of this material was used in production b. Direct laborers worked 73,000 hours at a rate of $14 per hour. c. Total variable manufacturing overhead for the month was $427,050. 2. What raw materials cost would be included in the company's flexible budget for March? Raw material cost The following information applies to the questions displayed below.) Preble Company manufactures one product. Its variable manufacturing overhead is applied to production based on direct labor-hours and its standard cost card per unit is as follows: Direct materials: 6 pounds at $8 per pound $ 48 Direct labor: 4 hours at $13 per hour Variable overhead: 4 hours at $5 per hour 20 Total standard cost per unit $120 The planning budget for March was based on producing and selling 20,000 units. However, during March the company actually produced and sold 25,500 units and incurred the following costs: a. Purchased 170,000 pounds of raw materials at a cost of $7.20 per pound. All of this material was used in production. b. Direct laborers worked 73,000 hours at a rate of $14 per hour. C. Total variable manufacturing overhead for the month was $427,050. 3. What is the materials price variance for March? (Indicate the effect of each variance by selecting "F" for favorable, "U" for unfavorable, and "None" for no effect (i.e., zero variance.). Input all amounts as positive values.) Materials price variance