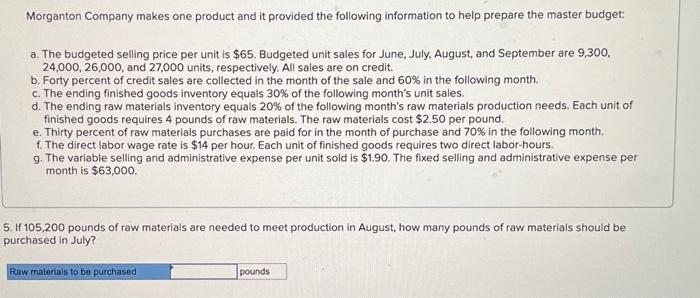

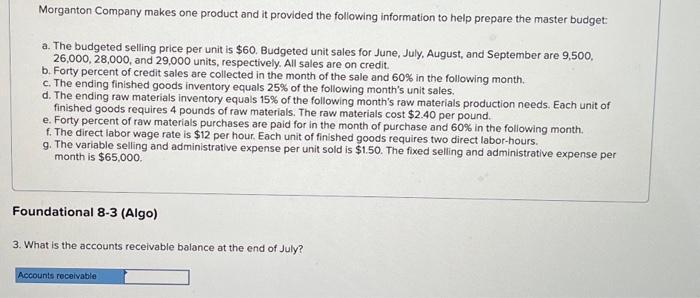

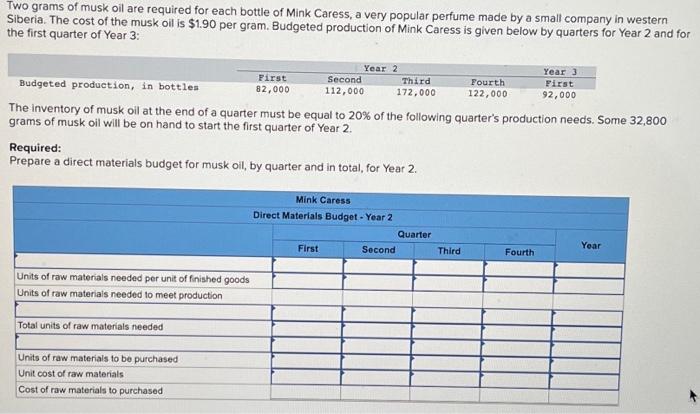

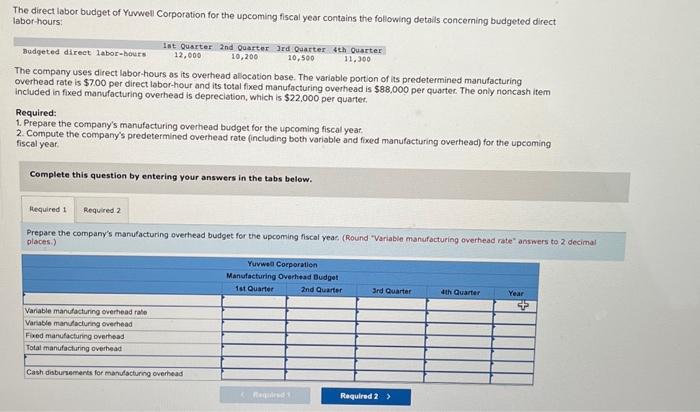

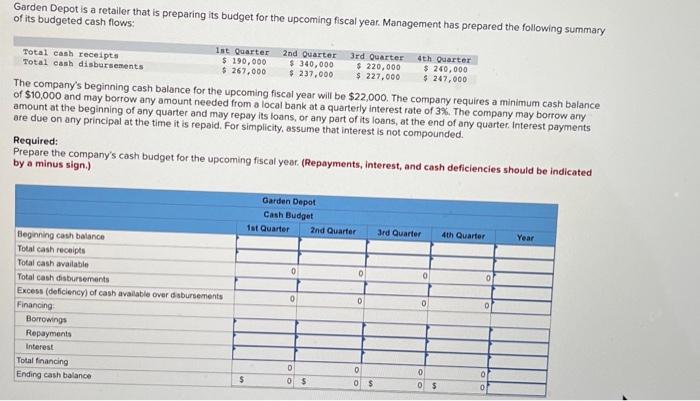

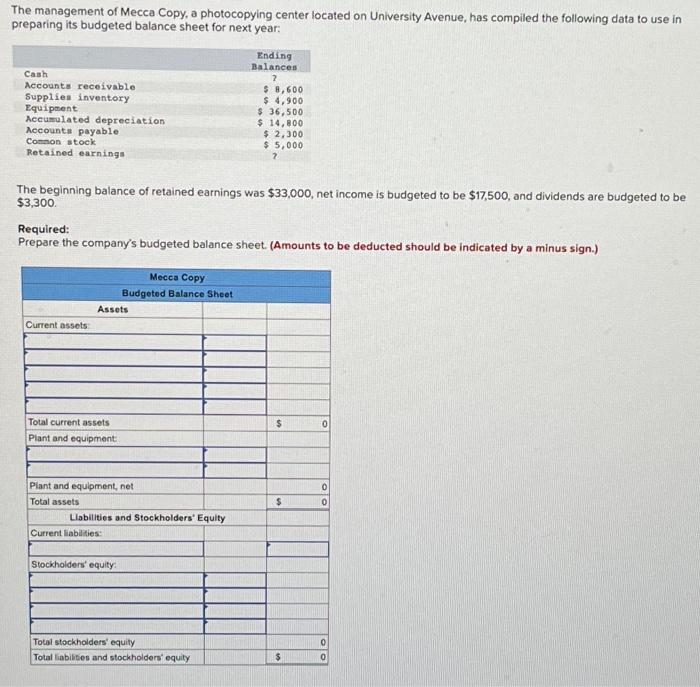

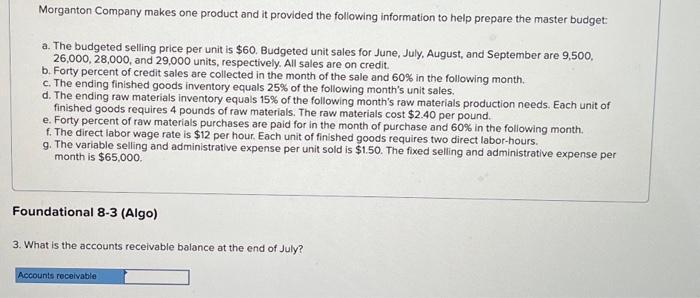

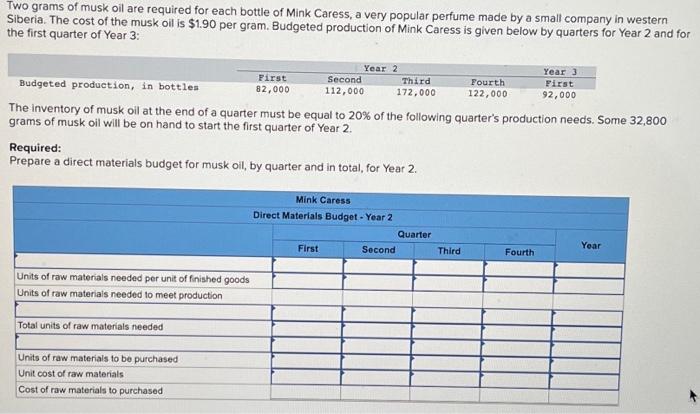

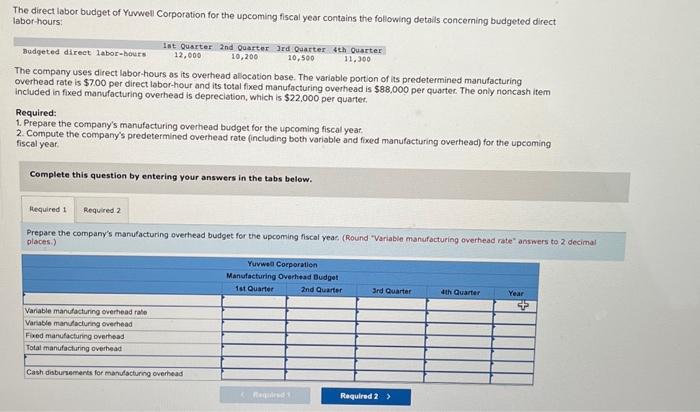

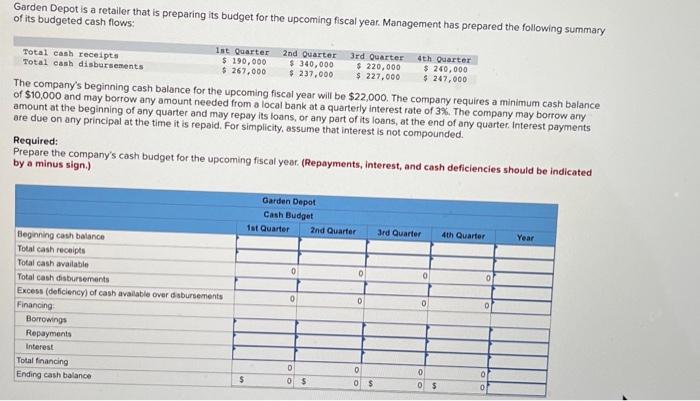

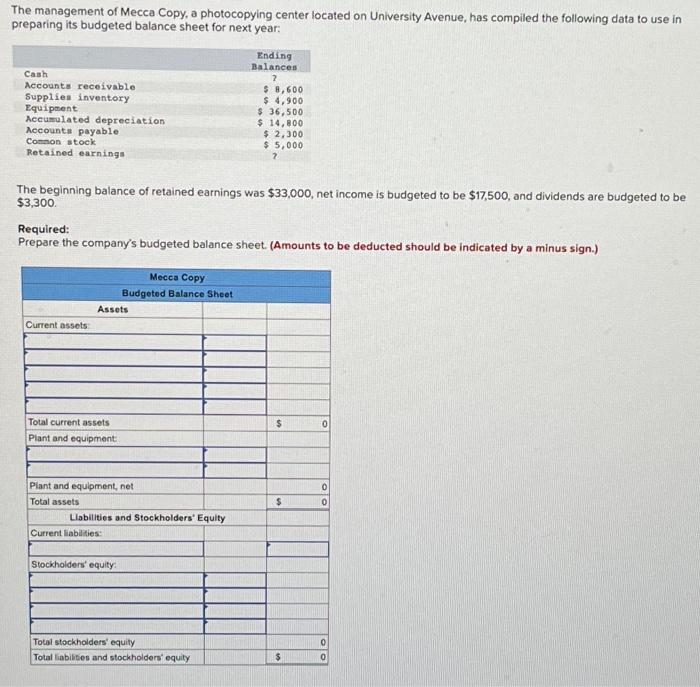

Morganton Company makes one product and it provided the following information to help prepare the master budget: a. The budgeted selling price per unit is $65. Budgeted unit sales for June, July. August, and September are 9,300, 24,000,26,000, and 27,000 units, respectively. All sales are on credit. b. Forty percent of credit sales are collected in the month of the sale and 60% in the following month. c. The ending finished goods inventory equals 30% of the following month's unit sales. d. The ending raw materials inventory equals 20% of the following month's raw materials production needs. Each unit of finished goods requires 4 pounds of raw materials. The raw materials cost $2.50 per pound. e. Thirty percent of raw materials purchases are paid for in the month of purchase and 70% in the following month. f. The direct labor wage rate is $14 per hour. Each unit of finished goods requires two direct labor-hours. g. The variable selling and administrative expense per unit sold is $1.90. The fixed selling and administrative expense per month is $63,000. If 105,200 pounds of raw materials are needed to meet production in August, how many pounds of raw materials should be. urchased in July? Morganton Company makes one product and it provided the following information to help prepare the master budget: a. The budgeted selling price per unit is $60. Budgeted unit sales for June, July, August, and September are 9,500 , 26,000,28,000, and 29,000 units, respectively. All sales are on credit. b. Forty percent of credit sales are collected in the month of the sale and 60% in the following month. c. The ending finished goods inventory equals 25% of the following month's unit sales. d. The ending raw materials inventory equals 15% of the following month's raw materials production needs. Each unit of finished goods requires 4 pounds of raw materials. The raw materials cost $2.40 per pound. e. Forty percent of raw materials purchases are paid for in the month of purchase and 60% in the following month. f. The direct labor wage rate is $12 per hour. Each unit of finished goods requires two direct labor-hours. 9 . The variable selling and administrative expense per unit sold is $1.50. The fixed selling and administrative expense per month is $65,000. Foundational 8-3 (Algo) 3. What is the accounts receivable balance at the end of July? Two grams of musk oil are required for each bottle of Mink Caress, a very popular perfume made by a small company in western Siberia. The cost of the musk oil is $1.90 per gram. Budgeted production of Mink Caress is given below by quarters for Year 2 and for the first quarter of Year 3: The inventory of musk oil at the end of a quarter must be equal to 20% of the following quarter's production needs. Some 32,800 grams of musk oil will be on hand to start the first quarter of Year 2 . Required: Prepare a direct materials budget for musk oil, by quarter and in total, for Year 2 . The direct labor budget of Yuwwell Corporation for the upcoming fiscal year contains the following detalls conceming budgeted direct labor-hours: The company uses direct labor-hours as its overhead allocation base. The variable portlon of its predetermined manutacturing overhead rate is $7.00 per direct labor-hour and its total fixed manufacturing overhead is $88,000 per quartec. The only noncash item included in fixed manufacturing overhead is depreciation, which is $22,000 per quartec. Required: 1. Prepare the company's manufacturing overhead budget for the upcoming fiscal yeat. 2. Compute the company's predetermined overhead rate (including both variable and foxed manufacturing overhead) for the upcoming fiscal year. Complete this question by entering your answers in the tabs below. Prepare the company's manufacturing overhead budget for the upcoming fiscal yeae, (Round 'Variable manufocturing overhead rate" answers to 2 dec places.) Garden Depot is a retailer that is preparing its budget for the upcoming fiscal year. Management has prepared the following summary of its budgeted cash flows: We companys beginning cash balance for the upcoming fiscal year will be $22,000. The company requires a minimum cash balance of $10,000 and may borrow any amount needed from a local bank at a quarterly interest rate of 3%. The company may bortow any amount at the beginning of any quarter and may repay its loans, or any part of its loans, at the end of any quarter. Interest payments are due on any principal at the time it is repaid. For simplicity, assume that interest is not compounded. Required: Prepare the company's cash budget for the upcoming fiscal year. (Repayments, interest, and cash deficiencies should be indicated by a minus sign.) The management of Mecca Copy, a photocopying center located on University Avenue, has compiled the following data to use in preparing its budgeted balance sheet for next year: The beginning balance of retained earnings was $33,000, net income is budgeted to be $17,500, and dividends are budgeted to be $3,300 Required: Prepare the company's budgeted balance sheet. (Amounts to be deducted should be indicated by a minus sign.)