Answered step by step

Verified Expert Solution

Question

1 Approved Answer

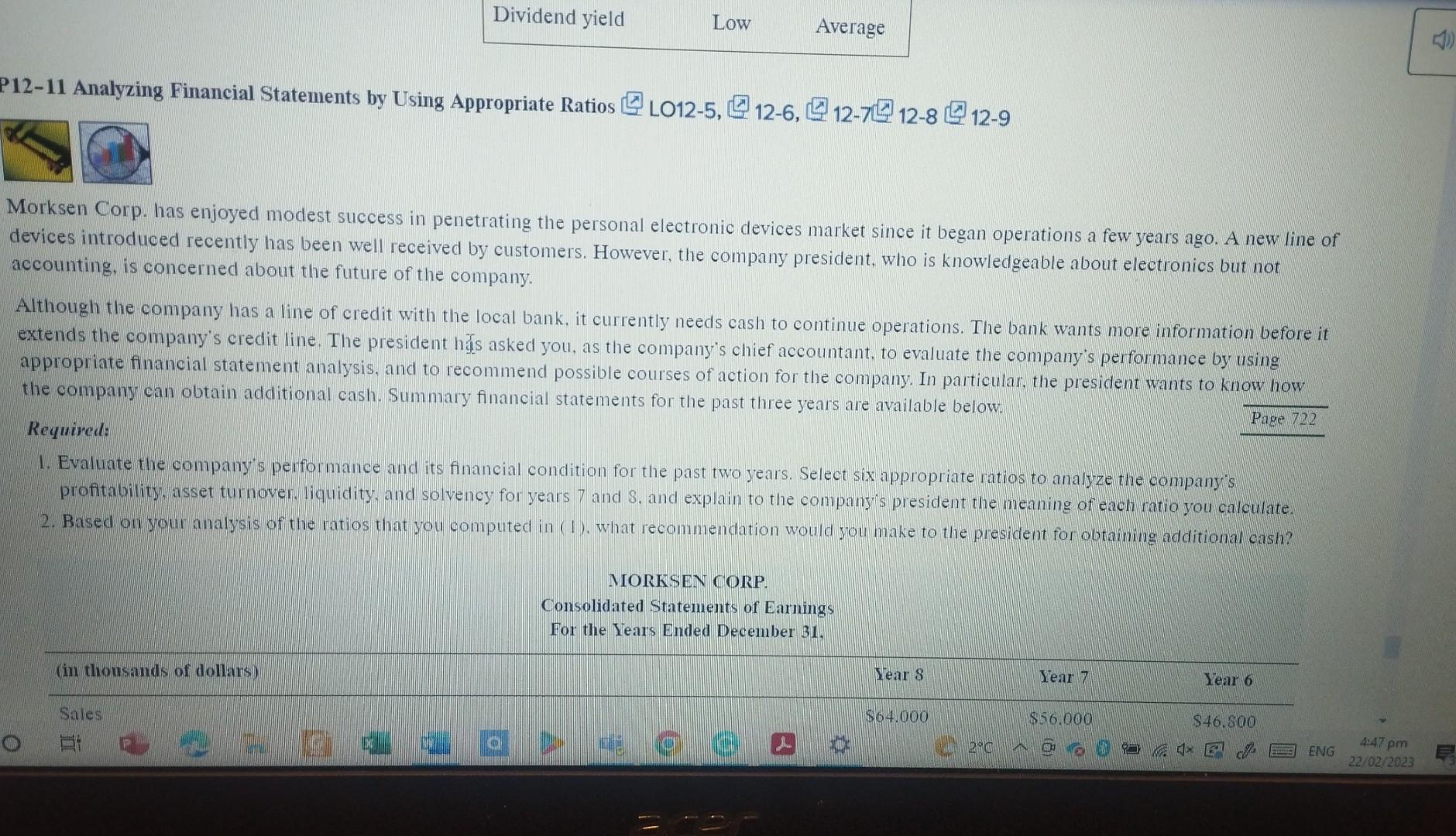

Morksen Corp. has enjoyed modest success in penetrating the personal electronic devices market since it began operations a few years ago. A new line of

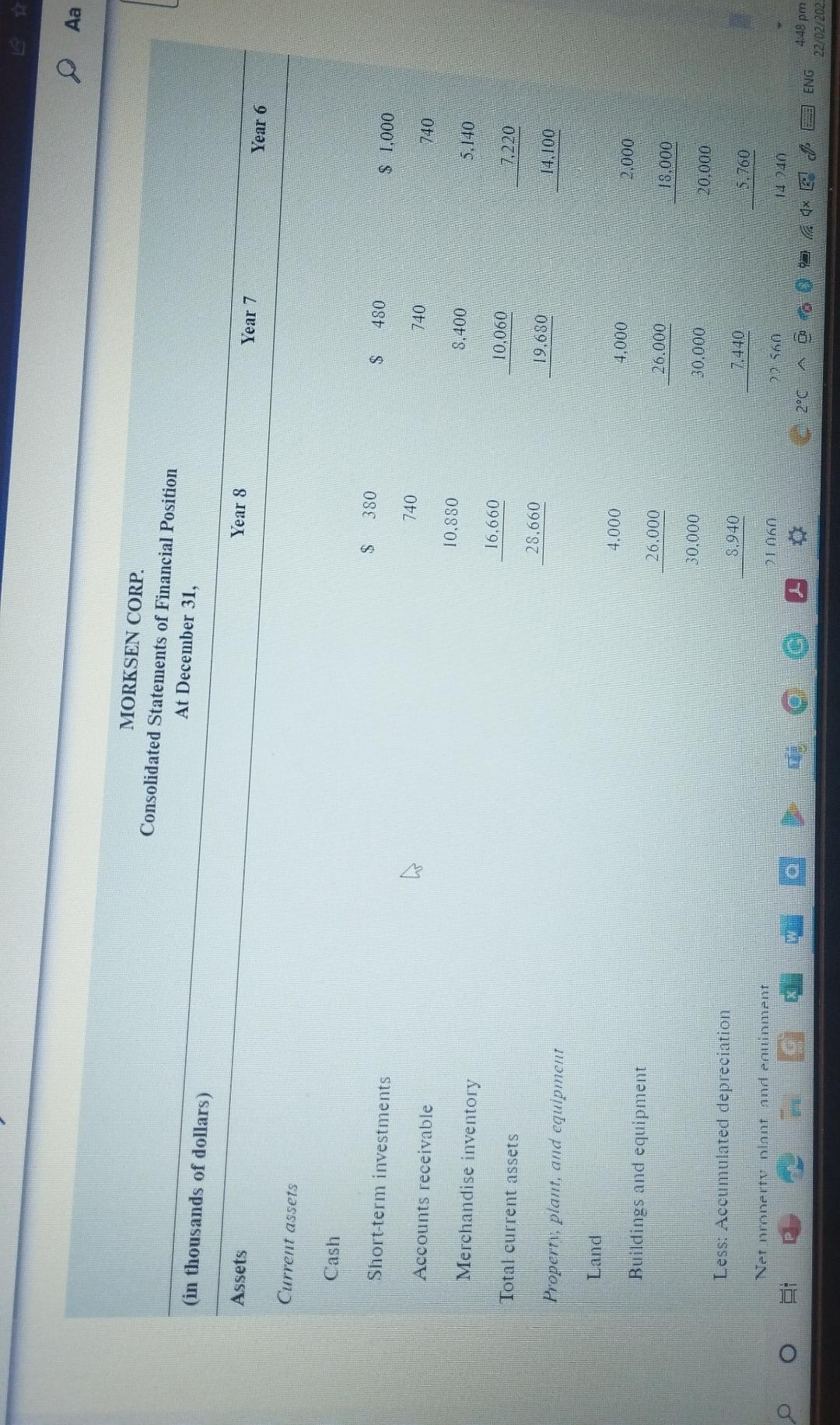

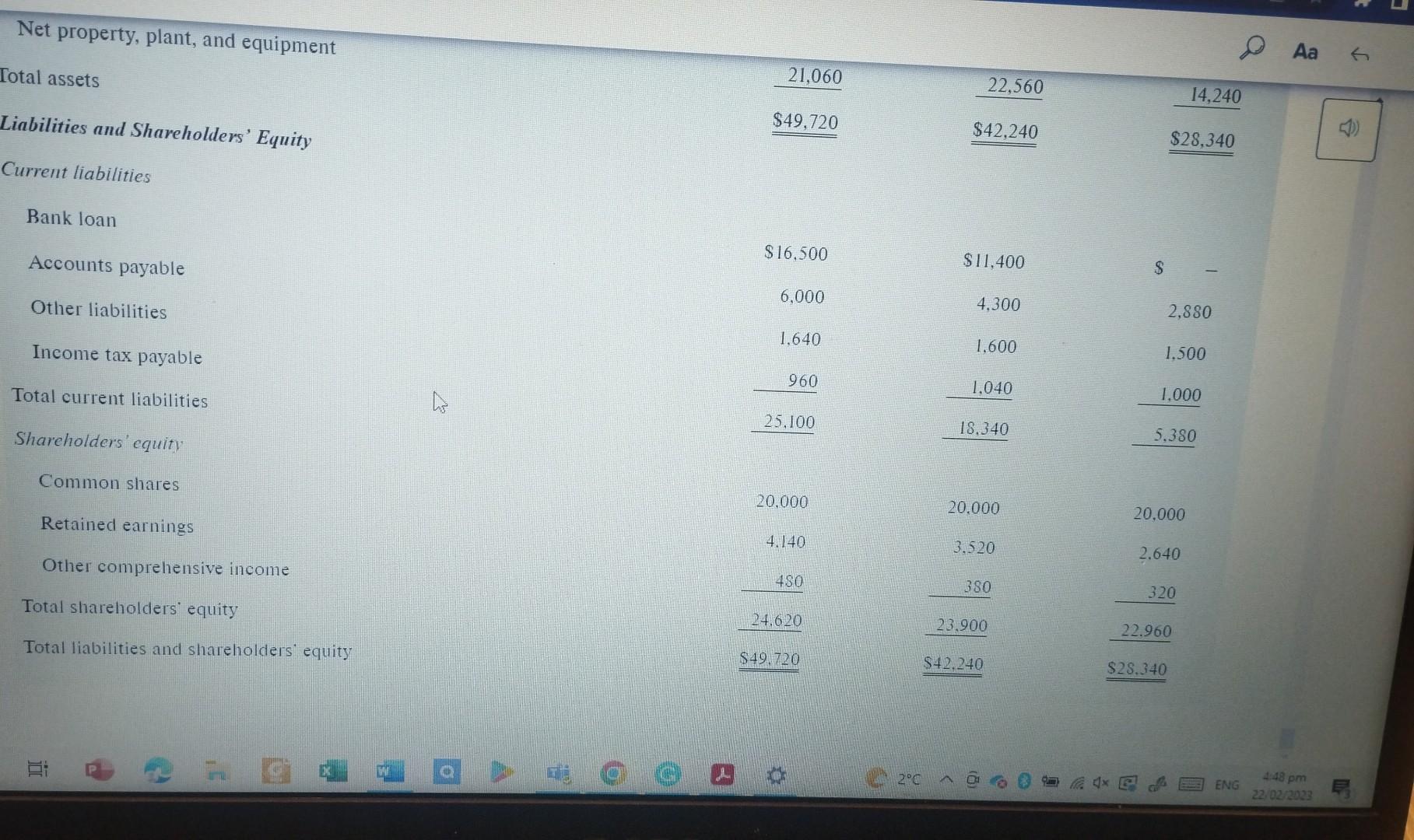

Morksen Corp. has enjoyed modest success in penetrating the personal electronic devices market since it began operations a few years ago. A new line of devices introduced recently has been well received by customers. However, the company president, who is knowledgeable about electronics but not accounting, is concerned about the future of the company. Although the company has a line of credit with the local bank, it currently needs cash to continue operations. The bank wants more information before it extends the company's credit line. The president h's asked you, as the company's chief accountant, to evaluate the company's performance by using appropriate financial statement analysis, and to recommend possible courses of action for the company. In particular the company can obtain additional cash. Summary financial statements for the past three years are available below. the comparived: 1. Evaluate the company's performance and its financial condition for the past two years. Select six appropriate ratios to analyze the company's profitability, asset turnover, liquidity, and solvency for years 7 and 8 , and explain to the company's president the meaning of each ratio you calculate. 2. Based on your analysis of the ratios that you computed in (1), what recommendation would you make to the president for obtaining additional cash? 238 of 369 (in thousands of dollars) Sales Cost of sales Gross profit Operating expenses before interest and income taxes Interest expense Earnings before income taxes Income tax expense Net earnings MORKSEN CORP. Consolidated Statements of Financial Position At December 31 . (in thousands of dollars) Assets \begin{tabular}{lll} Year 8 & Year 7 & lear 6 \\ \hline \end{tabular} Currut azaets Cash MORKSEN CORP. Consolidated Statements of Financial Position At December 31 , (in thousands of dollars) Assets Current assets Cash Short-term investments Accounts receivable Merchandise inventory Total current assets Properti, plant, and equipment Land Buildings and equipment Less: Accumulated depreciation Net mromerte nlant and palinment Net property, plant, and equipment Total assets Liabilities and Shareholders' Equity Current liabilities Bank loan Accounts payable 21,060$49,720 22,560$42,240 14,240 Other liabilities Income tax payable Total current liabilities Shareholders' equity \begin{tabular}{rrr} $16,500 & $11,400 & $ \\ 6,000 & 4,300 & 2,880 \\ 1,640 & 1,600 & 1,500 \\ 960 & 18,3401,040 & 5,3801,000 \\ \hline \end{tabular} Common shares Retained earnings Other comprehensive income Total shareholders' equity Total liabilities and shareholders' equity \begin{tabular}{rrr} 20.000 & 20.000 & 20,000 \\ 4.140 & 3.520 & 2.640 \\ \hline 450 & 380 & 320 \\ \hline 24.620 \\ \hline$49.720 & 23.900 & 22.960 \\ \hline \end{tabular} Morksen Corp. has enjoyed modest success in penetrating the personal electronic devices market since it began operations a few years ago. A new line of devices introduced recently has been well received by customers. However, the company president, who is knowledgeable about electronics but not accounting, is concerned about the future of the company. Although the company has a line of credit with the local bank, it currently needs cash to continue operations. The bank wants more information before it extends the company's credit line. The president h's asked you, as the company's chief accountant, to evaluate the company's performance by using appropriate financial statement analysis, and to recommend possible courses of action for the company. In particular the company can obtain additional cash. Summary financial statements for the past three years are available below. the comparived: 1. Evaluate the company's performance and its financial condition for the past two years. Select six appropriate ratios to analyze the company's profitability, asset turnover, liquidity, and solvency for years 7 and 8 , and explain to the company's president the meaning of each ratio you calculate. 2. Based on your analysis of the ratios that you computed in (1), what recommendation would you make to the president for obtaining additional cash? 238 of 369 (in thousands of dollars) Sales Cost of sales Gross profit Operating expenses before interest and income taxes Interest expense Earnings before income taxes Income tax expense Net earnings MORKSEN CORP. Consolidated Statements of Financial Position At December 31 . (in thousands of dollars) Assets \begin{tabular}{lll} Year 8 & Year 7 & lear 6 \\ \hline \end{tabular} Currut azaets Cash MORKSEN CORP. Consolidated Statements of Financial Position At December 31 , (in thousands of dollars) Assets Current assets Cash Short-term investments Accounts receivable Merchandise inventory Total current assets Properti, plant, and equipment Land Buildings and equipment Less: Accumulated depreciation Net mromerte nlant and palinment Net property, plant, and equipment Total assets Liabilities and Shareholders' Equity Current liabilities Bank loan Accounts payable 21,060$49,720 22,560$42,240 14,240 Other liabilities Income tax payable Total current liabilities Shareholders' equity \begin{tabular}{rrr} $16,500 & $11,400 & $ \\ 6,000 & 4,300 & 2,880 \\ 1,640 & 1,600 & 1,500 \\ 960 & 18,3401,040 & 5,3801,000 \\ \hline \end{tabular} Common shares Retained earnings Other comprehensive income Total shareholders' equity Total liabilities and shareholders' equity \begin{tabular}{rrr} 20.000 & 20.000 & 20,000 \\ 4.140 & 3.520 & 2.640 \\ \hline 450 & 380 & 320 \\ \hline 24.620 \\ \hline$49.720 & 23.900 & 22.960 \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started