Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Morris County's general fund has the following balances as of the beginning of 2020, pertaining to unpaid 2019 taxes: Property taxes receivable Allowance for

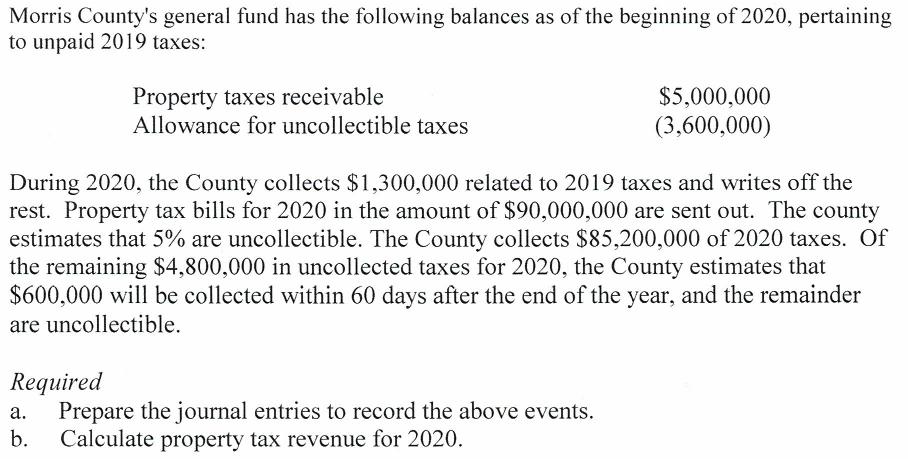

Morris County's general fund has the following balances as of the beginning of 2020, pertaining to unpaid 2019 taxes: Property taxes receivable Allowance for uncollectible taxes $5,000,000 (3,600,000) During 2020, the County collects $1,300,000 related to 2019 taxes and writes off the rest. Property tax bills for 2020 in the amount of $90,000,000 are sent out. The county estimates that 5% are uncollectible. The County collects $85,200,000 of 2020 taxes. Of the remaining $4,800,000 in uncollected taxes for 2020, the County estimates that $600,000 will be collected within 60 days after the end of the year, and the remainder are uncollectible. Required a. Prepare the journal entries to record the above events. Calculate property tax revenue for 2020. b.

Step by Step Solution

★★★★★

3.50 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

Answer Solution a Particulars Debit Credit Bank Ac Dr Allowance for uncollectible taxes Dr Uncolle...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started