Question

Morris Ltd. (owned by Martin Morris) has only one Class 1 building. During 2020, the Company disposes of the building and replaces it with

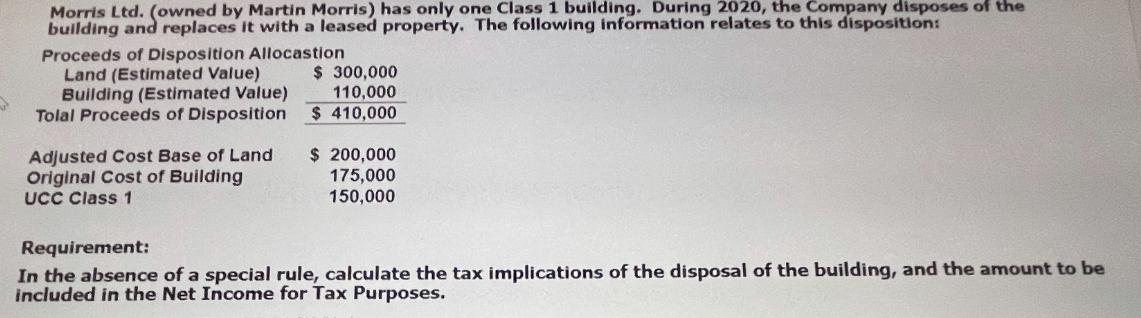

Morris Ltd. (owned by Martin Morris) has only one Class 1 building. During 2020, the Company disposes of the building and replaces it with a leased property. The following information relates to this disposition: Proceeds of Disposition Allocastion Land (Estimated Value) Building (Estimated Value) Tolal Proceeds of Disposition Adjusted Cost Base of Land Original Cost of Building UCC Class 1 $ 300,000 110,000 $ 410,000 $ 200,000 175,000 150,000 Requirement: In the absence of a special rule, calculate the tax implications of the disposal of the building, and the amount to be included in the Net Income for Tax Purposes.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate the tax implications of the disposal of the building and the amount to be included in t...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Advanced Accounting

Authors: Paul M. Fischer, William J. Tayler, Rita H. Cheng

11th edition

538480289, 978-0538480284

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App