Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Mortex is a Canadian public company with a December 31 taxation year. It is the policy of Mortex Ltd. to claim maximum CCA for

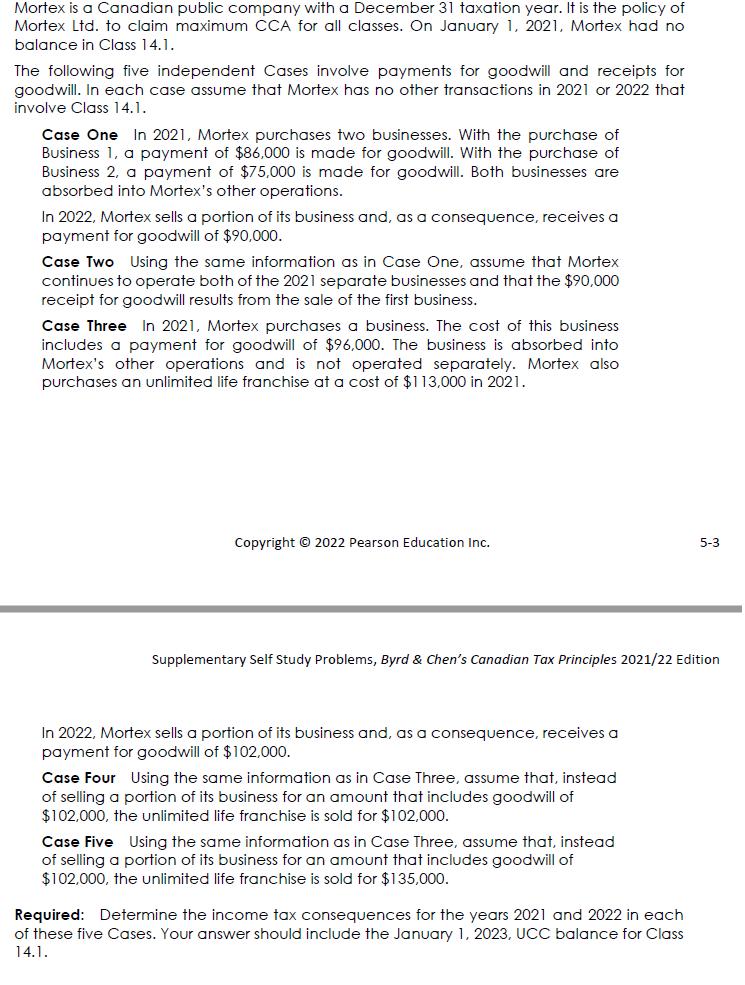

Mortex is a Canadian public company with a December 31 taxation year. It is the policy of Mortex Ltd. to claim maximum CCA for all classes. On January 1, 2021, Mortex had no balance in Class 14.1. The following five independent Cases involve payments for goodwill and receipts for goodwill. In each case assume that Mortex has no other transactions in 2021 or 2022 that involve Class 14.1. Case One In 2021, Mortex purchases two businesses. With the purchase of Business 1, a payment of $86,000 is made for goodwill. With the purchase of Business 2, a payment of $75,000 is made for goodwill. Both businesses are absorbed into Mortex's other operations. In 2022, Mortex sells a portion of its business and, as a consequence, receives a payment for goodwill of $90,000. Case Two Using the same information as in Case One, assume that Mortex continues to operate both of the 2021 separate businesses and that the $90,000 receipt for goodwill results from the sale of the first business. Case Three In 2021, Mortex purchases a business. The cost of this business includes a payment for goodwill of $96,000. The business is absorbed into Mortex's other operations and is not operated separately. Mortex also purchases an unlimited life franchise at a cost of $113,000 in 2021. Copyright 2022 Pearson Education Inc. Supplementary Self Study Problems, Byrd & Chen's Canadian Tax Principles 2021/22 Edition In 2022, Mortex sells a portion of its business and, as a consequence, receives a payment for goodwill of $102,000. Case Four Using the same information as in Case Three, assume that, instead of selling a portion of its business for an amount that includes goodwill of $102,000, the unlimited life franchise is sold for $102,000. Case Five Using the same information as in Case Three, assume that, instead of selling a portion of its business for an amount that includes goodwill of $102,000, the unlimited life franchise is sold for $135,000. 5-3 Required: Determine the income tax consequences for the years 2021 and 2022 in each of these five Cases. Your answer should include the January 1, 2023, UCC balance for Class 14.1.

Step by Step Solution

★★★★★

3.30 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

The income tax consequences for the years 2021 and 2022 in each of these five Cases are as follows Case One In 2021 Mortex purchases two businesses Wi...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started