Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Mortgage Amount: $450,000 Payment Amount: $2,090.19 Extra Payment: $200 Total Payment: $2,290.19 Mortgage Term: 30 years APR: 3.8% Number of Payments Per Year: 12 Question

Mortgage Amount: $450,000

Mortgage Amount: $450,000

Payment Amount: $2,090.19

Extra Payment: $200

Total Payment: $2,290.19

Mortgage Term: 30 years

APR: 3.8%

Number of Payments Per Year: 12

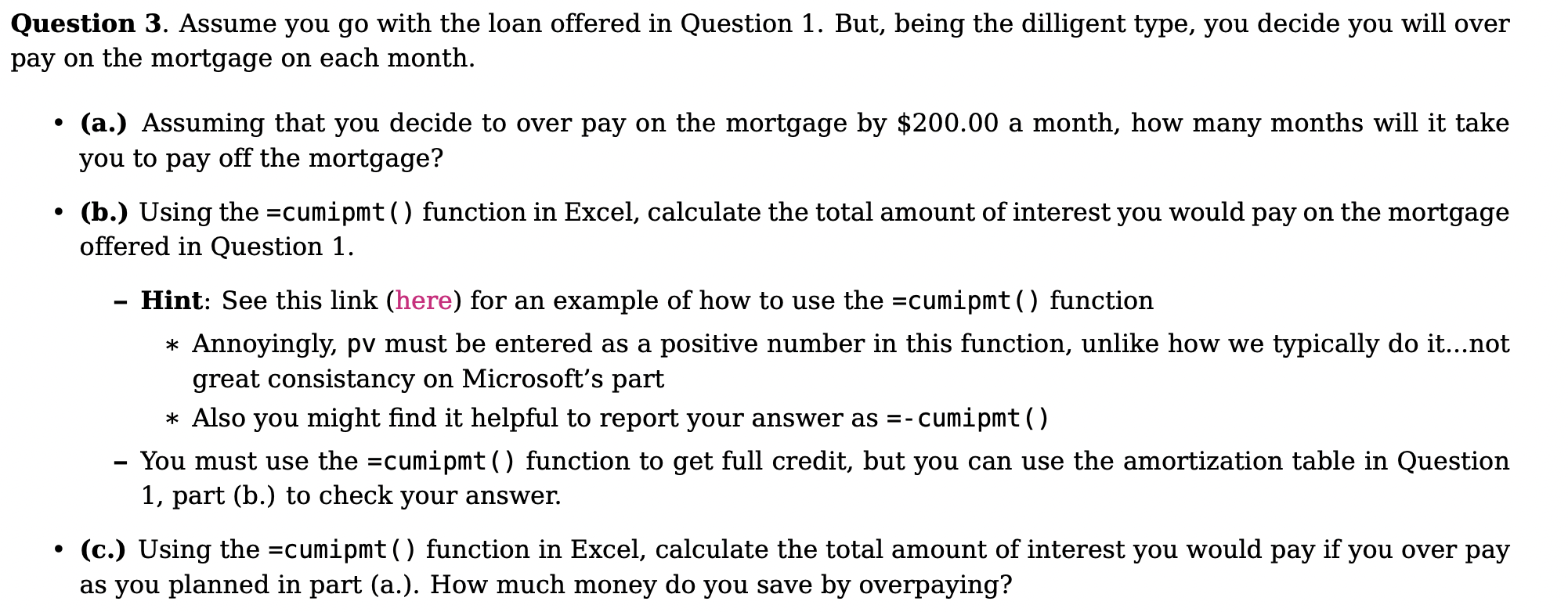

Question 3. Assume you go with the loan offered in Question 1. But, being the dilligent type, you decide you will over pay on the mortgage on each month. . (a.) Assuming that you decide to over pay on the mortgage by $200.00 a month, how many months will it take you to pay off the mortgage? . (b.) Using the =cumipmt() function in Excel, calculate the total amount of interest you would pay on the mortgage offered in Question 1. - Hint: See this link (here) for an example of how to use the =cumipmt() function * Annoyingly, pv must be entered as a positive number in this function, unlike how we typically do it...not great consistancy on Microsoft's part * Also you might find it helpful to report your answer as =-cumipmt() You must use the rcumipmt() function to get full credit, but you can use the amortization table in Question 1, part (b.) to check your answer. = (c.) Using the =cumipmt() function in Excel, calculate the total amount of interest you would pay if you over pay as you planned in part (a.). How much money do you save by overpaying? Question 3. Assume you go with the loan offered in Question 1. But, being the dilligent type, you decide you will over pay on the mortgage on each month. . (a.) Assuming that you decide to over pay on the mortgage by $200.00 a month, how many months will it take you to pay off the mortgage? . (b.) Using the =cumipmt() function in Excel, calculate the total amount of interest you would pay on the mortgage offered in Question 1. - Hint: See this link (here) for an example of how to use the =cumipmt() function * Annoyingly, pv must be entered as a positive number in this function, unlike how we typically do it...not great consistancy on Microsoft's part * Also you might find it helpful to report your answer as =-cumipmt() You must use the rcumipmt() function to get full credit, but you can use the amortization table in Question 1, part (b.) to check your answer. = (c.) Using the =cumipmt() function in Excel, calculate the total amount of interest you would pay if you over pay as you planned in part (a.). How much money do you save by overpayingStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started