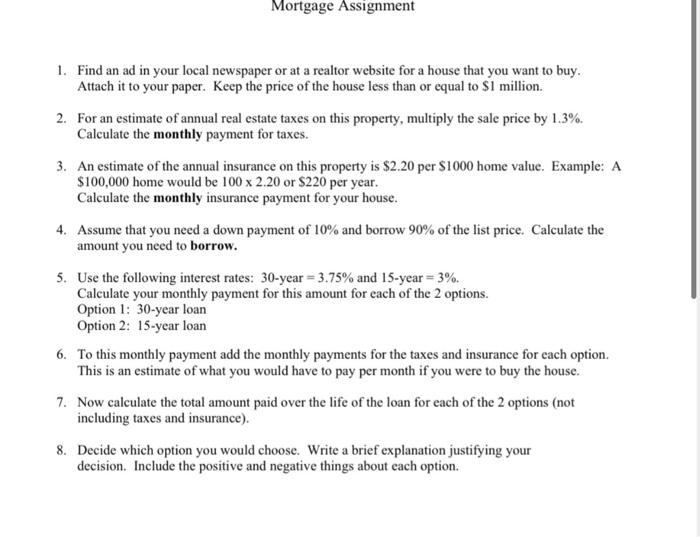

Mortgage Assignment 1. Find an ad in your local newspaper or at a realtor website for a house that you want to buy. Attach it to your paper. Keep the price of the house less than or equal to $1 million. 2. For an estimate of annual real estate taxes on this property, multiply the sale price by 1.3%. Calculate the monthly payment for taxes. 3. An estimate of the annual insurance on this property is $2.20 per $1000 home value. Example: A $100,000 home would be 100 x 2.20 or $220 per year. Calculate the monthly insurance payment for your house. 4. Assume that you need a down payment of 10% and borrow 90% of the list price. Calculate the amount you need to borrow. 5. Use the following interest rates: 30-year = 3.75% and 15-year = 3%. Calculate your monthly payment for this amount for each of the 2 options. Option 1: 30-year loan Option 2: 15-year loan 6. To this monthly payment add the monthly payments for the taxes and insurance for each option. This is an estimate of what you would have to pay per month if you were to buy the house. 7. Now calculate the total amount paid over the life of the loan for each of the 2 options (not including taxes and insurance). 8. Decide which option you would choose. Write a brief explanation justifying your decision. Include the positive and negative things about each option. Mortgage Assignment 1. Find an ad in your local newspaper or at a realtor website for a house that you want to buy. Attach it to your paper. Keep the price of the house less than or equal to $1 million. 2. For an estimate of annual real estate taxes on this property, multiply the sale price by 1.3%. Calculate the monthly payment for taxes. 3. An estimate of the annual insurance on this property is $2.20 per $1000 home value. Example: A $100,000 home would be 100 x 2.20 or $220 per year. Calculate the monthly insurance payment for your house. 4. Assume that you need a down payment of 10% and borrow 90% of the list price. Calculate the amount you need to borrow. 5. Use the following interest rates: 30-year = 3.75% and 15-year = 3%. Calculate your monthly payment for this amount for each of the 2 options. Option 1: 30-year loan Option 2: 15-year loan 6. To this monthly payment add the monthly payments for the taxes and insurance for each option. This is an estimate of what you would have to pay per month if you were to buy the house. 7. Now calculate the total amount paid over the life of the loan for each of the 2 options (not including taxes and insurance). 8. Decide which option you would choose. Write a brief explanation justifying your decision. Include the positive and negative things about each option