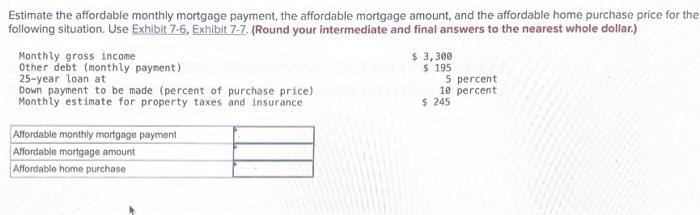

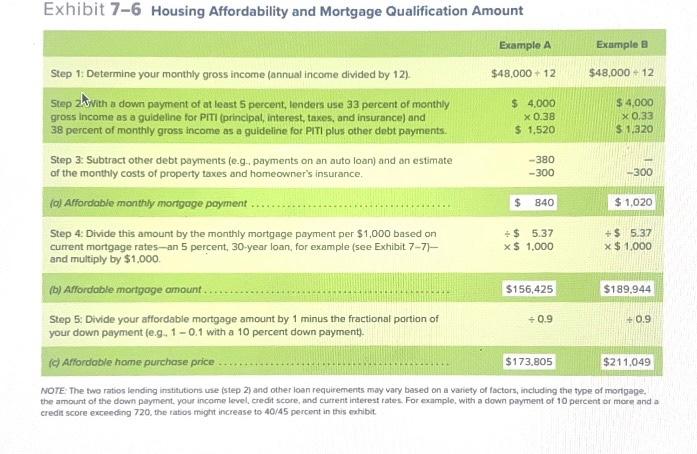

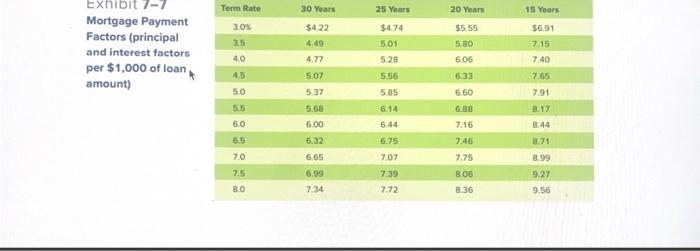

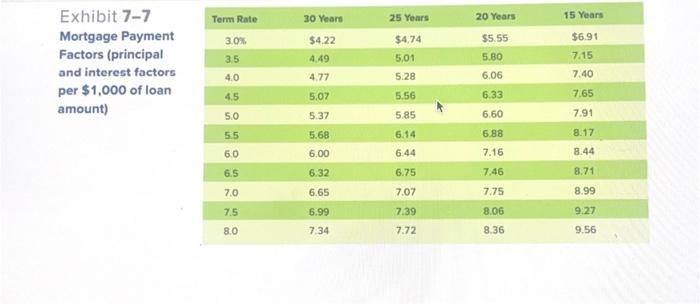

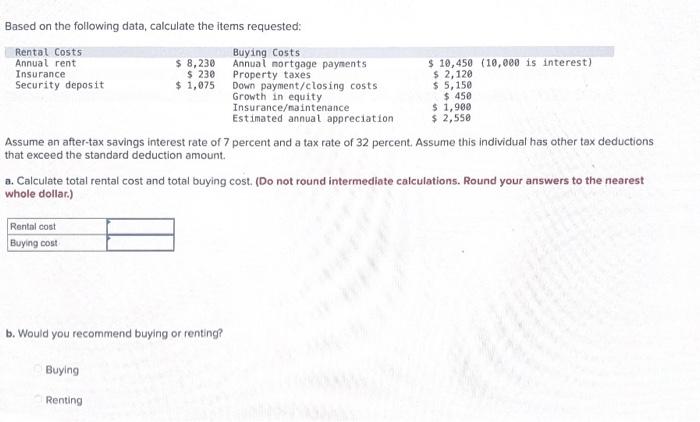

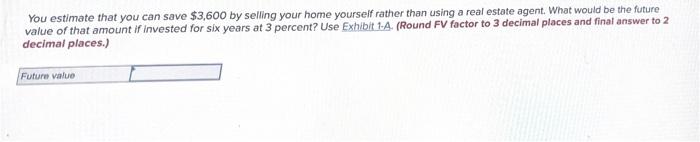

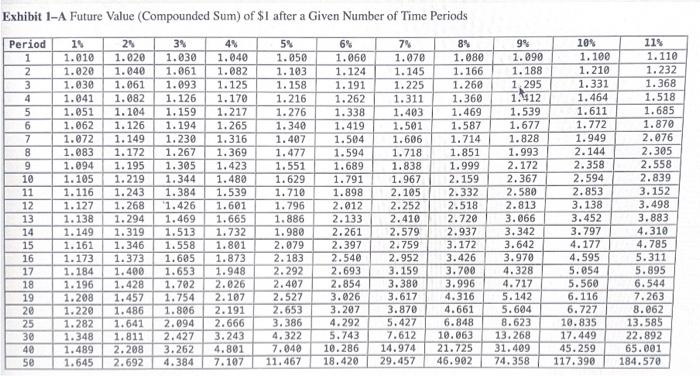

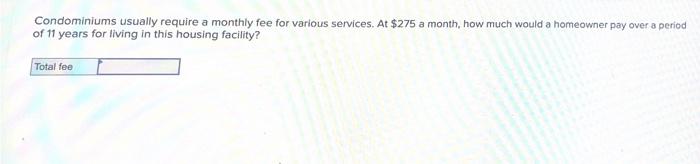

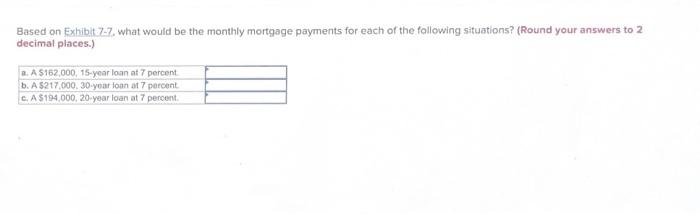

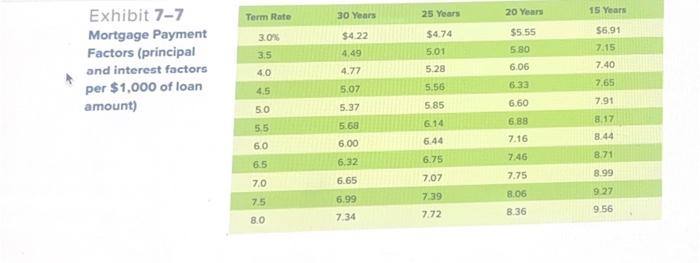

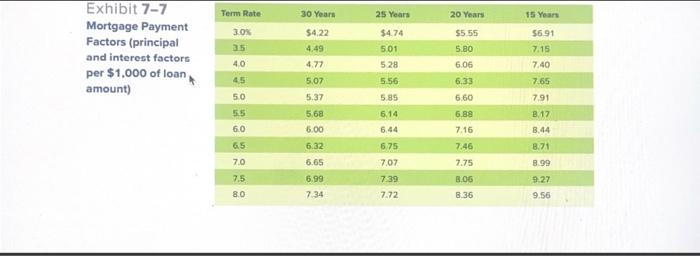

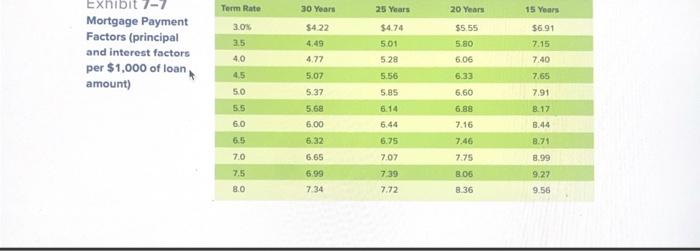

Mortgage Payment Factors (principal and interest factors per $1,000 of loan amount) Estimate the affordable monthly mortgage payment, the affordable mortgage amount, and the affordable home purchase price for the following situation. Use Exhibit 7-6, Exhibit 7-7. (Round your intermediate and final answers to the nearest whole dollar.) int nt Exhibit 7-7 Mortgage Payment Factors (principal and interest factors per $1,000 of loan amount) You estimate that you can save $3,600 by selling your home yourself rather than using a real estate agent. What would be the future value of that amount if invested for six years at 3 percent? Use Exhibit 1.A. (Round FV factor to 3 decimal places and final answer to 2 decimal places.) Condominiums usually require a monthly fee for various services. At $275 a month, how much would a homeowner pay over a period of 11 years for living in this housing facility? Exhibit 7-7 Mortgage Payment Factors (principal and interest factors per $1,000 of loan amount) Exhibit 7-6 Housing Affordability and Mortgage Qualification Amount Based on Exhibit 7-7. what would be the monthly mortgage payments for each of the following situations? (Round your answers to 2 decimat places.) Exhibit 1-A Future Value (Compounded Sum) of \$1 after a Given Number of Time Periods Based on the following data, calculate the items requested: Assume an after-tax savings interest rate of 7 percent and a tax rate of 32 percent. Assume this individual has other tax deductions that exceed the standard deduction amount. a. Calculate total rental cost and total buying cost. (Do not round intermediate calculations. Round your answers to the nearest whole dollar.) b. Would you recommend buying or renting? Buying Renting Mortgage Payment Factors (principal and interest factors per $1,000 of loan amount) Exhibit 7-7 Mortgage Payment Factors (principal and interest factors per $1,000 of loan amount) Mortgage Payment Factors (principal and interest factors per $1,000 of loan amount) Estimate the affordable monthly mortgage payment, the affordable mortgage amount, and the affordable home purchase price for the following situation. Use Exhibit 7-6, Exhibit 7-7. (Round your intermediate and final answers to the nearest whole dollar.) int nt Exhibit 7-7 Mortgage Payment Factors (principal and interest factors per $1,000 of loan amount) You estimate that you can save $3,600 by selling your home yourself rather than using a real estate agent. What would be the future value of that amount if invested for six years at 3 percent? Use Exhibit 1.A. (Round FV factor to 3 decimal places and final answer to 2 decimal places.) Condominiums usually require a monthly fee for various services. At $275 a month, how much would a homeowner pay over a period of 11 years for living in this housing facility? Exhibit 7-7 Mortgage Payment Factors (principal and interest factors per $1,000 of loan amount) Exhibit 7-6 Housing Affordability and Mortgage Qualification Amount Based on Exhibit 7-7. what would be the monthly mortgage payments for each of the following situations? (Round your answers to 2 decimat places.) Exhibit 1-A Future Value (Compounded Sum) of \$1 after a Given Number of Time Periods Based on the following data, calculate the items requested: Assume an after-tax savings interest rate of 7 percent and a tax rate of 32 percent. Assume this individual has other tax deductions that exceed the standard deduction amount. a. Calculate total rental cost and total buying cost. (Do not round intermediate calculations. Round your answers to the nearest whole dollar.) b. Would you recommend buying or renting? Buying Renting Mortgage Payment Factors (principal and interest factors per $1,000 of loan amount) Exhibit 7-7 Mortgage Payment Factors (principal and interest factors per $1,000 of loan amount)