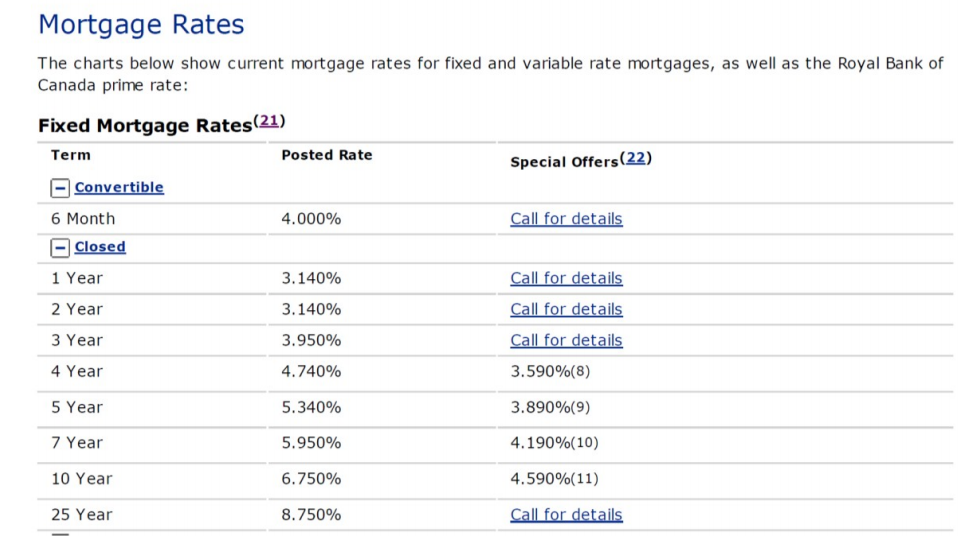

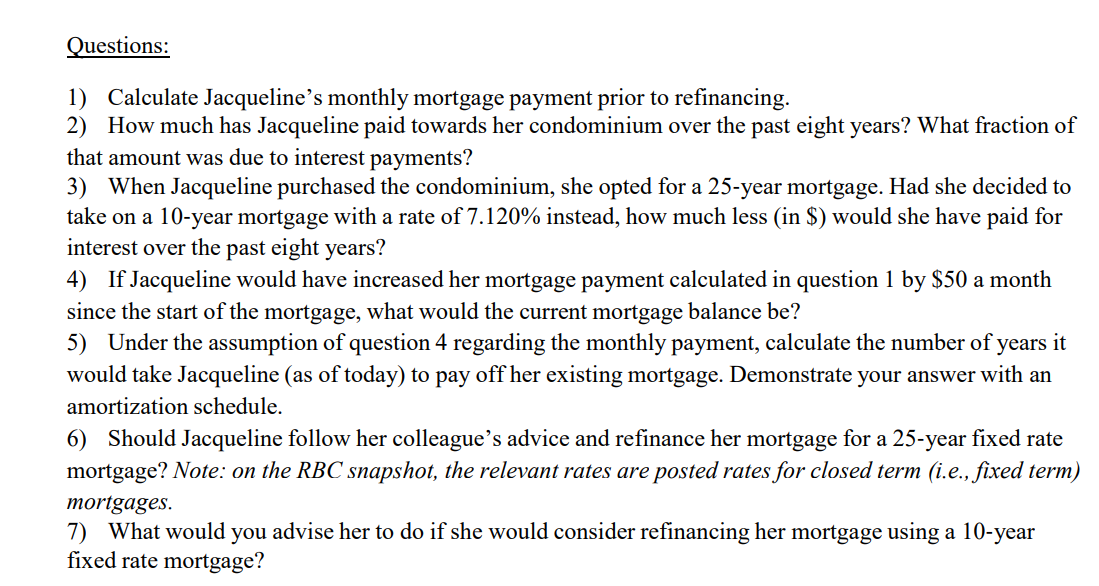

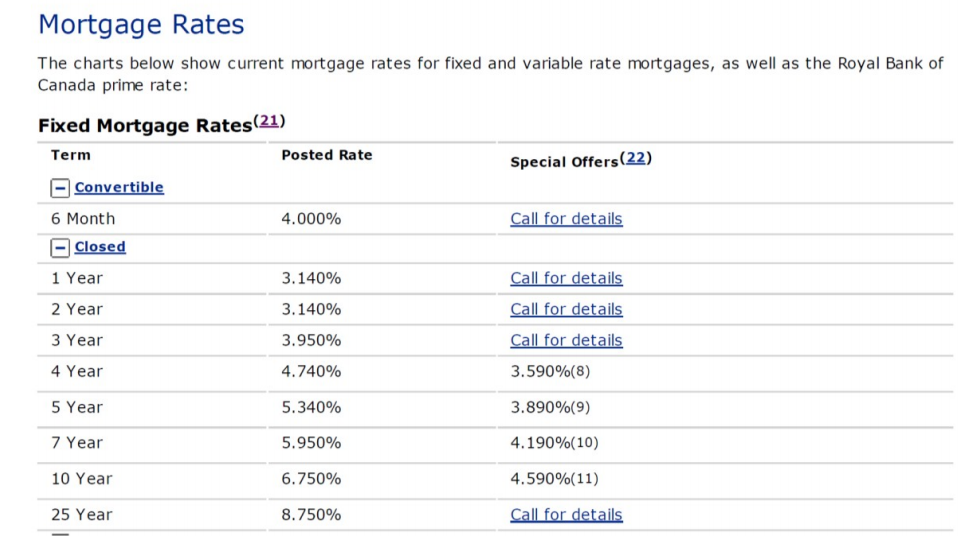

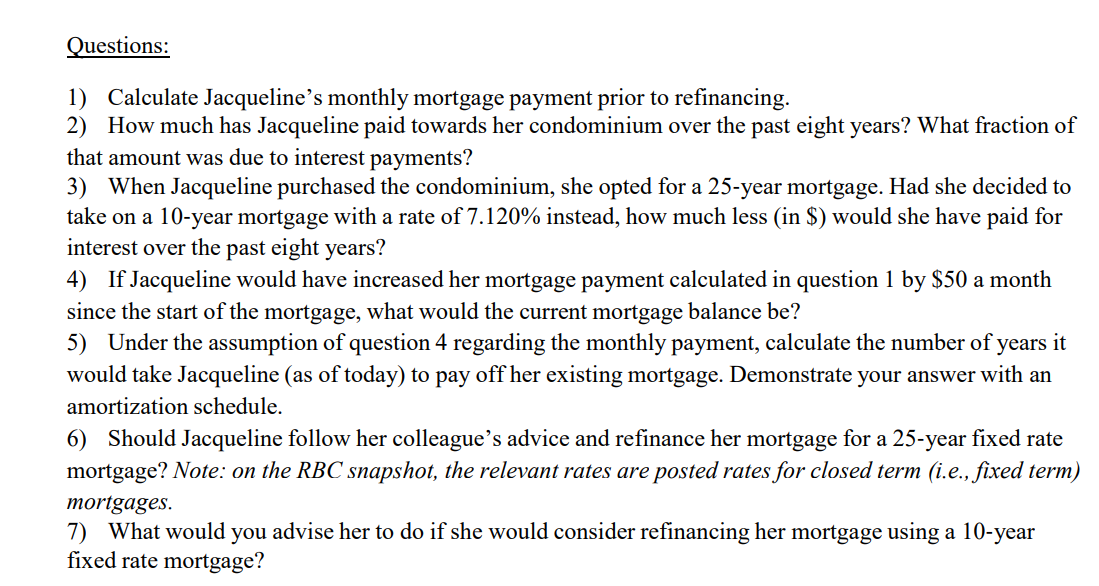

Mortgage refinancing Eight years ago, Jacqueline de Santos purchased a brand-new condominium at the Toronto Harbourfront for $180,000. Jacqueline had been saving for her first home purchase ever since she graduated from and she was able to make the 20% required down payment in order to avoid mortgage insurance. At the time, the mortgage rate on a 10-year fixed rate mortgage was 7.120% and the rate on a 25-year fixed rate mortgage was 9.240%. Jacqueline decided to take on a 25-year fixed rate mortgage. Today, Jacqueline works at RBC as a marketing manager. A couple of weeks ago during lunch, she was having a conversation with some of her colleagues at the mortgage department. Mortgage rates had fallen and she was advised to see whether she could refinance her mortgage in order to save some money. Normally, the penalty for refinancing a mortgage equals the amount of interest paid over the past three months. However, as an RBC employee, Jacqueline does not have to pay the penalty. One of her colleagues sent her the following information about current mortgage rates at RBC: Mortgage Rates The charts below show current mortgage rates for fixed and variable rate mortgages, as well as the Royal Bank of Canada prime rate: Fixed Mortgage Rates(21) Term Posted Rate Special Offers (22) -Convertible 6 Month 4.000% Call for details Closed 1 Year 3.140% Call for details 2 Year 3.140% Call for details 3 Year 3.950% Call for details 4 Year 4.740% 3.590%(8) 5 Year 5.340% 3.890%(9) 7 Year 5.950% 4.190%(10) 10 Year 6.750% 4.590%(11) 25 Year 8.750% Call for details Questions: 1) Calculate Jacquelines monthly mortgage payment prior to refinancing. 2) How much has Jacqueline paid towards her condominium over the past eight years? What fraction of that amount was due to interest payments? 3) When Jacqueline purchased the condominium, she opted for a 25-year mortgage. Had she decided to take on a 10-year mortgage with a rate of 7.120% instead, how much less (in $) would she have paid for interest over the past eight years? 4) If Jacqueline would have increased her mortgage payment calculated in question 1 by $50 a month since the start of the mortgage, what would the current mortgage balance be? 5) Under the assumption of question 4 regarding the monthly payment, calculate the number of years it would take Jacqueline (as of today) to pay off her existing mortgage. Demonstrate your answer with an amortization schedule. 6) Should Jacqueline follow her colleague's advice and refinance her mortgage for a 25-year fixed rate mortgage? Note: on the RBC snapshot, the relevant rates are posted rates for closed term (i.e., fixed term) mortgages. 7) What would you advise her to do if she would consider refinancing her mortgage using a 10-year fixed rate mortgage? Mortgage refinancing Eight years ago, Jacqueline de Santos purchased a brand-new condominium at the Toronto Harbourfront for $180,000. Jacqueline had been saving for her first home purchase ever since she graduated from and she was able to make the 20% required down payment in order to avoid mortgage insurance. At the time, the mortgage rate on a 10-year fixed rate mortgage was 7.120% and the rate on a 25-year fixed rate mortgage was 9.240%. Jacqueline decided to take on a 25-year fixed rate mortgage. Today, Jacqueline works at RBC as a marketing manager. A couple of weeks ago during lunch, she was having a conversation with some of her colleagues at the mortgage department. Mortgage rates had fallen and she was advised to see whether she could refinance her mortgage in order to save some money. Normally, the penalty for refinancing a mortgage equals the amount of interest paid over the past three months. However, as an RBC employee, Jacqueline does not have to pay the penalty. One of her colleagues sent her the following information about current mortgage rates at RBC: Mortgage Rates The charts below show current mortgage rates for fixed and variable rate mortgages, as well as the Royal Bank of Canada prime rate: Fixed Mortgage Rates(21) Term Posted Rate Special Offers (22) -Convertible 6 Month 4.000% Call for details Closed 1 Year 3.140% Call for details 2 Year 3.140% Call for details 3 Year 3.950% Call for details 4 Year 4.740% 3.590%(8) 5 Year 5.340% 3.890%(9) 7 Year 5.950% 4.190%(10) 10 Year 6.750% 4.590%(11) 25 Year 8.750% Call for details Questions: 1) Calculate Jacquelines monthly mortgage payment prior to refinancing. 2) How much has Jacqueline paid towards her condominium over the past eight years? What fraction of that amount was due to interest payments? 3) When Jacqueline purchased the condominium, she opted for a 25-year mortgage. Had she decided to take on a 10-year mortgage with a rate of 7.120% instead, how much less (in $) would she have paid for interest over the past eight years? 4) If Jacqueline would have increased her mortgage payment calculated in question 1 by $50 a month since the start of the mortgage, what would the current mortgage balance be? 5) Under the assumption of question 4 regarding the monthly payment, calculate the number of years it would take Jacqueline (as of today) to pay off her existing mortgage. Demonstrate your answer with an amortization schedule. 6) Should Jacqueline follow her colleague's advice and refinance her mortgage for a 25-year fixed rate mortgage? Note: on the RBC snapshot, the relevant rates are posted rates for closed term (i.e., fixed term) mortgages. 7) What would you advise her to do if she would consider refinancing her mortgage using a 10-year fixed rate mortgage