Answered step by step

Verified Expert Solution

Question

1 Approved Answer

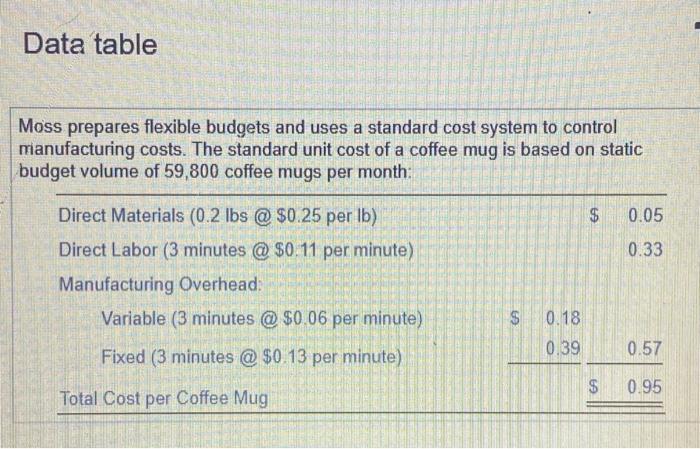

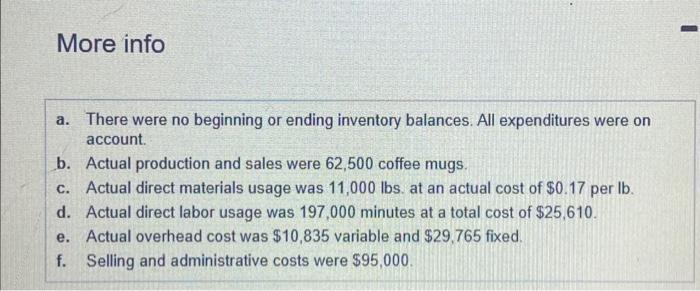

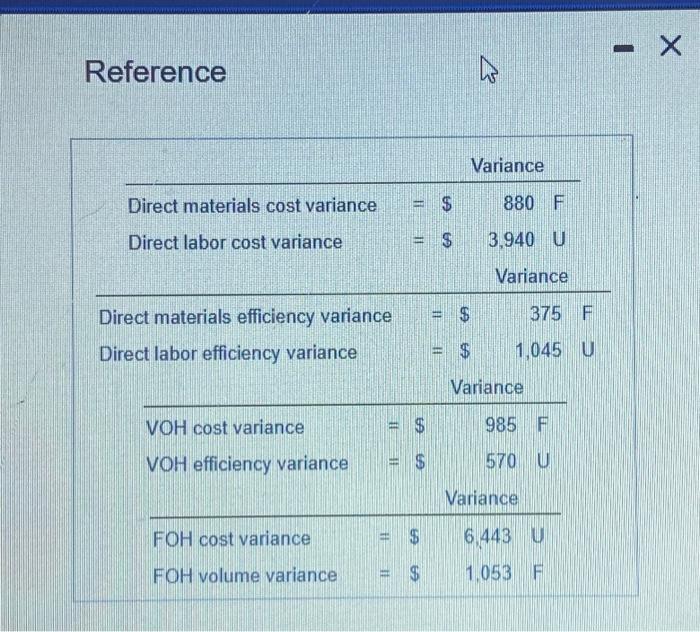

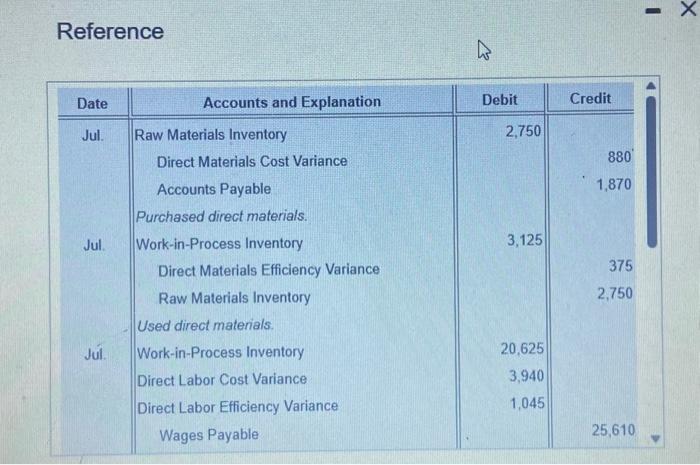

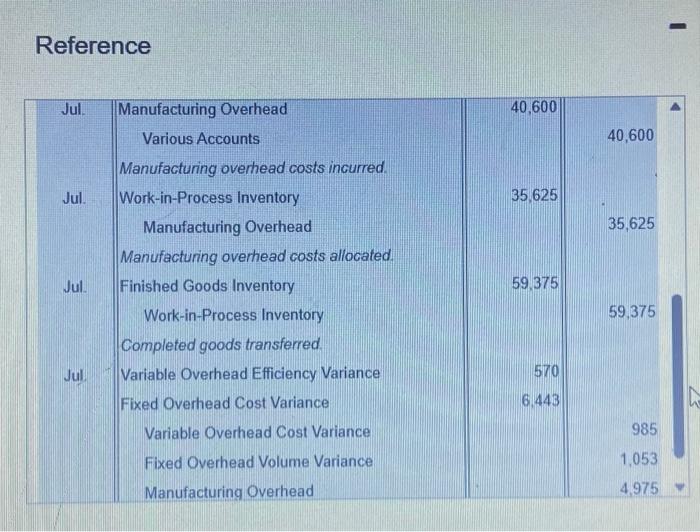

Moss manufactures collee mugs that it sells to other companies for customicing with their own logos. (Click the icon to view the cost data) Actual

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started