Question

Most Company has an opportunity to invest in one of two new projects. Project Y requires a $330,000 investment for new machinery with a six-year

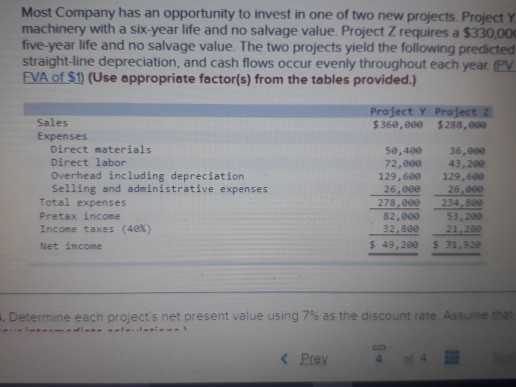

Most Company has an opportunity to invest in one of two new projects. Project Y requires a $330,000 investment for new machinery with a six-year life and no salvage value. Project Z requires a $330,000 investment for new machinery with a five-year life and no salvage value. The two projects yield the following predicted annual results. The company uses straight-line depreciation, and cash flows occur evenly throughout each year. (PV of $1, FV of $1, PVA of $1, and FVA of $1) (Use appropriate factor(s) from the tables provided.)

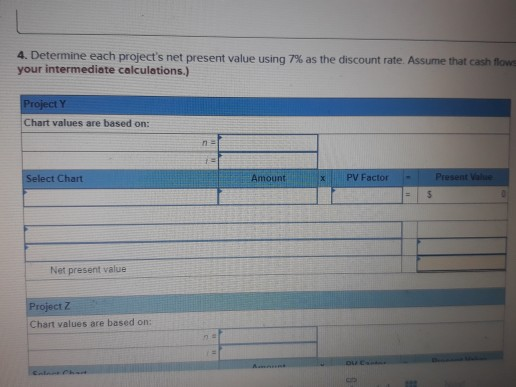

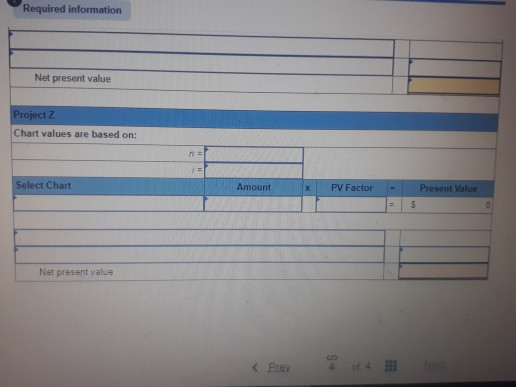

Determine each projects net present value using 7% as the discount rate. Assume that cash flows occur at each year-end. (Round your intermediate calculations.)

Most Company has an opportunity to invest in one of two new projects Project machinery with a six-year life and no salvage value. Project Z requires a $330.000 five-year life and no salvage value. The two projects yield the following predicted straight-line depreciation, and cash flows occur evenly throughout each year PM FVA Of S1) (Use appropriate factor(s) from the tables provided.) Project Y Project $360,000 $288,000 Sales Expenses Direct materials Direct labor Overhead including depreciation Selling and administrative expenses Total expenses Pretax income Income taxes (40%) Net income 50,400 72,000 129,600 26, eee 278,000 82,000 32,800 $ 49,200 43,200 129,600 26.ee 234,800 53,200 21.289 $ 31,920 .. Determine each projects net present value using 7% as the discount rate Assume

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started