Answered step by step

Verified Expert Solution

Question

1 Approved Answer

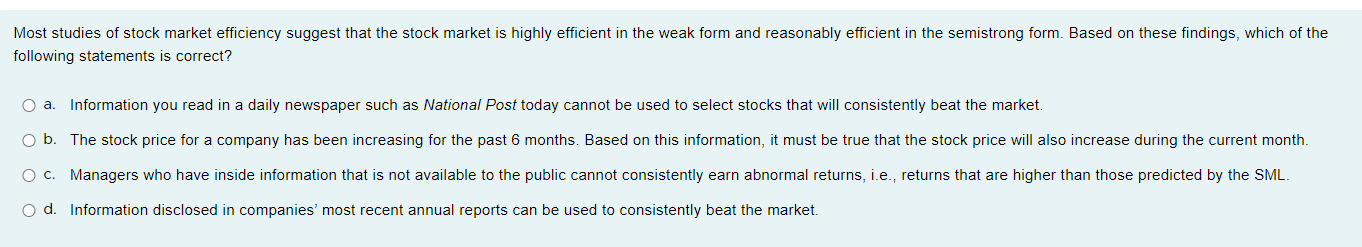

Most studies of stock market efficiency suggest that the stock market is highly efficient in the weak form and reasonably efficient in the semistrong form.

Most studies of stock market efficiency suggest that the stock market is highly efficient in the weak form and reasonably efficient in the semistrong form. Based on these findings, which of the

following statements is correct?

a Information you read in a daily newspaper such as National Post today cannot be used to select stocks that will consistently beat the market.

b The stock price for a company has been increasing for the past months. Based on this information, it must be true that the stock price will also increase during the current month.

c Managers who have inside information that is not available to the public cannot consistently earn abnormal returns, ie returns that are higher than those predicted by the SML

d Information disclosed in companies' most recent annual reports can be used to consistently beat the market.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started