Question

MOTEL 365 In 1982, Natalie Rose obtained her bachelors degree in Business Administration from California State University, Chino, specializing in the hospitality industry. After working

MOTEL 365

In 1982, Natalie Rose obtained her bachelors degree in Business Administration from California State University, Chino, specializing in the hospitality industry. After working for fifteen years as a manager at the Sheraton Hotel in Main Valley, Green, Ms. Rose decided to go on her own and acquire an existing hotel located in Springfield in the state of Green and convert it to a bed and breakfast inn. After locating a suitable hotel, known as Motel 365, Ms. Rose conducted an in-depth study of the market and decided that the hotel possessed an immense potential if it were to become a bed and breakfast inn. She contacted the listing agent of the hotel, Leon Reed, and obtained preliminary data on the property, including financial statements of the hotel for the past three years. The hotel was listed for sale for $4.5 million. After conducting her own due diligence, Ms. Rose, Patricia Martinez, the hotel owner, and Mr. Reed met on January 5, 2005 and had a preliminary discussion on the purchase and sale of the hotel. Following the meeting, Ms. Martinez called Ms. Rose and offered her the property for $4.3 million, excluding the furniture. The sale was to conclude following a 45-day escrow. On January 6, 2005, Ms. Rose faxed Ms. Martinez a letter stating the following: Thank you for offering to sell me the hotel you own, Motel 365, located at 20567 Avenue of the Stars, Springfield, Green. I am excited to accept your offer to sell the hotel for $4.3 million, excluding the furniture. However, since it would take me some time to arrange financing, I would like to close escrow within 60 days. I look forward to working with you on this deal. Sincerely, Signed /S/ Natalie Rose The same day, Ms. Rose contacted a number of lenders to secure financing for the deal. Most lenders that she contacted turned her down due to her poor credit record and lack of business ownership experience. However, on January 30, 2005, she managed to obtain a financing commitment from one lender. It was a sixty-day firm commercial loan commitment from Bank of the West. The loan commitment required that Bank of the West would obtain a first priority lien on the hotel property, as well as on an unrelated undeveloped parcel of land that Ms. Rose owned in Lagoon Beach, Green. Ms. Rose had acquired the land in Lagoon Beach in 1984 and had managed to pay off the mortgage on that property on November 1, 2004. However, the lender on the Lagoon Beach property, First Bank of Green, had failed to remove the lien it had on that property despite the language in the deed of trust requiring it to promptly record a reconveyance of its lien on the property upon payment in full of the underlying loan.1 For the next sixty days following her faxed response, Ms. Rose vigorously attempted to get First Bank of Green to remove its lien on the Lagoon Beach property, but to no avail. She specifically mentioned to a number of officers at the bank that she would need First Bank of Green to remove the lien on her Lagoon Beach property as soon as possible so that she could pledge the Copyright 2009, Dr. Janice Bell and Dr. Rafi Efrat. 1 In most states, lenders typically use the deed of trust as the mechanism for holding a security interest in real property. In a deed of trust transaction, the borrower deeds to the trustee the property that is to be put up as security for the mortgage obtained from the lender. The trust agreement usually gives the trustee the right to foreclose or sell the property if the debtor fails to make a required payment on the debt. However, under the typical reconveyance clause in a deed of trust, upon full repayment of the debt, the lender must request the trustee to promptly reconvey the property and release any liens on it too. 2 property as collateral for a new loan she was in the process of obtaining to finance a hotel acquisition. Despite repeated assurances from various officers at First Bank of Green, no one at First Bank of Green initiated and followed up on the processing of the reconveyance request. The failure resulted due to the various internal turnovers in First Bank of Green. To further her chances of obtaining a loan from the Bank of the West (and to try and persuade them to lend the money without a lien on the vacant land,) Ms. Rose contracted for an appraisal report from an independent company. Ms. Rose hired Peterson Accounting to prepare an appraisal using techniques that banks generally employ to determine the loan value of small hotels. Unfortunately, that valuation did not result in enough loan value to justify the hotel property as the sole collateral on the loan. Hence, to obtain the loan from Bank of the West, she still needed clear title to the vacant land. On March 28, 2005, following the sixtieth day, Bank of the West informed Ms. Rose that its previous loan commitment of sixty days had expired. Ms. Rose desperately attempted to obtain alternative financing, but was unable to locate another loan. Hoping to get extra time, Ms. Rose contacted Ms. Martinez and Mr. Reed and asked for a thirty days extension for the consummation of the deal. Mr. Reed then informed Ms. Rose that Ms. Martinez had already entered into a sale agreement with another buyer and hence the property was no longer available for sale. Not giving up on her dream of owning a bed and breakfast Inn, Ms. Rose located another hotel, similarly situated, that was virtually identical to the one she pursued previously. Later in 2005, Ms. Rose acquired it for $4.7 million, excluding the furniture. Ms. Rose is now seeking a recovery for her damages of lost opportunity to acquire the first Springfield hotel. She is suing her former mortgage lender, First Bank of Green, for negligent failure to promptly remove the lien on her Lagoon Beach property.

Calculate present value and expected value of the loan she received. Then calculate the present value and expected value of the loan she didn't get to confirm that it wasn't worth as much as the hotel.

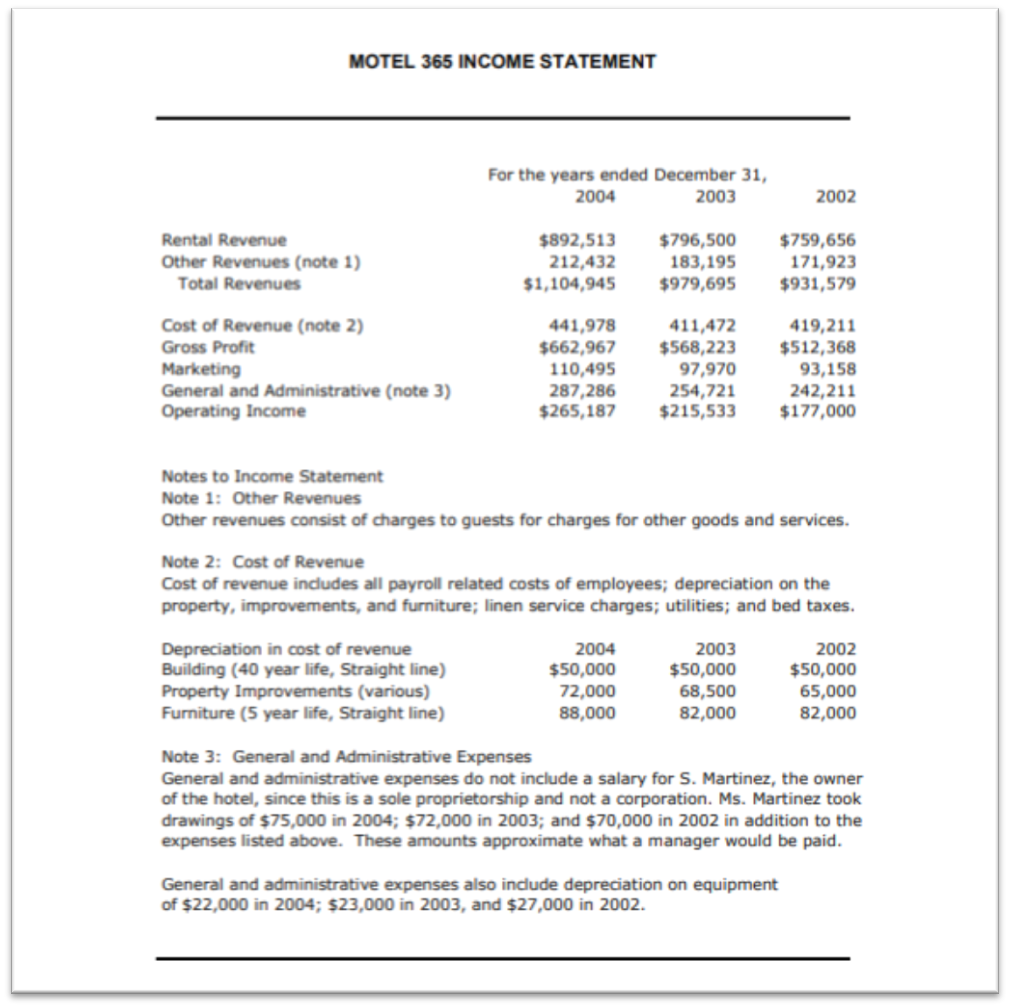

Ms. Rose originally approached the company, Peterson Accounting, when she discovered problems with her faulty title to the vacant land. She hired the company to value the hotel property so she could provide lenders an independent appraisal of the collateral value of the property.

Peterson Accounting researched valuation approaches used to determine most banks collateral value of bed and breakfast Inns in the Springfield area and discovered that most bank appraisers calculate the collateral value using the expected value approach. They place weights on appraisals that result from two methods. First, many bed and breakfast operations are valued at four times the past two years' average gross margin. Appraisers assume that this appraisal is correct about 40% of the time, and accordingly place a 40% weight on the number derived from this method. Second, many properties are valued by taking the present value of the average of the past three years' cash flows discounted at an 8% discount rate for 10 years. (Appraisers assume that the past cash flows are a good estimate of future cash flows and those cash flows should continue for 10 years in the future.) Appraisers place a weight of 60% on the number derived from this method.

Using the income statement and footnotes for Motel 365 for the past three years provided by the existing owner's accountant to help in the appraisal process, verify the value of the hotel determined by Peterson Accounting by using:

a. Four times the past two years' average gross margin

- The present value of the average of the past three years' cash flows discounted at 8% for the next 10 years. In order to do this, first prepare an estimate of cash flow from operations for the three years. Then discount the average of this amount at 8% for 10 years to determine the hotel's implied value.

- Combine the values calculated in a) and b) using the weights provided. What is the appraised value of the Bed and Breakfast? Assume the appraised value is the total amount that the bank will loan Ms. rose unless Ms. Warren either pays 25% of the purchase in cash or pledges to the bank a first priority lien on the vacant land as collateral. If Ms. Rose has $500,000 available as a down payment, could she have borrowed enough money based on this appraisal without pledging the vacant land as collateral?

- Should Peterson Accounting have relied on the income statement and footnote information provided by Ms. Martinezs accountant? Why or why not?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started