Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Motor Sales sold its old office furniture for $9000. The original cost was $17,000, and at the time of sale, accumulated depreciation was $14,000. What

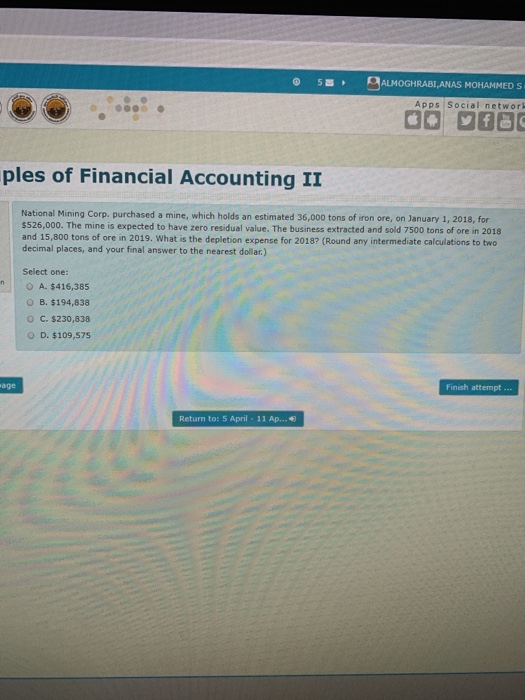

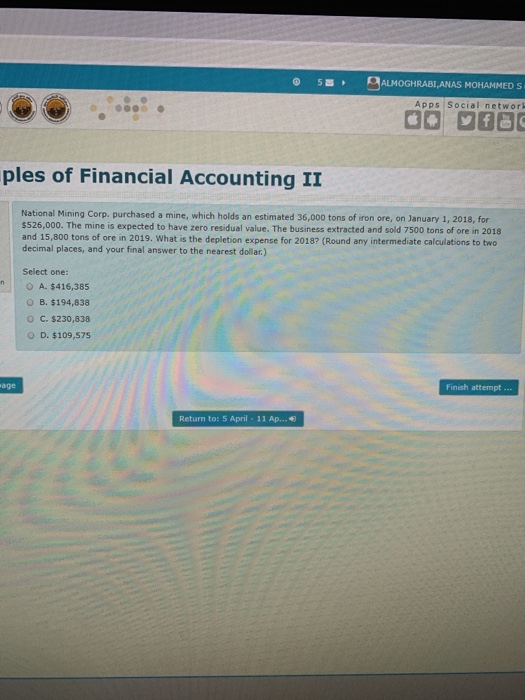

Motor Sales sold its old office furniture for $9000. The original cost was $17,000, and at the time of sale, accumulated depreciation was $14,000. What is the effect of this transaction?  @ S ALMOGHRABI,ANAS MOHAMMED S Apps Social network ples of Financial Accounting II National Mining Corp. purchased a mine, which holds an estimated 36,000 tons of iron ore, on January 1, 2018, for $526,000. The mine is expected to have zero residual value. The business extracted and sold 7500 tons of ore in 2018 and 15,800 tons of ore in 2019. What is the depletion expense for 2018? (Round any intermediate calculations to two decimal places, and your final answer to the nearest dollar) Select one: O A. $416,385 O B. $194,838 OC. $230,838 O D. $109,575 age Finish attempt ... Return to: 5 April - 11 Ap

@ S ALMOGHRABI,ANAS MOHAMMED S Apps Social network ples of Financial Accounting II National Mining Corp. purchased a mine, which holds an estimated 36,000 tons of iron ore, on January 1, 2018, for $526,000. The mine is expected to have zero residual value. The business extracted and sold 7500 tons of ore in 2018 and 15,800 tons of ore in 2019. What is the depletion expense for 2018? (Round any intermediate calculations to two decimal places, and your final answer to the nearest dollar) Select one: O A. $416,385 O B. $194,838 OC. $230,838 O D. $109,575 age Finish attempt ... Return to: 5 April - 11 Ap

Motor Sales sold its old office furniture for $9000. The original cost was $17,000, and at the time of sale, accumulated depreciation was $14,000. What is the effect of this transaction?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started