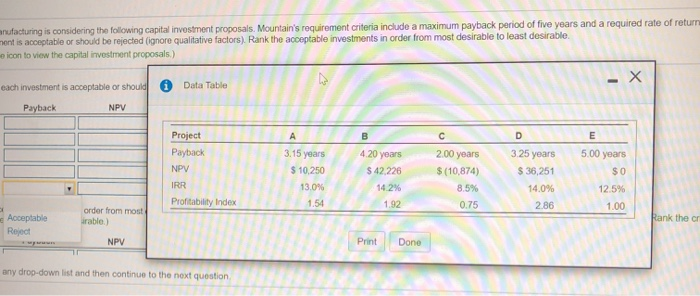

Mountain Manufacturing is considering the following capital investment proposals Mountain's requirement criteria include a maximum payback period of five years and a required rate of return of 12.5%. Determine if each investment is acceptable or should be rejected grore qualitative factors) Rank the acceptable investments in order from most desirable to last desirable (click the icon to view the capital investment proposals) Determined each investment is acceptable or should be rejected ignore qualitative factors). Evaluate the criteria of each investment operately) Payback NPV RR Profitability index A B D E Hank the acci investments Acceptable Reject Rank order from most desirable to last desirable Acceptable investments are those which are not rejected by any of the capital budgeting methods. Rank the criteria of each aratie NPV RR Penis anufacturing is considering the following capital investment proposals. Mountain's requirement criteria include a maximum payback period of five years and a required rate of return mentis acceptable or should be rejected (ignore qualitative factors). Rank the acceptable investments in order from most desirable to least desirable icon to view the capital investment proposals.) - X each investment is acceptable or should Data Table Payback NPV B D E Project Payback NPV 5.00 years A 3.15 years $ 10,250 13.0% 1.54 4 20 years $42.226 2.00 years $(10,874) 8.5% 0.75 $0 325 years $ 38,251 14.0% 2.86 IRR 12.5% 14.2% 1.92 Profitability Index 1.00 order from most irable & Acceptable Reject Rank the cr NPV Print Done 11 any drop-down list and then continue to the next question Mountain Manufacturing is considering the following capital investment proposals Mountain's requirement criteria include a maximum payback period of five years and a required rate of return of 12.5%. Det each investment is acceptable or should be rejected (ignore qualitative factors). Rank the acceptable investments in order from most desirable to least desirable Click the icon to view the capital investment proposals) B D E Rank the acceptable investments in order from most desirable to least desirable. Acceptable investments are those which are not rejected by any of the capital budgeting methods. (Rank the criteria of each investment separately. 1 most desirable) Rank Payback NPV IRR Profitability index 1 2 3 4 Choose