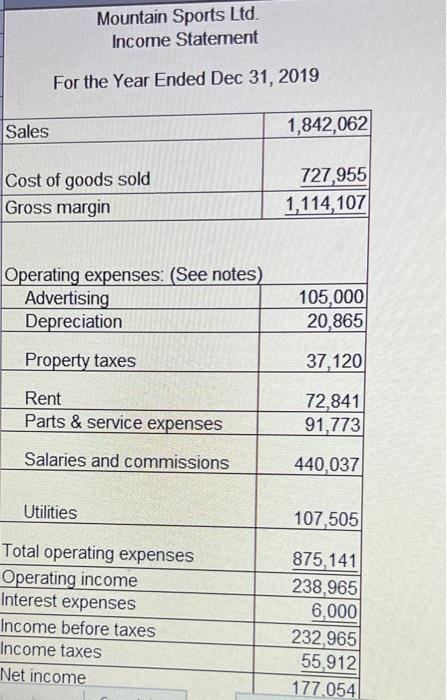

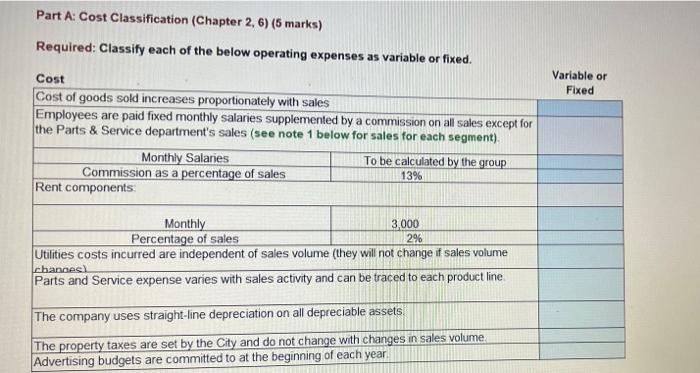

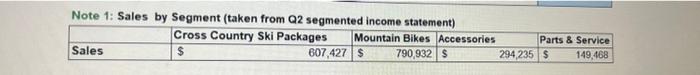

Mountain Sports Ltd. Income Statement For the Year Ended Dec 31, 2019 Sales 1,842,062 Cost of goods sold Gross margin 727,955 1,114, 107 Operating expenses: (See notes) Advertising Depreciation 105,000 20,865 Property taxes 37,120 Rent Parts & service expenses 72,841 91,773 Salaries and commissions 440,037 Utilities 107,505 Total operating expenses Operating income Interest expenses Income before taxes Income taxes Net income 875,141 238,965 6,000 232,965 55,912 177,054 Part A: Cost Classification (Chapter 2, 6) (5 marks) Required: Classify each of the below operating expenses as variable or fixed. Variable or Fixed Cost Cost of goods sold increases proportionately with sales Employees are paid fixed monthly salaries supplemented by a commission on all sales except for the Parts & Service department's sales (see note 1 below for sales for each segment). Monthly Salaries To be calculated by the group Commission as a percentage of sales 13% Rent components Monthly 3,000 Percentage of sales 2% Utilities costs incurred are independent of sales volume (they will not change if sales volume changes Parts and Service expense varies with sales activity and can be traced to each product line The company uses straight-line depreciation on all depreciable assets The property taxes are set by the City and do not change with changes in sales volume, Advertising budgets are committed to at the beginning of each year Note 1: Sales by Segment (taken from Q2 segmented income statement) Cross Country Ski Packages Mountain Bikes Accessories Parts & Service Sales $ 607,427 790,932 $ 294 235 $ 149,468 Part B: CVP Income Statement (Chapter 6) (13 marks) Prepare a contribution margin income statement (below), using the traditional income statement provided and the cost information provided in Part A Check figures have been provided to ensure you are on the right track. See the document provided to your group! Mountain Sports Ltd Contribution Margin Income Statement For the Year Ended Dec 31, 2019 Note from Instructors All formules must be completed within the answer boxes. Do no use a calculator and input the final answer it will result in rounding errors and you will be marked as incorrect. This is applicable for all calculations in the case study TOTAL PERCENT Sales $1842 0621 Less Variable Costs must be used in alphabetical order) 100% Note from instructor You will be incorrect if you do not follow inst Please read carefully! Total variable costs Less: Fixed Costs (must be listed in alphabetical order) Advertising Part C: CVP Analysis (Chapter 6) (9 marks) G Calculate the following and explain each calculation in your own words). Be sure to explain what the number you've calculated means, ensuring you write it in a way so that a non-accountant can understand. For example, if you calculate a breakeven point of $1,000, what does $1,000 mean? Marks will not be awarded for textbook definitions Calculition Explanation 64 Not 1) Breakeven Point in Sales Dollars thu the bu 2) Margin of Safety (in percent) 3) Degree of Operating Leverage (DOL) operating income to be used in calculation)