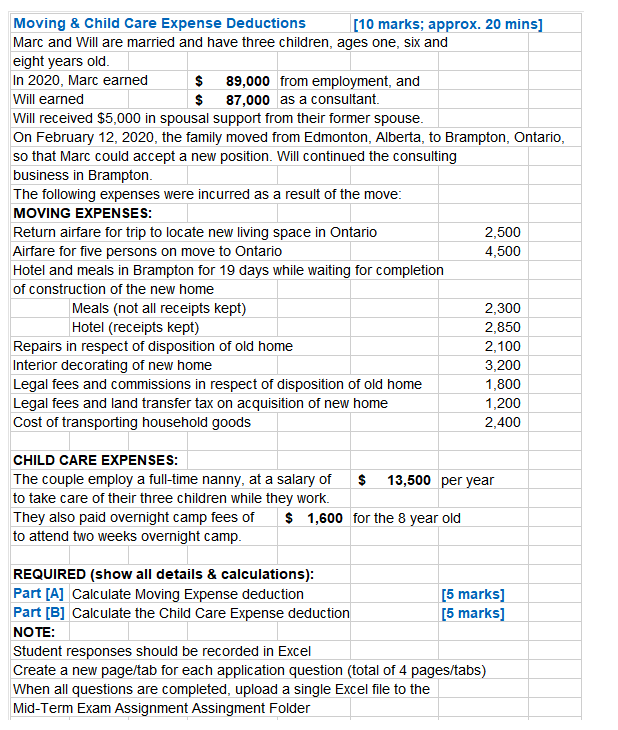

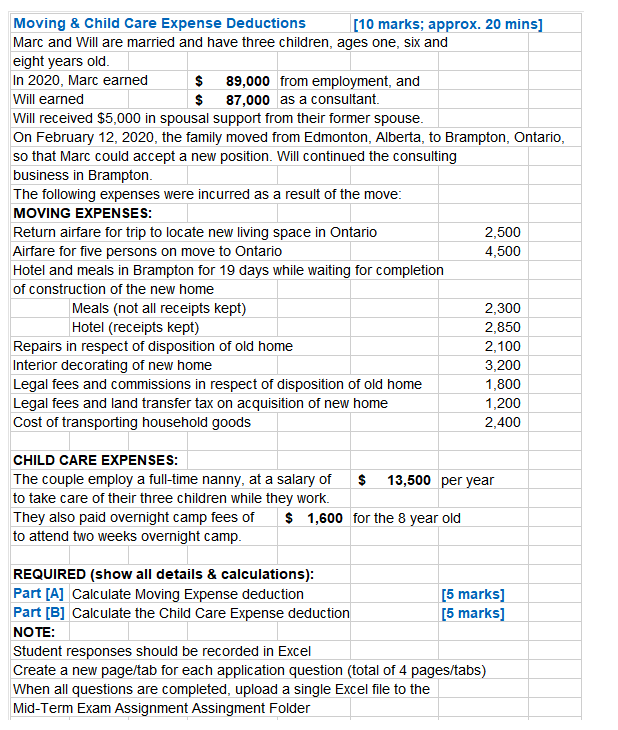

Moving & Child Care Expense Deductions [10 marks; approx. 20 mins] Marc and Will are married and have three children, ages one, six and eight years old. In 2020, Marc earned $ 89,000 from employment, and Will earned $ 87,000 as a consultant. Will received $5,000 in spousal support from their former spouse. On February 12, 2020, the family moved from Edmonton, Alberta, to Brampton, Ontario, so that Marc could accept a new position. Will continued the consulting business in Brampton The following expenses were incurred as a result of the move: MOVING EXPENSES: Return airfare for trip to locate new living space in Ontario 2,500 Airfare for five persons on move to Ontario 4,500 Hotel and meals in Brampton for 19 days while waiting for completion of construction of the new home Meals (not all receipts kept) 2,300 Hotel (receipts kept) 2,850 Repairs in respect of disposition of old home 2,100 Interior decorating of new home 3,200 Legal fees and commissions in respect of disposition of old home 1,800 Legal fees and land transfer tax on acquisition of new home 1,200 Cost of transporting household goods 2,400 CHILD CARE EXPENSES: The couple employ a full-time nanny, at a salary of $ 13,500 per year to take care of their three children while they work. They also paid overnight camp fees of $ 1,600 for the 8 year old to attend two weeks overnight camp. REQUIRED (show all details & calculations): Part [A] Calculate Moving Expense deduction [5 marks] Part [B] Calculate the Child Care Expense deduction [5 marks] NOTE: Student responses should be recorded in Excel Create a new page/tab for each application question (total of 4 pages/tabs) When all questions are completed, upload a single Excel file to the Mid-Term Exam Assignment Assingment Folder Moving & Child Care Expense Deductions [10 marks; approx. 20 mins] Marc and Will are married and have three children, ages one, six and eight years old. In 2020, Marc earned $ 89,000 from employment, and Will earned $ 87,000 as a consultant. Will received $5,000 in spousal support from their former spouse. On February 12, 2020, the family moved from Edmonton, Alberta, to Brampton, Ontario, so that Marc could accept a new position. Will continued the consulting business in Brampton The following expenses were incurred as a result of the move: MOVING EXPENSES: Return airfare for trip to locate new living space in Ontario 2,500 Airfare for five persons on move to Ontario 4,500 Hotel and meals in Brampton for 19 days while waiting for completion of construction of the new home Meals (not all receipts kept) 2,300 Hotel (receipts kept) 2,850 Repairs in respect of disposition of old home 2,100 Interior decorating of new home 3,200 Legal fees and commissions in respect of disposition of old home 1,800 Legal fees and land transfer tax on acquisition of new home 1,200 Cost of transporting household goods 2,400 CHILD CARE EXPENSES: The couple employ a full-time nanny, at a salary of $ 13,500 per year to take care of their three children while they work. They also paid overnight camp fees of $ 1,600 for the 8 year old to attend two weeks overnight camp. REQUIRED (show all details & calculations): Part [A] Calculate Moving Expense deduction [5 marks] Part [B] Calculate the Child Care Expense deduction [5 marks] NOTE: Student responses should be recorded in Excel Create a new page/tab for each application question (total of 4 pages/tabs) When all questions are completed, upload a single Excel file to the Mid-Term Exam Assignment Assingment Folder