Answered step by step

Verified Expert Solution

Question

1 Approved Answer

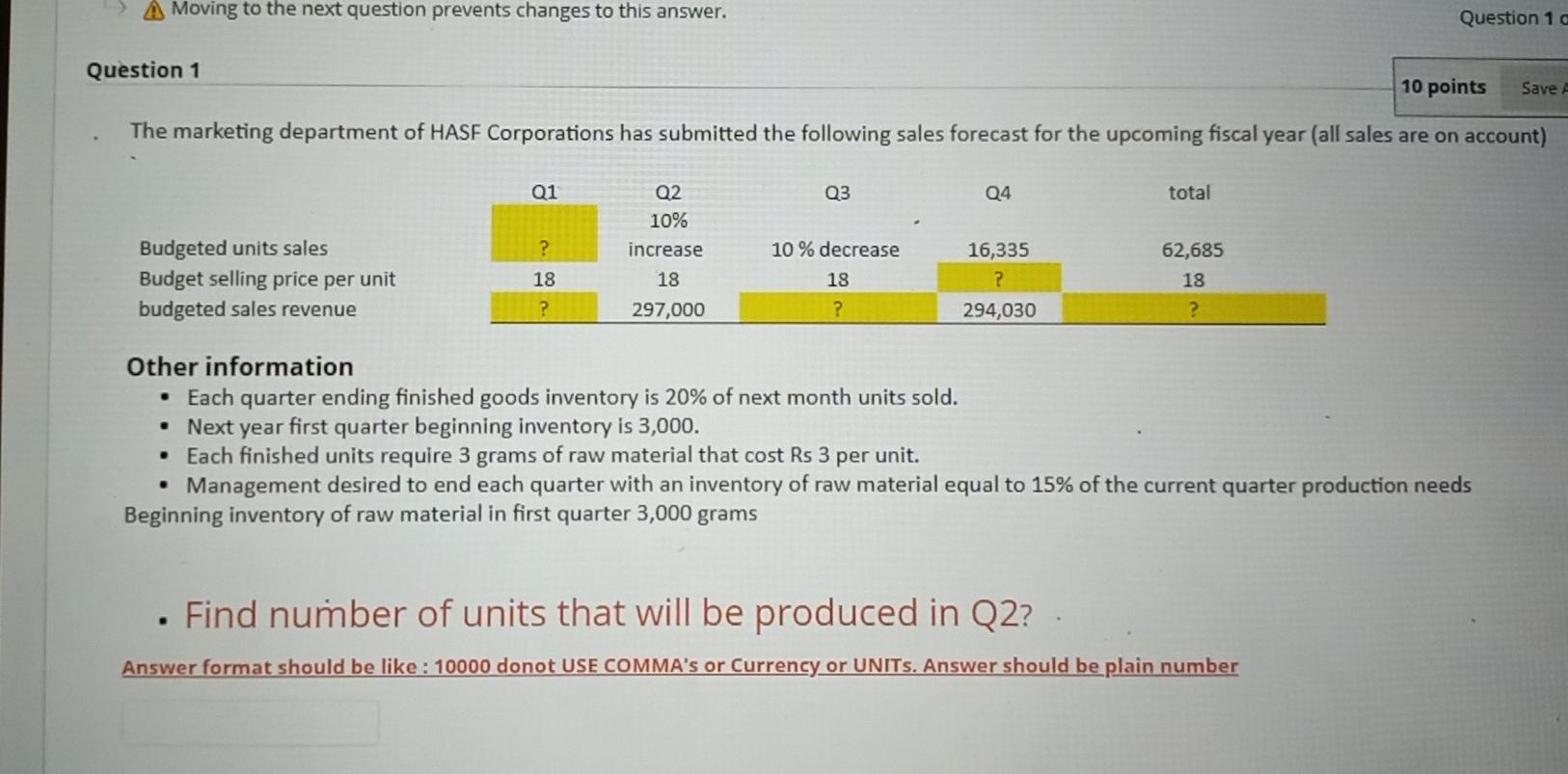

>Moving to the next question prevents changes to this answer. Question 1 Question 1 c 10 points Save A The marketing department of HASF

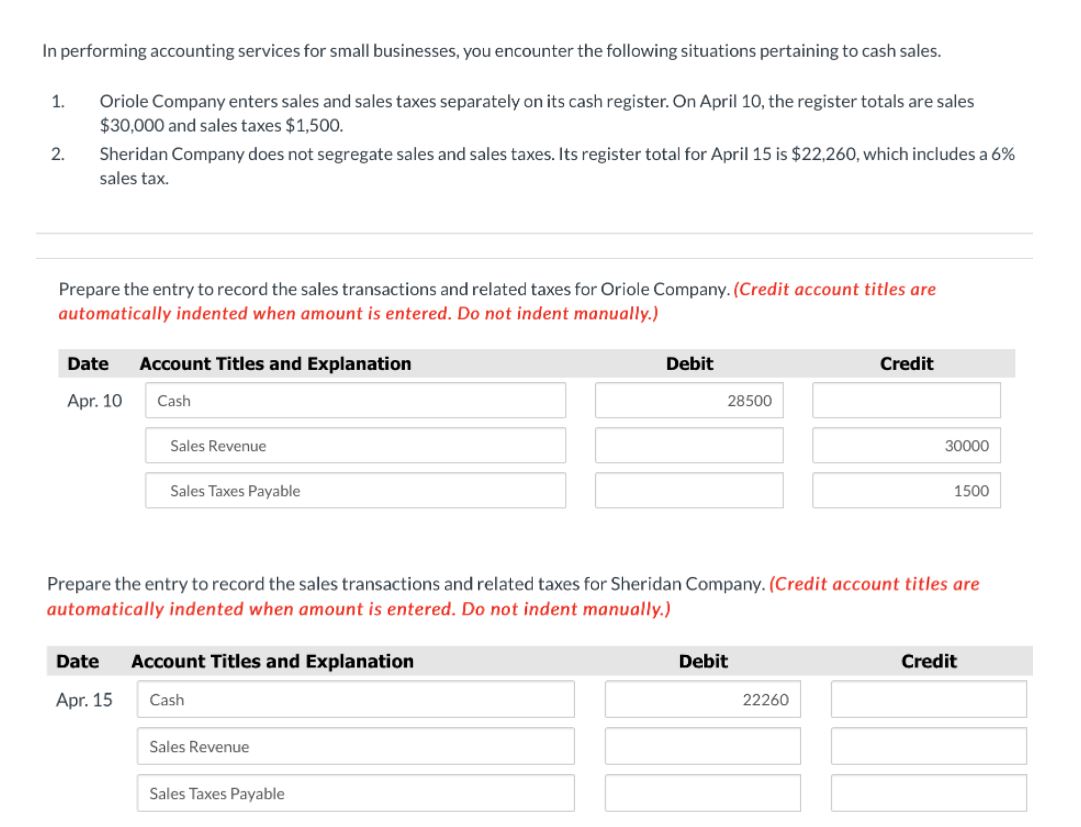

>Moving to the next question prevents changes to this answer. Question 1 Question 1 c 10 points Save A The marketing department of HASF Corporations has submitted the following sales forecast for the upcoming fiscal year (all sales are on account) Q1 Q2 Q3 Q4 total 10% Budgeted units sales ? Budget selling price per unit 18 increase 18 10 % decrease 18 16,335 ? 62,685 18 budgeted sales revenue ? 297,000 ? 294,030 ? Other information Each quarter ending finished goods inventory is 20% of next month units sold. Next year first quarter beginning inventory is 3,000. Each finished units require 3 grams of raw material that cost Rs 3 per unit. Management desired to end each quarter with an inventory of raw material equal to 15% of the current quarter production needs Beginning inventory of raw material in first quarter 3,000 grams . Find number of units that will be produced in Q2?. Answer format should be like: 10000 donot USE COMMA's or Currency or UNITS. Answer should be plain number In performing accounting services for small businesses, you encounter the following situations pertaining to cash sales. 1. Oriole Company enters sales and sales taxes separately on its cash register. On April 10, the register totals are sales $30,000 and sales taxes $1,500. 2. Sheridan Company does not segregate sales and sales taxes. Its register total for April 15 is $22,260, which includes a 6% sales tax. Prepare the entry to record the sales transactions and related taxes for Oriole Company. (Credit account titles are automatically indented when amount is entered. Do not indent manually.) Date Account Titles and Explanation Apr. 10 Cash Sales Revenue Sales Taxes Payable Debit Credit 28500 30000 1500 Prepare the entry to record the sales transactions and related taxes for Sheridan Company. (Credit account titles are automatically indented when amount is entered. Do not indent manually.) Date Account Titles and Explanation Apr. 15 Cash Sales Revenue Sales Taxes Payable Debit Credit 22260

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started