Question

Mowen Corporation has manufacturing plants in Boston and Chicago. Both plants produce the same product, Xoff, which sells for $20 per unit. Budgeted revenues and

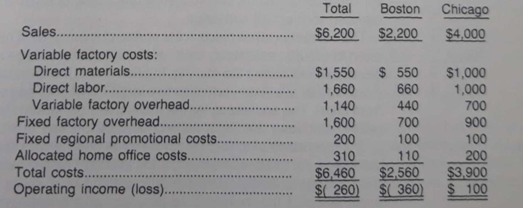

Mowen Corporation has manufacturing plants in Boston and Chicago. Both plants produce the same product, Xoff, which sells for $20 per unit. Budgeted revenues and costs (000s omitted) for the coming year are as follows:

Home office costs are fixed and are allocated to manufacturing plants on the basis of relative sales levels. Fixed regional promotional costs are discretionary advertising costs needed to obtain budgeted sales levels. Because of the budgeted operating loss, Mowen is considering the possibility of ceasing operations at its Boston plant. If Mowen were to cease operations at its Boston plant, proceeds from the sale of plant assets would exceed their book value and exactly cover all termination costs. Fixed factory overhead costs of $50,000 would not be eliminated. Mowen is considering the following three alternative plans:

Plan A. Expand Bostons operations from the budgeted 110,000 units of Xoff to a budgeted 170,000 units. It is believed that this can be accomplished by increasing Bostons fixed regional promotional expenditures by $120,000.

Plan B. Close the Boston plant and expand Chicagos operations from the current budgeted 200,000 units of Xoff to 310,000 units in order to fill Bostons budgeted production of 110,000 units. The Boston region would continue to incur promotional costs in order to sell the 110,000 units. All sales and costs would be budgeted through the Chicago plant.

Plan C. Close the Boston plant and enter into a long-term contract with a competitor to serve the Boston regions customers. This competitor would pay Mowen a royalty of $2.50 per unit of Xoff sold. Mowen would continue to incur fixed regional promotional costs in order to maintain sales of 110,000 units in the Boston region.

Required:

(1) Without considering the effects of implementing Plans A, B, and C, compute the number of units of Xoff required by the Boston plant to cover its fixed factory overhead costs and fixed regional promotional costs.

(2) Prepare a schedule by plant and in total, computing Mowens budgeted contribution margin and operating income resulting from the implementation of each of the three alternative plans. (AICPA adapted)

Sales. $6,200TotalChicagoBoston Variable factory costs: Direct materials. Direct labor... Variable factory overhead. Fixed factory overhead... Fixed regional promotional costs. Allocated home office costs. Total costs... Operating income (loss)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started