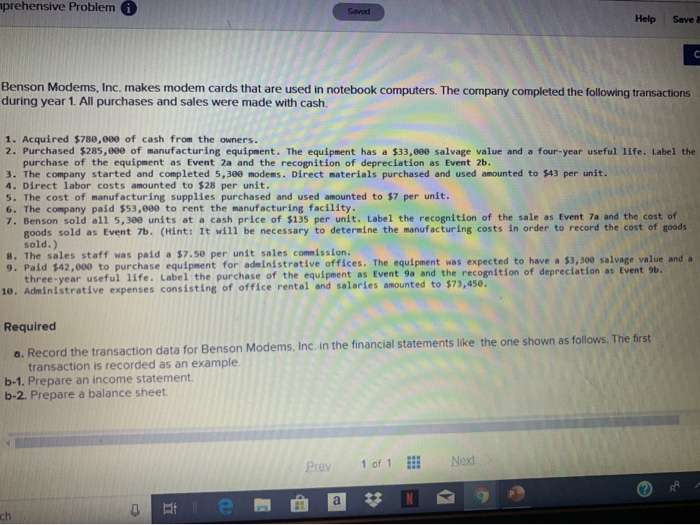

mprehensive Problem Help Save Benson Modems, Inc. makes modem cards that are used in notebook computers. The company completed the following transactions during year 1. All purchases and sales were made with cash. 1. Acquired $780,000 of cash from the owners. 2. Purchased $285,000 of manufacturing equipment. The equipment has a $33,eee salvage value and a four-year useful life. Label the purchase of the equipment as Event 2a and the recognition of depreciation as Event 2b. 3. The company started and completed 5,300 modems. Direct materials purchased and used amounted to $43 per unit. 4. Direct labor costs amounted to $28 per unit. 5. The cost of manufacturing supplies purchased and used amounted to $7 per unit. 6. The company paid $53,000 to rent the manufacturing facility. 7. Benson sold all 5,300 units at a cash price of $135 per unit. Label the recognition of the sale as Event 7a and the cost of goods sold as Event 7b. (Hint: It will be necessary to determine the manufacturing costs in order to record the cost of goods sold.) 8. The sales staff was paid a $7.50 per unit sales commission 9. Paid 542,000 to purchase equipment for administrative offices. The equipment was expected to have a $3,300 salvage value and three-year useful life. Label the purchase of the equipment as Event 9a and the recognition of depreciation as Event 9b. 10. Administrative expenses consisting of office rental and salaries amounted to $73,450. Required a. Record the transaction data for Benson Modems, Inc. in the financial statements like the one shown as follows. The first transaction is recorded as an example, b-1. Prepare an income statement. b-2. Prepare a balance sheet Prev 1 of 1 1 Next DA e a 3N mprehensive Problem Help Save Benson Modems, Inc. makes modem cards that are used in notebook computers. The company completed the following transactions during year 1. All purchases and sales were made with cash. 1. Acquired $780,000 of cash from the owners. 2. Purchased $285,000 of manufacturing equipment. The equipment has a $33,eee salvage value and a four-year useful life. Label the purchase of the equipment as Event 2a and the recognition of depreciation as Event 2b. 3. The company started and completed 5,300 modems. Direct materials purchased and used amounted to $43 per unit. 4. Direct labor costs amounted to $28 per unit. 5. The cost of manufacturing supplies purchased and used amounted to $7 per unit. 6. The company paid $53,000 to rent the manufacturing facility. 7. Benson sold all 5,300 units at a cash price of $135 per unit. Label the recognition of the sale as Event 7a and the cost of goods sold as Event 7b. (Hint: It will be necessary to determine the manufacturing costs in order to record the cost of goods sold.) 8. The sales staff was paid a $7.50 per unit sales commission 9. Paid 542,000 to purchase equipment for administrative offices. The equipment was expected to have a $3,300 salvage value and three-year useful life. Label the purchase of the equipment as Event 9a and the recognition of depreciation as Event 9b. 10. Administrative expenses consisting of office rental and salaries amounted to $73,450. Required a. Record the transaction data for Benson Modems, Inc. in the financial statements like the one shown as follows. The first transaction is recorded as an example, b-1. Prepare an income statement. b-2. Prepare a balance sheet Prev 1 of 1 1 Next DA e a 3N