Question

Mr. A is a VAT-registered professional offering accounting services to his clients in 2022. The following data were reported from his income statement:

Mr. A is a VAT-registered professional offering accounting services to his clients in 2022. The following data were reported from his income statement:

| First Quarter | Second Quarter |

Professional fee (All are government sales) | P2,000,000 | P2,800,000 |

Professional expenses from VAT registered | 2,500,000 | 1,200,000 |

Depreciation expense | 500,000 | 500,000 |

All of the fees received by Mr. A were properly withheld and the corresponding BIR Forms 2307 were issued to him.

He also opted the optional standard deduction (OSD) as a method of deduction.

Note: All amounts were collected and paid.

Additional information: He also received a quarterly compensation income of P180,000.

Amount of Net Taxable Income | Rate | |

Over | But Not Over |

|

- | P250,000 | 0% |

P250,000 | P400,000 | 20% of the excess over P250,000 |

P400,000 | P800,000 | P30,000 + 25% of the excess over P400,000 |

P800,000 | P2,000,000 | P130,000 + 30% of the excess over P800,000 |

P2,000,000 | P8,000,000 | P490,000 + 32% of the excess over P2,000,000 |

P8,000,000 |

| P2,410,000 + 35% of the excess over P8,000,000 |

Based on the information above, answer the following:

- How much is the overpayment of BIR Form No. 2550 Q in the second quarter of 2022?

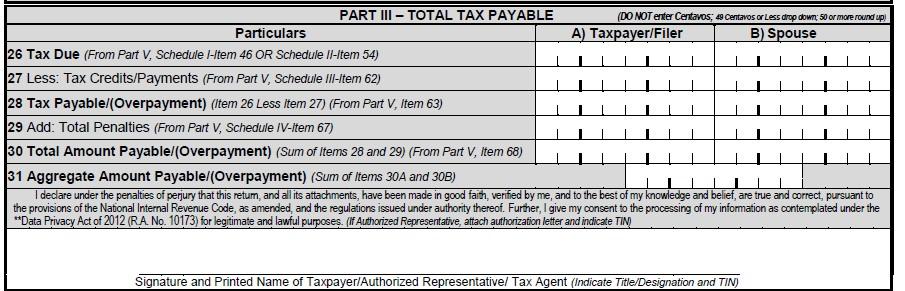

- How much is the amount in line item 31 Part III of BIR Form No. 1701Q in the first quarter of 2022?

PART III - TOTAL TAX PAYABLE Particulars 26 Tax Due (From Part V, Schedule I-Item 46 OR Schedule II-Item 54) 27 Less: Tax Credits/Payments (From Part V, Schedule III-Item 62) 28 Tax Payable/(Overpayment) (Item 26 Less Item 27) (From Part V, Item 63) 29 Add: Total Penalties (From Part V, Schedule IV-Item 67) (DO NOT enter Centavos; 49 Centavos or Less drop down; 50 or more round up) A) Taxpayer/Filer B) Spouse 30 Total Amount Payable/(Overpayment) (Sum of Items 28 and 29) (From Part V, Item 68) 31 Aggregate Amount Payable/(Overpayment) (Sum of Items 30A and 30B) I declare under the penalties of perjury that this retum, and all its attachments, have been made in good faith, verified by me, and to the best of my knowledge and belief, are true and correct, pursuant to the provisions of the National Internal Revenue Code, as amended, and the regulations issued under authority thereof. Further, I give my consent to the processing of my information as contemplated under the **Data Privacy Act of 2012 (R.A. No. 10173) for legitimate and lawful purposes. (If Authorized Representative, attach authorization letter and indicate TIN Signature and Printed Name of Taxpayer/Authorized Representative/ Tax Agent (Indicate Title/Designation and TIN)

Step by Step Solution

3.42 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

Based on the information given 1 How much is the overpayment of BIR Form No 2550 Q in the second qua...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started