Answered step by step

Verified Expert Solution

Question

1 Approved Answer

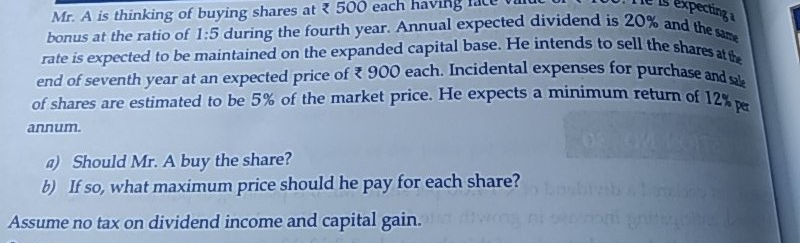

Mr. A is thinking of buying shares at ? 500 each having fate ouiut U bonus at the ratio of 1:5 during the fourth year.

Mr. A is thinking of buying shares at ? 500 each having fate ouiut U bonus at the ratio of 1:5 during the fourth year. Annual expected dividend is 20% rate is expected to be maintained on the expanded capital base. He intends to sell the end of seventh year at an expected price of 900 each. Incidental expenses for and the same ncidental expenses for purch and sle eturn of 12%pe of shares are estimated to be 5% of the market price. He expects a minimum r annum a) Should Mr. A buy the share? b) If so, what maximum price should he pay for each share? Assume no tax on dividend income and capital gain

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started