Question

Mr. A = man = husband = worked in 2017 as employee. Mrs. B = woman = wife = self-employed in 2017. Mr. A is

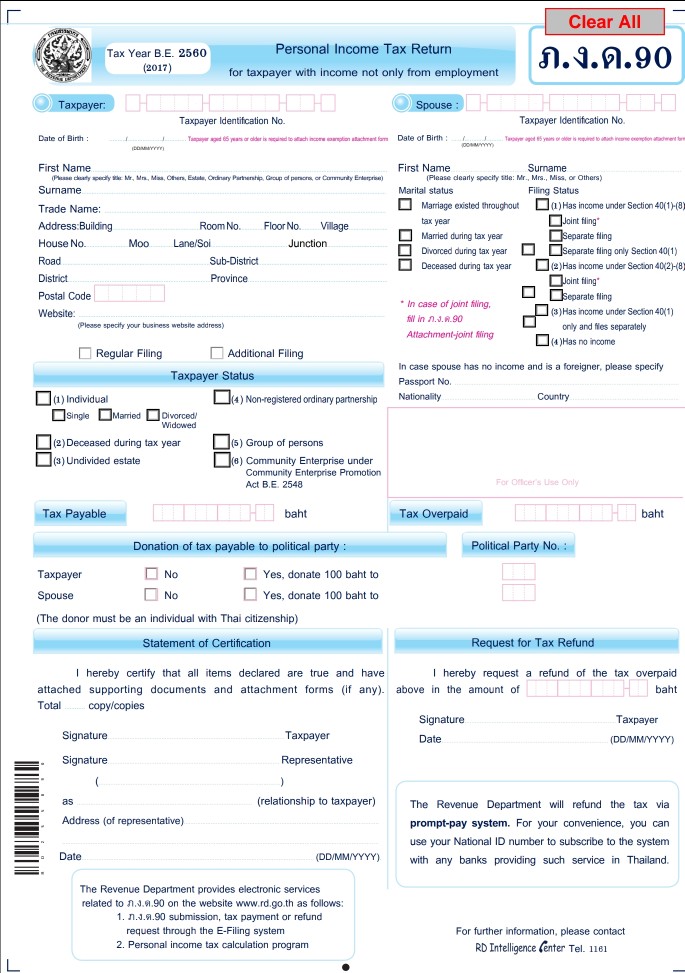

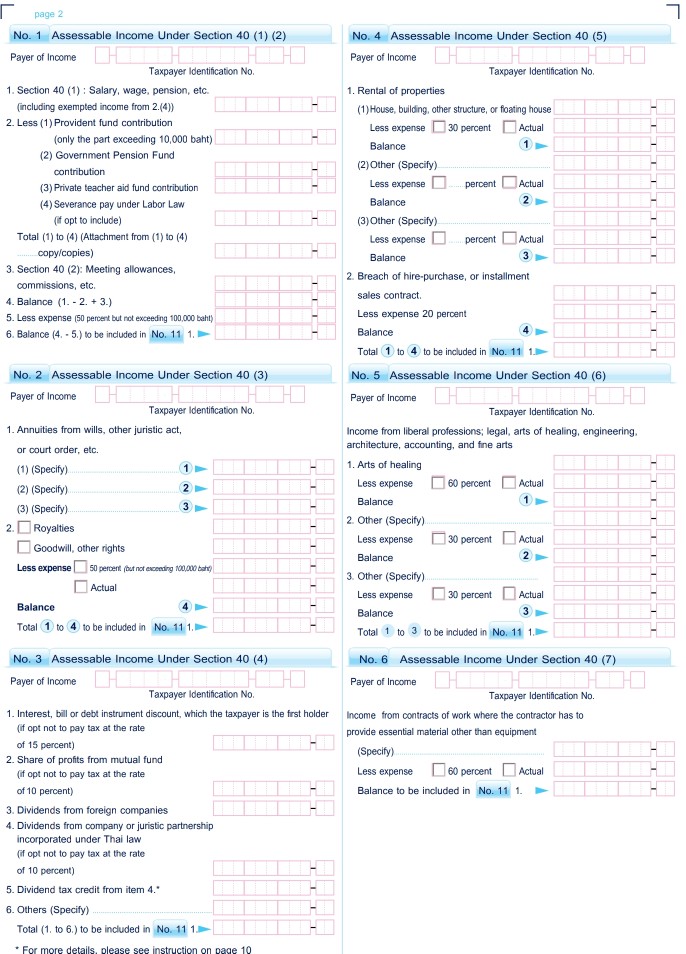

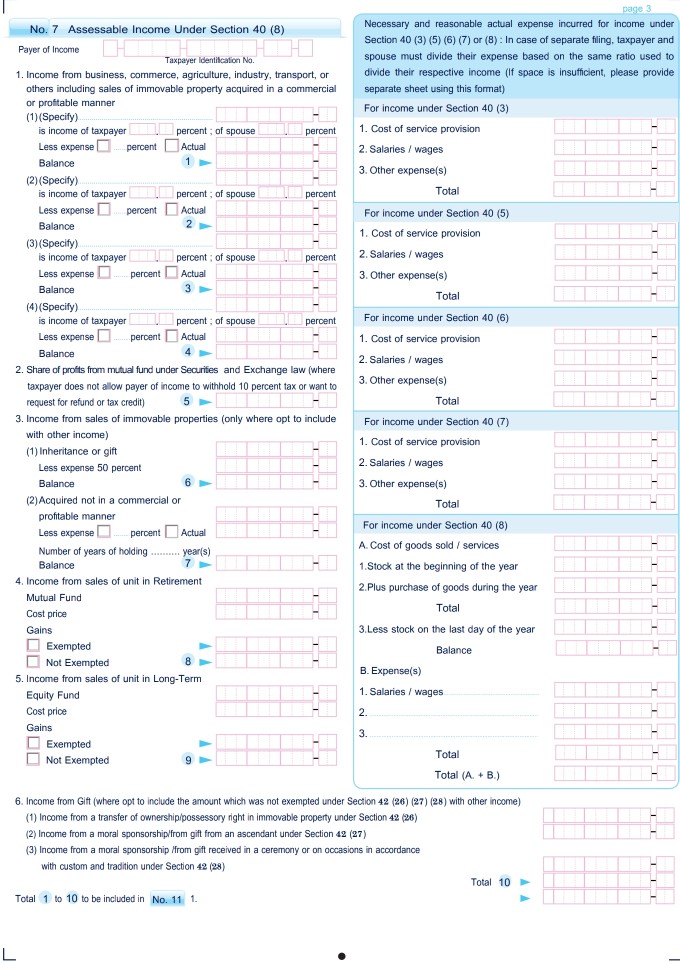

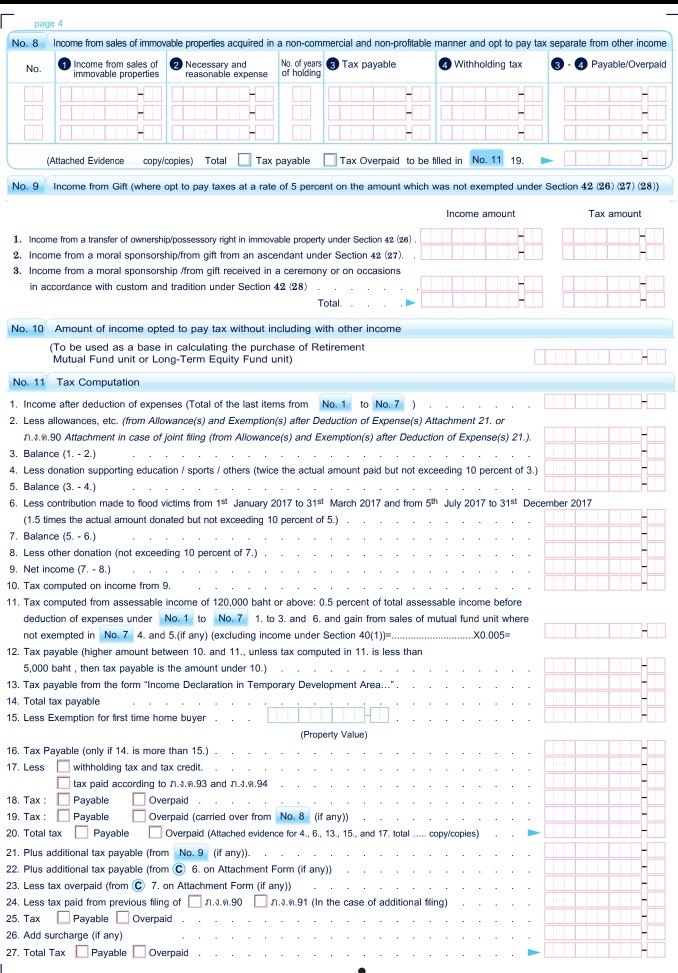

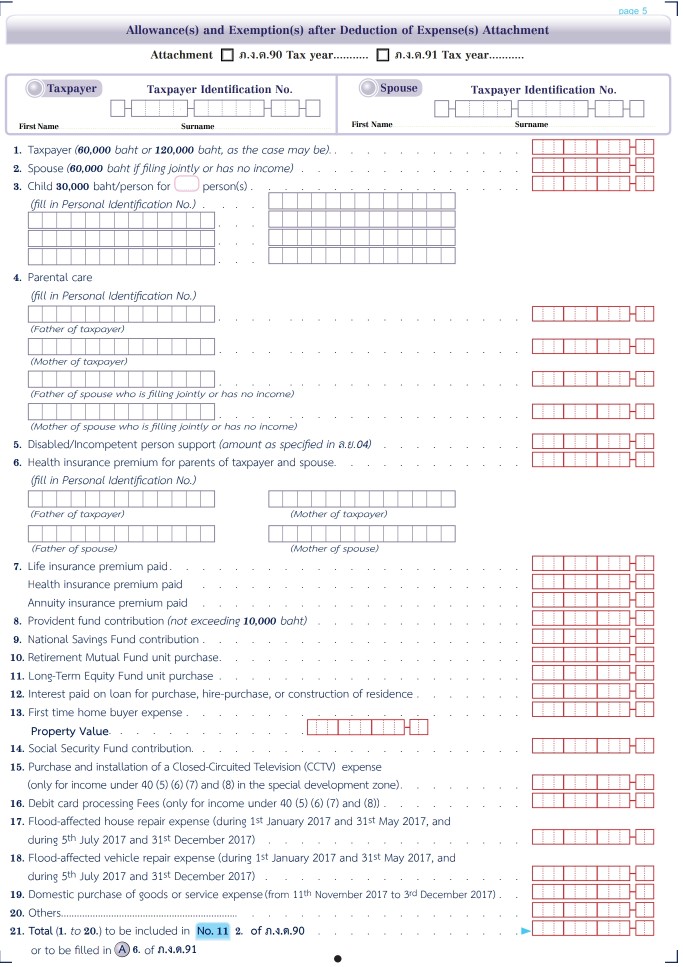

Mr. A = man = husband = worked in 2017 as employee. Mrs. B = woman = wife = self-employed in 2017. Mr. A is married to Mrs. B. The couple has 3 children, aged 15, 13 and 10. In 2017, Mr. A worked for an engineering firm in Bangkok and earned_?_Baht per month. To avoid underpayment of his income tax, Mr. A request the payroll department at the company to withholds _?_ from his gross earning as income tax withholding. In addition to working full-time for a company, Mr. A also worked on side projects on the weekend to make extra money. All the money earned from the weekend job is used for retirement plan. Mr. A contributes_?_ Baht per month to a retirement plan and put the rest in an annuity account that will be paid when he is 65. Mr. A is now 50 years old. In 2017, Mr. A earned a total of_?_ Baht from the weekend job. In 2017, Mrs. B worked as a business consultant specializing in setting up Regional Operating Headquarters for foreign companies that want to establish ROH in Thailand. Mrs. B gets paid only if the ROH application is approved; her fee is_?_per application. In 2017, she submitted 10 application; 8 were approved and 2 were rejected. With the money earned from her ROH consulting work, Mrs. B bought two condo units in June 2017 and rented both units to college students at _?_ Baht per month per unit. At the end of December 2017, Mrs. B completed her book on ROH Guide for Foreign Companies and a publisher agreed to pay her G % royalty fees from gross sales proceeds that will be launched on January 1, 2018 to mark the new year. The book will be sold at _?_ Baht per copy. The publisher estimated that at least 1,000 copies will be sold in the first year upon its release. Mrs. B is excited and starts to plan for her impending tax liability in 2018 from the book sales income. In 2017, Mrs. B used the income earned from her consulting work to invest in stocks, bonds, and savings deposit. She also made contribution to her retirement account separate from her husband. In 2017, she bought I shares of stock that paid 5 Baht per share dividends. The stock was a good investment and paid dividends every quarter in 2017. She bought a 5 years government bond that pays a discount rate of_?_ % and matures in December 15, 2017 which she redeemed a full value of 1,000,000 Baht. She has K Baht in savings account that pays fixed interest at _?_ % a year. In 2017, she also put M Baht into a retirement account, and prepaid her income tax _?_ Baht hoping to use it as a credit to offset any tax liability in 2017. In April 2017, during the Songkran festival (Thai new year), the family made merit by donating _?_ Baht to the Olympic Fund of Thailand (OFT), a nonprofit organization promoting Thai athletes to compete in the Olympics. To show its appreciation, OFT gave Mr. A and Mrs. B a gift voucher to a beach front 5 stars hotel in Phuket for 5 nights. The couple took the whole family on vacation in December 2017, stayed at the hotel for 5 nights. When they checked out of the hotel, the bill showed _?_ Baht offset by OFT gift voucher 5 nights; the couple did not have to pay.

Question: i want to know that each one that have ? how can i calculated to get it (show me solution pls) and which form of tax i have to put each one on? (for the number my teacher don't give it to me yet i just want to know have to get each result and where to put in) thank you so much

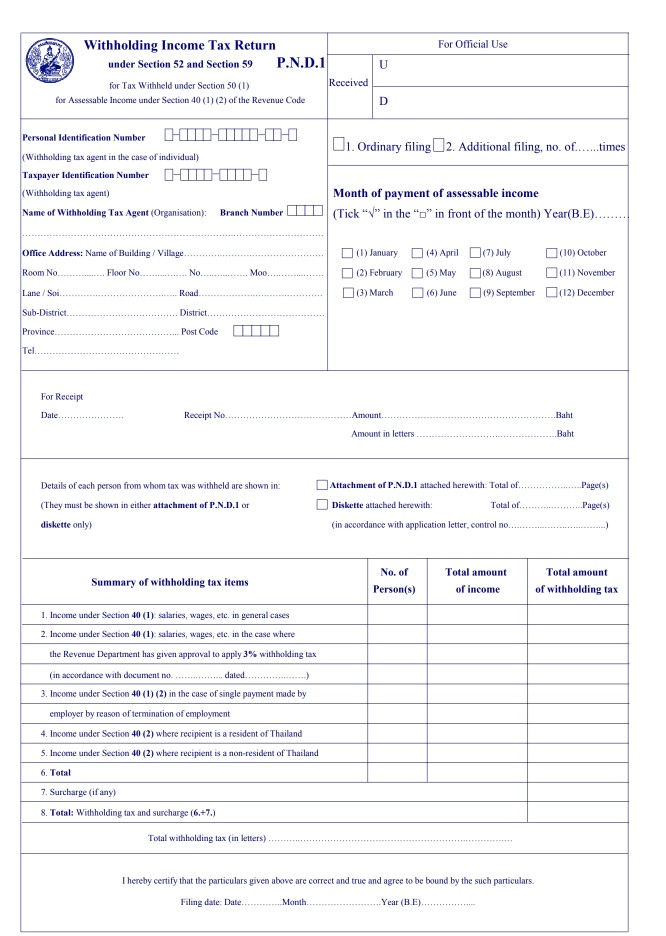

Withholding Income Tax Return under Section 52 and Section 59 for Tax Withheld under Section 50 (1) for Assessable Income under Section 40 (1) (2) of the Revenue Code For Official Use P.N.D.1 Personal Identification Number (Withholding tax agent in the case of individual) Taxpayer Identification Numher (Withbolding tax agent) Name of Withholding Tax Agent (Organisation): U1. Ordinary filing2. Additional filing, no. of....times [HIHHH Month of payment of assessable income Branch Number (Tick 'in the "o" n front of the month) Year(BE) January 4) AprilJuly(10) October (2) February (5)May 8 Aust 1)November (3) March (6) June(9) September (12) December e Address: Name of Building Vilage No. Floor No Moo District Postcode Tel. For Receipt Date Receipt No. Baht Amount in letters Baht Attachment of PN.D 1 attached herewith Total of Details of each person from whom tax was withheld are shown m (They must be shown in either attachment of P.N.D.1 or diskette only s) Diskette attached herewith: Total of .Pagels) (in accordance with application letter, control no No. of Total amount Total amount Summary of withholding tax items Person(s) of income of withholding tax 1 Income under Section 40 (1) salaries, wages, etc. in general cases 2. Income under Section 40 (1) salaries, wages, etc. in the case where the Revenue Department has given approval to apply 3% withholding tax in accordance with document no dated 3. Income under Section 40 (1) (2) in the case of single payment made by employer by reason of termination of employment 4. Income under Section 40 (2) where recipient is a resident of Thailand 5. Income under Section 40 (2) where recipient is a non-resident of Thailand 6. Total 7. Surcharge (ifany) 8. Total: Withholding tax and surcharge (6.+7.) Total withholding tax (in letters) I hereby certify that the particulars given above are correct and true and agree to be bound by the such particulars Filing date: DateMonth. Year (B.E).. Withholding Income Tax Return under Section 52 and Section 59 for Tax Withheld under Section 50 (1) for Assessable Income under Section 40 (1) (2) of the Revenue Code For Official Use P.N.D.1 Personal Identification Number (Withholding tax agent in the case of individual) Taxpayer Identification Numher (Withbolding tax agent) Name of Withholding Tax Agent (Organisation): U1. Ordinary filing2. Additional filing, no. of....times [HIHHH Month of payment of assessable income Branch Number (Tick 'in the "o" n front of the month) Year(BE) January 4) AprilJuly(10) October (2) February (5)May 8 Aust 1)November (3) March (6) June(9) September (12) December e Address: Name of Building Vilage No. Floor No Moo District Postcode Tel. For Receipt Date Receipt No. Baht Amount in letters Baht Attachment of PN.D 1 attached herewith Total of Details of each person from whom tax was withheld are shown m (They must be shown in either attachment of P.N.D.1 or diskette only s) Diskette attached herewith: Total of .Pagels) (in accordance with application letter, control no No. of Total amount Total amount Summary of withholding tax items Person(s) of income of withholding tax 1 Income under Section 40 (1) salaries, wages, etc. in general cases 2. Income under Section 40 (1) salaries, wages, etc. in the case where the Revenue Department has given approval to apply 3% withholding tax in accordance with document no dated 3. Income under Section 40 (1) (2) in the case of single payment made by employer by reason of termination of employment 4. Income under Section 40 (2) where recipient is a resident of Thailand 5. Income under Section 40 (2) where recipient is a non-resident of Thailand 6. Total 7. Surcharge (ifany) 8. Total: Withholding tax and surcharge (6.+7.) Total withholding tax (in letters) I hereby certify that the particulars given above are correct and true and agree to be bound by the such particulars Filing date: DateMonth. Year (B.E)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started