Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Mr. Abdullah is a banker at CIMZ Group Bhd who is married to Mdm. Fatimah a lecturer at Excellent University. For the year ended

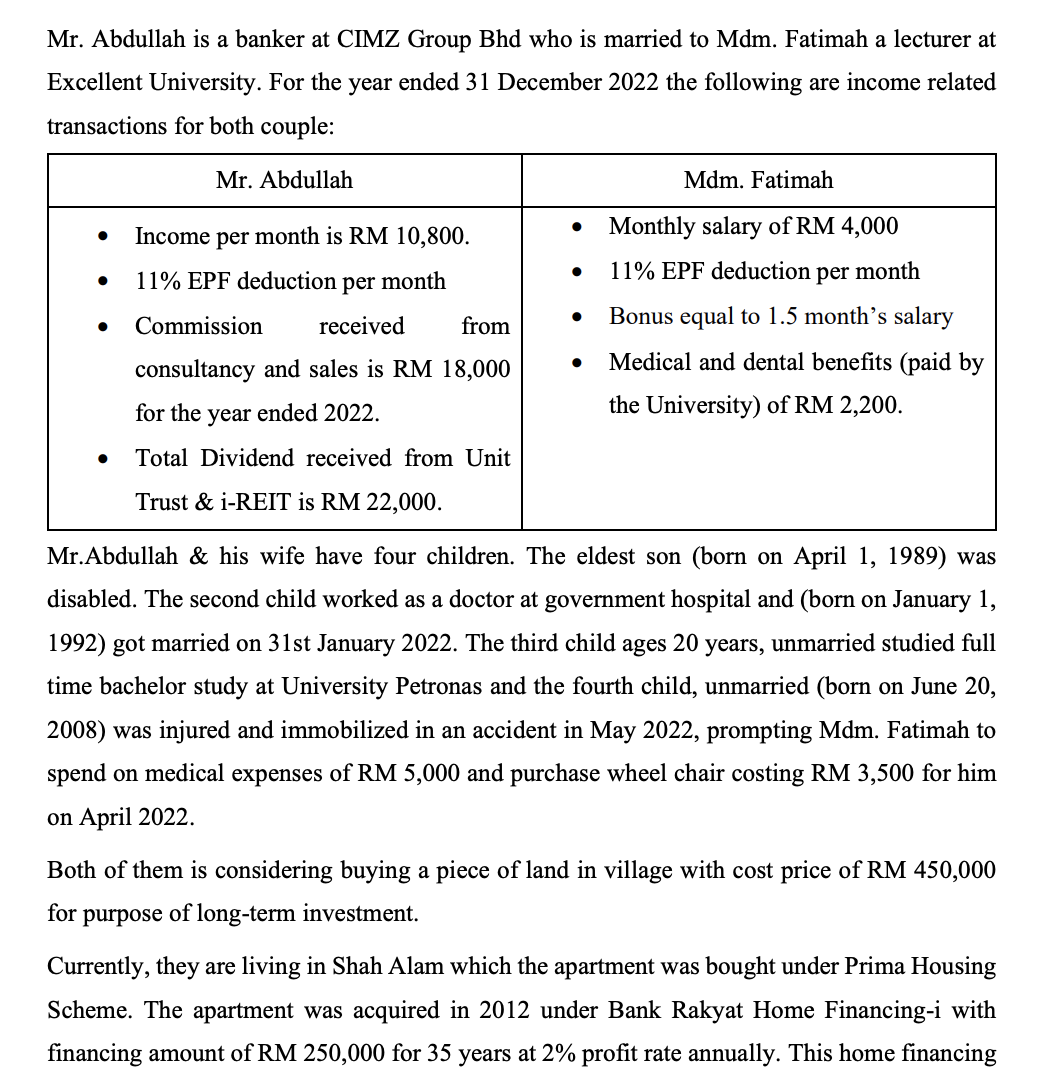

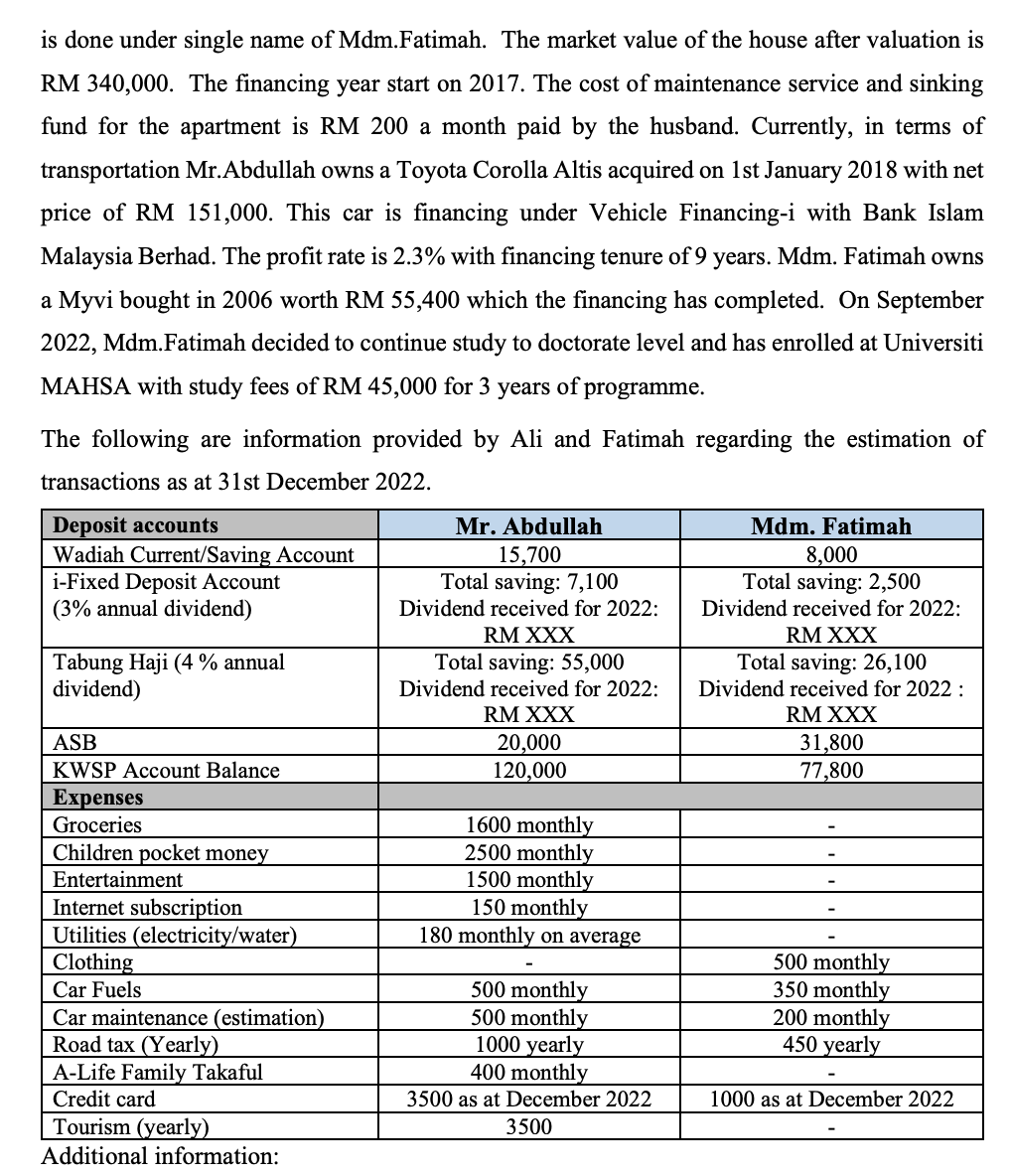

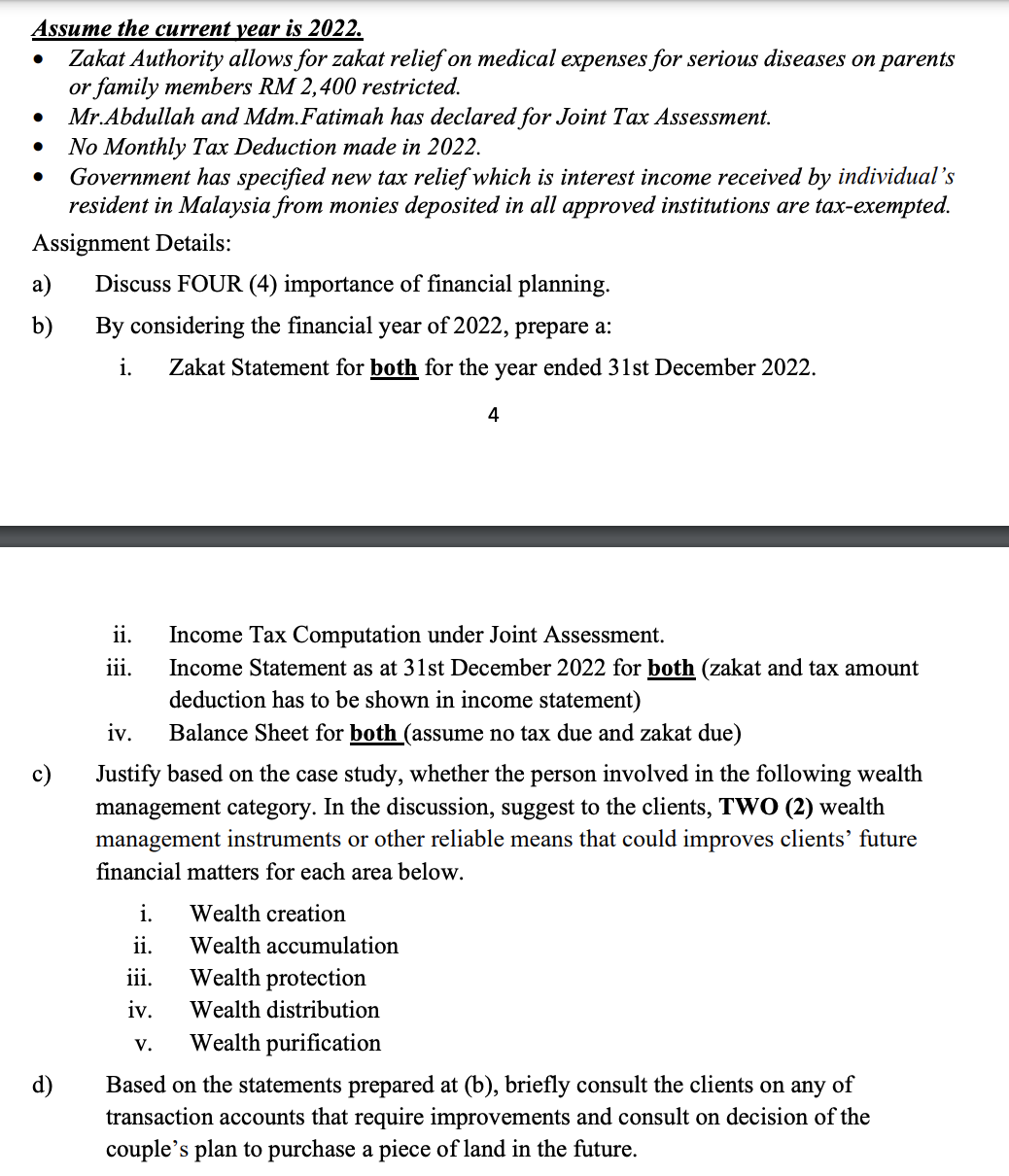

Mr. Abdullah is a banker at CIMZ Group Bhd who is married to Mdm. Fatimah a lecturer at Excellent University. For the year ended 31 December 2022 the following are income related transactions for both couple: Mr. Abdullah Income per month is RM 10,800. 11% EPF deduction per month Commission received from consultancy and sales is RM 18,000 for the year ended 2022. Total Dividend received from Unit Trust & i-REIT is RM 22,000. Mdm. Fatimah Monthly salary of RM 4,000 11% EPF deduction per month Bonus equal to 1.5 month's salary Medical and dental benefits (paid by the University) of RM 2,200. Mr. Abdullah & his wife have four children. The eldest son (born on April 1, 1989) was disabled. The second child worked as a doctor at government hospital and (born on January 1, 1992) got married on 31st January 2022. The third child ages 20 years, unmarried studied full time bachelor study at University Petronas and the fourth child, unmarried (born on June 20, 2008) was injured and immobilized in an accident in May 2022, prompting Mdm. Fatimah to spend on medical expenses of RM 5,000 and purchase wheel chair costing RM 3,500 for him on April 2022. Both of them is considering buying a piece of land in village with cost price of RM 450,000 for purpose of long-term investment. Currently, they are living in Shah Alam which the apartment was bought under Prima Housing Scheme. The apartment was acquired in 2012 under Bank Rakyat Home Financing-i with financing amount of RM 250,000 for 35 years at 2% profit rate annually. This home financing is done under single name of Mdm.Fatimah. The market value of the house after valuation is RM 340,000. The financing year start on 2017. The cost of maintenance service and sinking fund for the apartment is RM 200 a month paid by the husband. Currently, in terms of transportation Mr. Abdullah owns a Toyota Corolla Altis acquired on 1st January 2018 with net price of RM 151,000. This car is financing under Vehicle Financing-i with Bank Islam Malaysia Berhad. The profit rate is 2.3% with financing tenure of 9 years. Mdm. Fatimah owns a Myvi bought in 2006 worth RM 55,400 which the financing has completed. On September 2022, Mdm.Fatimah decided to continue study to doctorate level and has enrolled at Universiti MAHSA with study fees of RM 45,000 for 3 years of programme. The following are information provided by Ali and Fatimah regarding the estimation of transactions as at 31st December 2022. Deposit accounts Wadiah Current/Saving Account i-Fixed Deposit Account (3% annual dividend) Tabung Haji (4 % annual dividend) ASB KWSP Account Balance Expenses Groceries Children pocket money Entertainment Internet subscription Utilities (electricity/water) Clothing Car Fuels Car maintenance (estimation) Road tax (Yearly) A-Life Family Takaful Credit card Tourism (yearly) Additional information: Mr. Abdullah 15,700 Total saving: 7,100 Dividend received for 2022: RM XXX Total saving: 55,000 Dividend received for 2022: RM XXX 20,000 120,000 1600 monthly 2500 monthly 1500 monthly 150 monthly 180 monthly on average 500 monthly 500 monthly 1000 yearly 400 monthly 3500 as at December 2022 3500 Mdm. Fatimah 8,000 Total saving: 2,500 Dividend received for 2022: RM XXX Total saving: 26,100 Dividend received for 2022: RM XXX 31,800 77,800 500 monthly 350 monthly 200 monthly 450 yearly 1000 as at December 2022 Assume the current year is 2022. Zakat Authority allows for zakat relief on medical expenses for serious diseases on parents or family members RM 2,400 restricted. Mr. Abdullah and Mdm. Fatimah has declared for Joint Tax Assessment. No Monthly Tax Deduction made in 2022. Government has specified new tax relief which is interest income received by individual's resident in Malaysia from monies deposited in all approved institutions are tax-exempted. Assignment Details: a) Discuss FOUR (4) importance of financial planning. b) By considering the financial year of 2022, prepare a: i. c) d) ii. iii. Zakat Statement for both for the year ended 31st December 2022. Income Tax Computation under Joint Assessment. Income Statement as at 31st December 2022 for both (zakat and tax amount deduction has to be shown in income statement) Balance Sheet for both (assume no tax due and zakat due) 4 iv. Justify based on the case study, whether the person involved in the following wealth management category. In the discussion, suggest to the clients, TWO (2) wealth management instruments or other reliable means that could improves clients' future financial matters for each area below. i. Wealth creation ii. iii. iv. Wealth accumulation Wealth protection Wealth distribution V. Wealth purification Based on the statements prepared at (b), briefly consult the clients on any of transaction accounts that require improvements and consult on decision of the couple's plan to purchase a piece of land in the future.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

SOLUTION a Importance of Financial Planning Goal Setting Financial planning helps individuals and families set specific financial goals and create a roadmap to achieve them By identifying and prioriti...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started