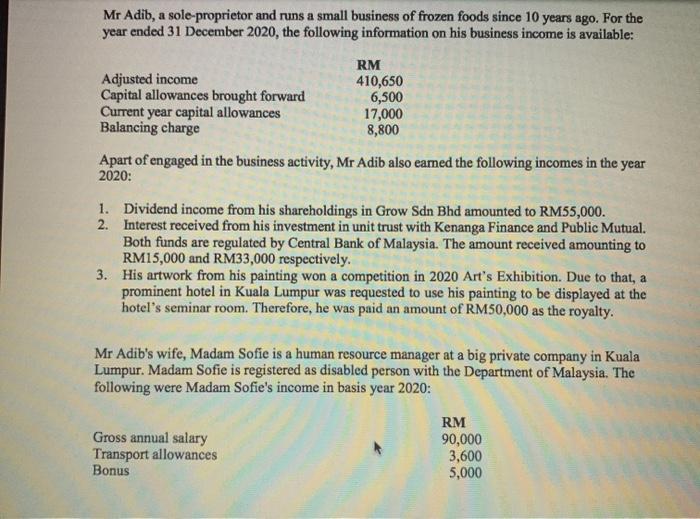

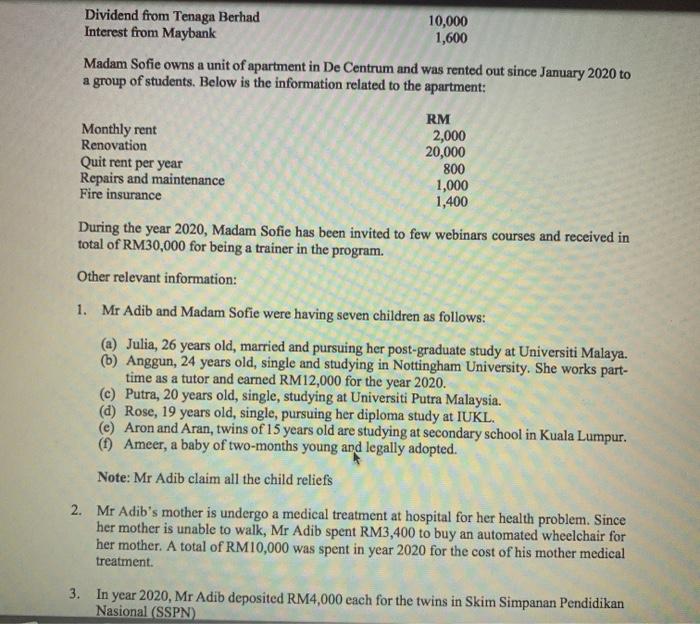

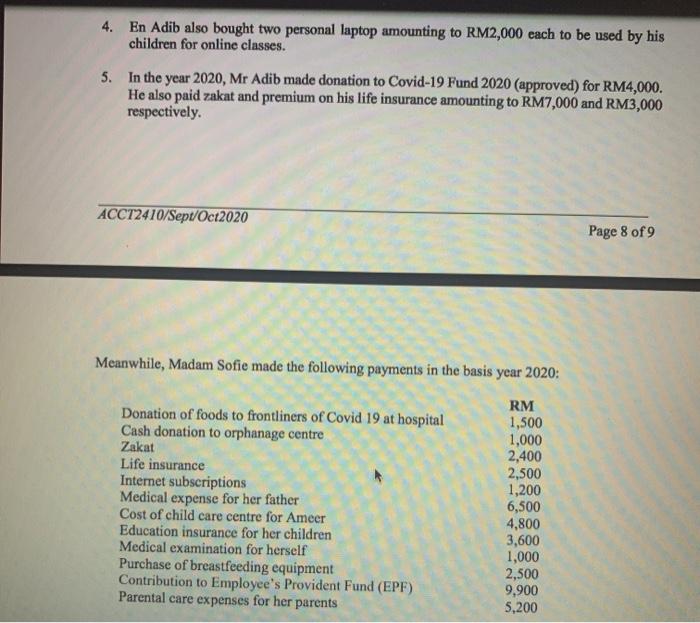

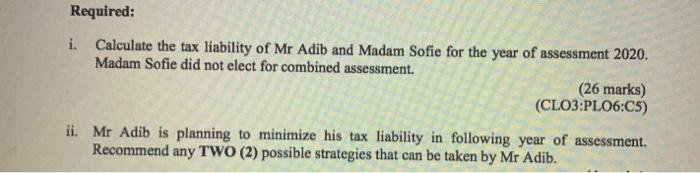

Mr Adib, a sole proprietor and runs a small business of frozen foods since 10 years ago. For the year ended 31 December 2020, the following information on his business income is available: Adjusted income Capital allowances brought forward Current year capital allowances Balancing charge RM 410,650 6,500 17,000 8,800 Apart of engaged in the business activity, Mr Adib also earned the following incomes in the year 2020: 1. Dividend income from his shareholdings in Grow Sdn Bhd amounted to RM55,000. 2. Interest received from his investment in unit trust with Kenanga Finance and Public Mutual. Both funds are regulated by Central Bank of Malaysia. The amount received amounting to RM15,000 and RM33,000 respectively. 3. His artwork from his painting won a competition in 2020 Art's Exhibition. Due to that, a prominent hotel in Kuala Lumpur was requested to use his painting to be displayed at the hotel's seminar room. Therefore, he was paid an amount of RM50,000 as the royalty. Mr Adib's wife, Madam Sofie is a human resource manager at a big private company in Kuala Lumpur. Madam Sofie is registered as disabled person with the Department of Malaysia. The following were Madam Sofie's income in basis year 2020: Gross annual salary Transport allowances Bonus RM 90,000 3,600 5,000 Dividend from Tenaga Berhad Interest from Maybank 10,000 1,600 Madam Sofie owns a unit of apartment in De Centrum and was rented out since January 2020 to a group of students. Below is the information related to the apartment: RM Monthly rent 2,000 Renovation 20,000 Quit rent per year 800 Repairs and maintenance 1,000 Fire insurance 1,400 During the year 2020, Madam Sofie has been invited to few webinars courses and received in total of RM30,000 for being a trainer in the program. Other relevant information: 1. Mr Adib and Madam Sofie were having seven children as follows: (a) Julia, 26 years old, married and pursuing her post-graduate study at Universiti Malaya. (b) Anggun, 24 years old, single and studying in Nottingham University. She works part- time as a tutor and earned RM12,000 for the year 2020. (C) Putra, 20 years old, single, studying at Universiti Putra Malaysia. (d) Rose, 19 years old, single, pursuing her diploma study at IUKL. (e) Aron and Aran, twins of 15 years old are studying at secondary school in Kuala Lumpur. (1) Ameer, a baby of two-months young and legally adopted. Note: Mr Adib claim all the child reliefs 2. Mr Adib's mother is undergo a medical treatment at hospital for her health problem. Since her mother is unable to walk, Mr Adib spent RM3,400 to buy an automated wheelchair for her mother. A total of RM10,000 was spent in year 2020 for the cost of his mother medical treatment. 3. In year 2020, Mr Adib deposited RM4,000 each for the twins in Skim Simpanan Pendidikan Nasional (SSPN) 4. En Adib also bought two personal laptop amounting to RM2,000 each to be used by his children for online classes. 5. In the year 2020, Mr Adib made donation to Covid-19 Fund 2020 (approved) for RM4,000. He also paid zakat and premium on his life insurance amounting to RM7,000 and RM3,000 respectively. ACCT2470/Sept/Oct2020 Page 8 of 9 Meanwhile, Madam Sofie made the following payments in the basis year 2020: Donation of foods to frontliners of Covid 19 at hospital Cash donation to orphanage centre Zakat Life insurance Internet subscriptions Medical expense for her father Cost of child care centre for Ameer Education insurance for her children Medical examination for herself Purchase of breastfeeding equipment Contribution to Employee's Provident Fund (EPF) Parental care expenses for her parents RM 1,500 1,000 2,400 2,500 1,200 6,500 4,800 3,600 1,000 2,500 9,900 5,200 Required: i. Calculate the tax liability of Mr Adib and Madam Sofie for the year of assessment 2020. Madam Sofie did not elect for combined assessment. (26 marks) (CLO3:PLO6:05) ii. Mr Adib is planning to minimize his tax liability in following year of assessment. Recommend any TWO (2) possible strategies that can be taken by Mr Adib