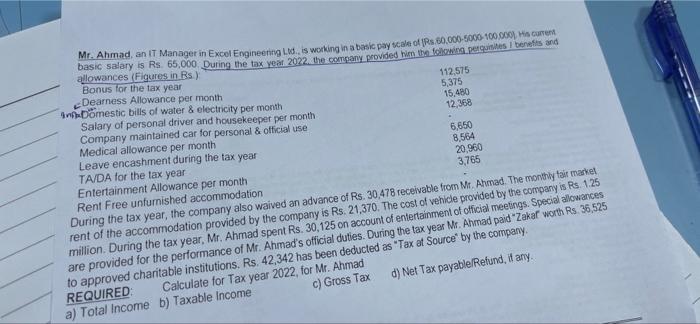

Mr. Ahmad, an IT Manager in Excel Engineering Lod. is working in a booke pay scale of Rs.60.000-6000 100.000 a curent basic salary is Rs. 65,000 During the tax year 2022. the company provided him to following pesquinies bereits and allowances (Figures in Bs ) Bonus for the tax year Dearness Allowance per month 112,575 in Domestic bills of water & electricity per month 5,375 Salary of personal driver and housekeeper per month 15,480 Company maintained car for personal & official use 12,368 Medical allowance per month 6,650 Leave encashment during the tax year 8,564 TA/DA for the tax year 20,960 Entertainment Allowance per month 3,765 Rent Free unfurnished accommodation During the tax year, the company also waived an advance of Rs. 30,478 receivable from Mr. Ahmad. The monthly to market rent of the accommodation provided by the company is Rs. 21,370. The cost of vehicle provided by the company is Rs. 1.25 million. During the tax year, Mr. Ahmad spent Rs. 30,125 on account of entertainment of official meetings. Special allowances are provided for the performance of Mr. Ahmad's official duties. During the tax year Mr. Ahmad paid "Zakar worth Rs 36,525 to approved charitable institutions. Rs. 42,342 has been deducted as "Tax at Source" by the company REQUIRED Calculate for Tax year 2022, for Mr. Ahmad d) Net Tax payable/Refund, if any. a) Total Income b) Taxable income c) Gross Tax Mr. Ahmad, an IT Manager in Excel Engineering Lod. is working in a booke pay scale of Rs.60.000-6000 100.000 a curent basic salary is Rs. 65,000 During the tax year 2022. the company provided him to following pesquinies bereits and allowances (Figures in Bs ) Bonus for the tax year Dearness Allowance per month 112,575 in Domestic bills of water & electricity per month 5,375 Salary of personal driver and housekeeper per month 15,480 Company maintained car for personal & official use 12,368 Medical allowance per month 6,650 Leave encashment during the tax year 8,564 TA/DA for the tax year 20,960 Entertainment Allowance per month 3,765 Rent Free unfurnished accommodation During the tax year, the company also waived an advance of Rs. 30,478 receivable from Mr. Ahmad. The monthly to market rent of the accommodation provided by the company is Rs. 21,370. The cost of vehicle provided by the company is Rs. 1.25 million. During the tax year, Mr. Ahmad spent Rs. 30,125 on account of entertainment of official meetings. Special allowances are provided for the performance of Mr. Ahmad's official duties. During the tax year Mr. Ahmad paid "Zakar worth Rs 36,525 to approved charitable institutions. Rs. 42,342 has been deducted as "Tax at Source" by the company REQUIRED Calculate for Tax year 2022, for Mr. Ahmad d) Net Tax payable/Refund, if any. a) Total Income b) Taxable income c) Gross Tax