Answered step by step

Verified Expert Solution

Question

1 Approved Answer

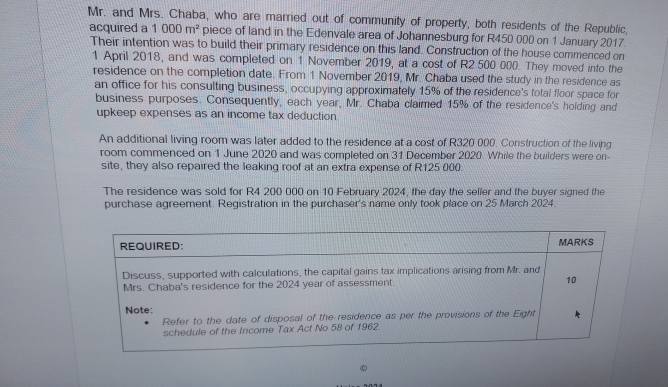

Mr . and Mrs . Chaba, who are married out of community of property, both residents of the Republic, acquired a 1 0 0 0

Mr and Mrs Chaba, who are married out of community of property, both residents of the Republic, acquired a piece of land in the Edenvale area of Johannesburg for R on January Their intention was to build their primary residence on this land. Construction of the house commenced on April and was completed on November at a cost of R They moved into the residence on the completion date. From November Mr Chaba used the study in the residence as an office for his consulting business, occupying approximately of the residence's total floor space for business purposes. Consequently, each year, Mr Chaba claimed of the residence's hoiding and upkeep expenses as an income tax deduction

An additional living room was later added to the residence at a cost of R Construction of the living room commenced on June and was completed on December While the builders were onsite, they also repaired the leaking roof at an extra expense of R

The residence was sold for R on February the day the seller and the buyer signed the purchase agreement. Registration in the purchaser's name only took place on March

tableREQUIRED:tableDiscuss supported with calculations, the capital gains tax implications arising from Mr andMrs Chaba's residence for the year of assessment.Note: Refer to the date of disposal of the residence as per the provisions of the Eghtschedule of the Income Tax Act No of MARKS

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started