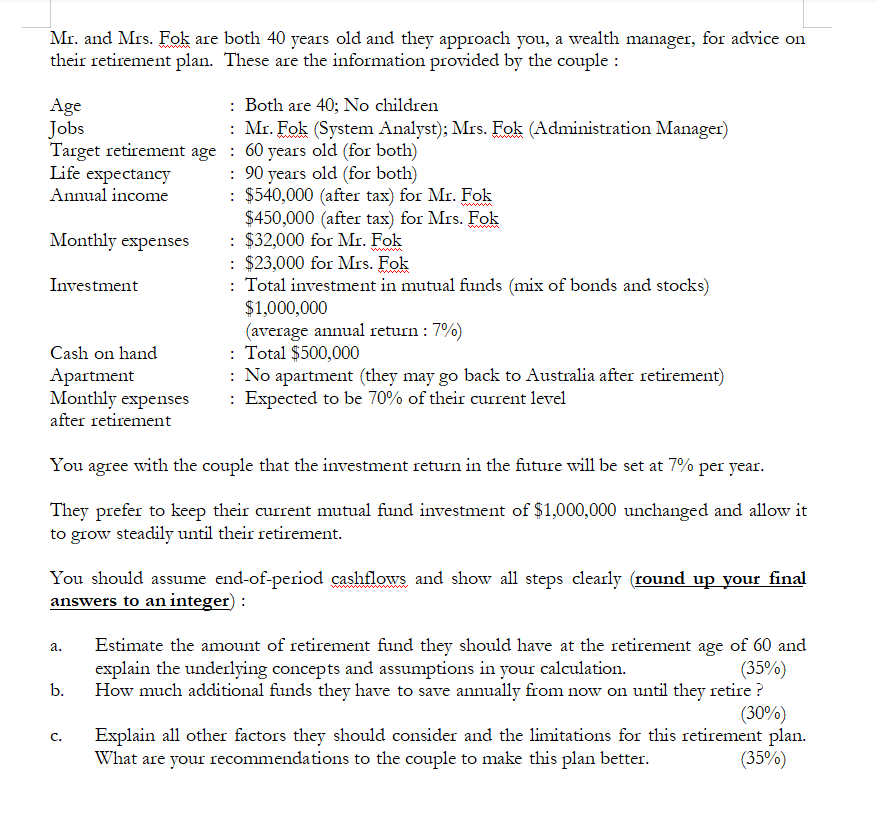

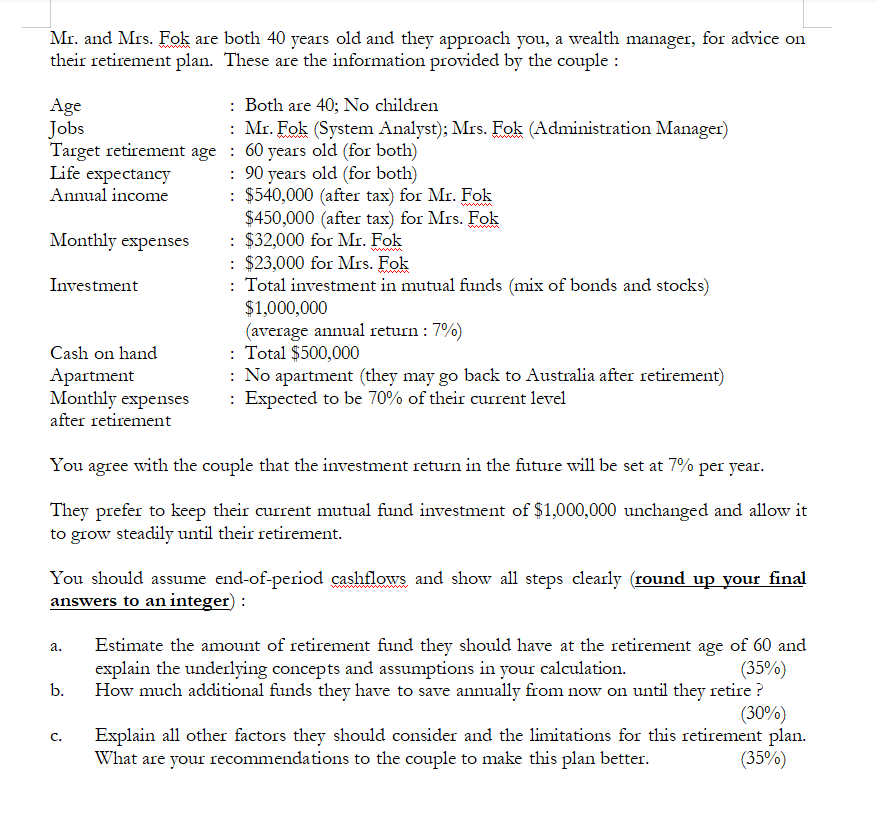

Mr. and Mrs. Fok are both 40 years old and they approach you, a wealth manager, for advice on their retirement plan. These are the information provided by the couple : Age : Both are 40; No children Jobs : Mr. Fok (System Analyst); Mrs. Fok (Administration Manager) Target retirement age : 60 years old (for both) Life expectancy : 90 years old (for both) Annual income : $540,000 (after tax) for Mr. Fok $450,000 (after tax) for Mrs. Fok Monthly expenses : $32,000 for Mr. Fok : $23,000 for Mrs. Fok Investment : Total investment in mutual funds (mix of bonds and stocks) $1,000,000 (average annual return : 7%) Cash on hand : Total $500,000 Apartment No apartment (they may go back to Australia after retirement) Monthly expenses : Expected to be 70% of their current level after retirement You agree with the couple that the investment return in the future will be set at 7% per year. They prefer to keep their current mutual fund investment of $1,000,000 unchanged and allow it to grow steadily until their retirement. You should assume end-of-period cashflows and show all steps clearly (round up your final answers to an integer) : a. b. Estimate the amount of retirement fund they should have at the retirement age of 60 and explain the underlying concepts and assumptions in your calculation. (35% How much additional funds they have to save annually from now on until they retire ? (30% Explain all other factors they should consider and the limitations for this retirement plan. What are your recommendations to the couple to make this plan better. (35%) C. Mr. and Mrs. Fok are both 40 years old and they approach you, a wealth manager, for advice on their retirement plan. These are the information provided by the couple : Age : Both are 40; No children Jobs : Mr. Fok (System Analyst); Mrs. Fok (Administration Manager) Target retirement age : 60 years old (for both) Life expectancy : 90 years old (for both) Annual income : $540,000 (after tax) for Mr. Fok $450,000 (after tax) for Mrs. Fok Monthly expenses : $32,000 for Mr. Fok : $23,000 for Mrs. Fok Investment : Total investment in mutual funds (mix of bonds and stocks) $1,000,000 (average annual return : 7%) Cash on hand : Total $500,000 Apartment No apartment (they may go back to Australia after retirement) Monthly expenses : Expected to be 70% of their current level after retirement You agree with the couple that the investment return in the future will be set at 7% per year. They prefer to keep their current mutual fund investment of $1,000,000 unchanged and allow it to grow steadily until their retirement. You should assume end-of-period cashflows and show all steps clearly (round up your final answers to an integer) : a. b. Estimate the amount of retirement fund they should have at the retirement age of 60 and explain the underlying concepts and assumptions in your calculation. (35% How much additional funds they have to save annually from now on until they retire ? (30% Explain all other factors they should consider and the limitations for this retirement plan. What are your recommendations to the couple to make this plan better. (35%) C